EUR/USD Current price: 1.1791

- ECB and Fed's meeting minutes to take center stage this week.

- US tax-reform jitters to keep weighing on the American dollar.

After Tuesday's bullish breakout the EUR/USD pair found a new comfort zone around 1.1800, where it closed the week, little impacted by political headlines or risk sentiment. The pair topped at 1.1860, rallying roughly 300 pips after bottoming the previous week at 1.1553, as better-than-expected German growth figures, coupled with a softer greenback, affected by the absence of clarity around the US tax-reform bill, and fresh macroeconomic first-tier clues, which sent investors dumping their USD-related assets, resulting in local equities plummeting to 4-week lows.

This coming week will see the release of the Minutes of the latest ECB and Fed meetings, ahead of December ones. The ECB has already set a monetary policy path for the next year, extending its bond-buying program to September 2018, but reducing it to €30B per month, a dovish cut that kept EUR's gains in check. As for the US Federal Reserve, the market has long away priced in a December hike, but 2018 moves are in doubt. Even more, inflation has been soft all through this year, with core inflation barely peaking up in October, so what can shock the market more this time is a dovish stance that puts December move in doubt. Also, investors will be paying attention to whatever happens with the planned tax-reform, as the Senate should vote on it around Thanksgiving.

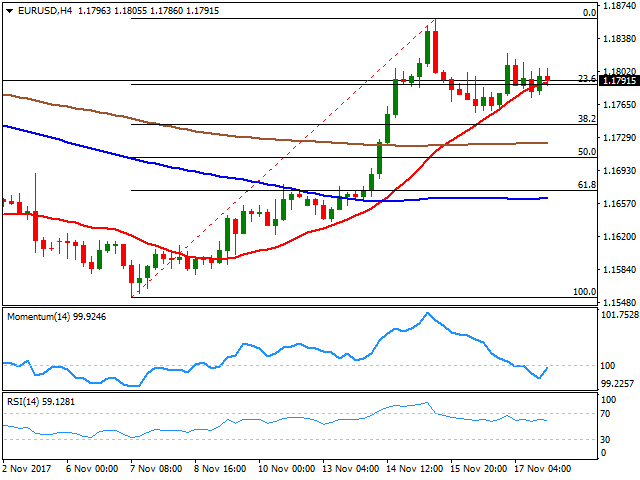

From a technical point of view, the pair has turned bullish, yet the daily chart shows that the price settled right below its 100 DMA, with some follow-through beyond the moving average needed to confirm more solid gains ahead. In the same chart, technical indicators are aiming to pick up after a period of consolidation well into positive territory, favoring a new leg higher. The pair is also struggling around the 23.6% retracement of its latest bullish run, with the 38.2% retracement of the rally at 1.1745, being a key support for the upcoming days. Shorter term and according to the 4 hours chart, the outlook is neutral-to-bullish, as the price settled around a bullish 20 SMA, which converges with the mentioned 23.6% Fibonacci retracement, while the RSI hovers around 59, while the Momentum tries to re-enter positive territory, heading higher right below its 100 level.

Support levels: 1.1745 1.1700 1.1665

Resistance levels: 1.1830 1.1860 1.1890

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Fed statement language and QT strategy could drive USD action – LIVE

The US Federal Reserve is set to leave the policy rate unchanged after April 30 - May 1 policy meeting. Possible changes to the statement language and quantitative tightening strategy could impact the USD's valuation.

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.