EUR/USD

4 hour

The EUR/USD remains in a narrow price range since the beginning of December. A bearish breakout below support (green) could see an expansion of wave X (brown) whereas a bullish breakout above resistance (orange) could see a continuation of wave C (purple).

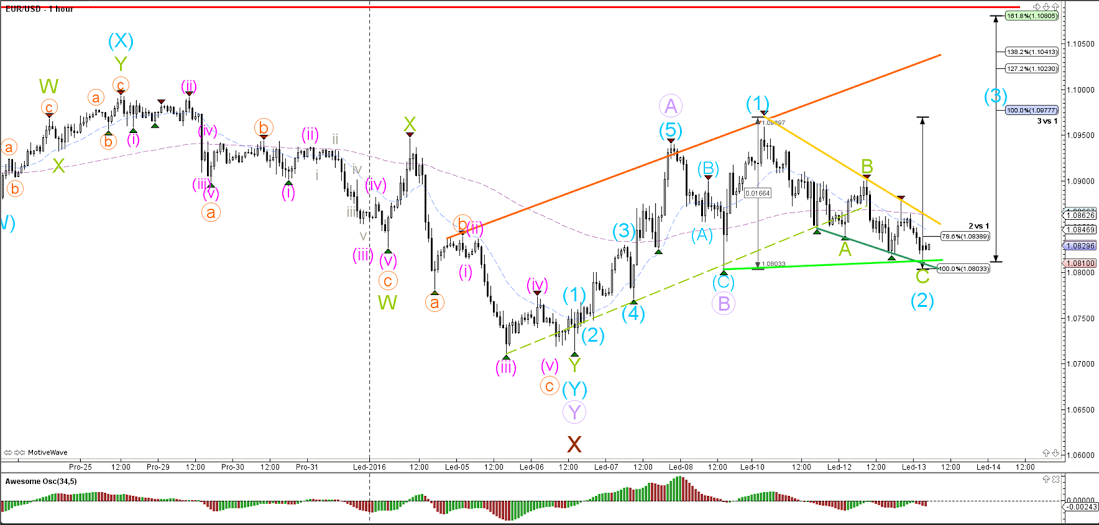

1 hour

The EUR/USD continued its bearish retracement yesterday without breaking the bottom of wave B (purple). A break below that bottom (green) invalidates the current wave 1-2 (blue) whereas a break above resistance (yellow) could see price head to the Fibonacci targets of wave 3 (blue).

GBP/USD

4 hour

The GBP/USD broke the bottom of the downtrend channel and made yet another lower low. Price has however reached the 61.8% Fibonacci target which could cause a retracement.

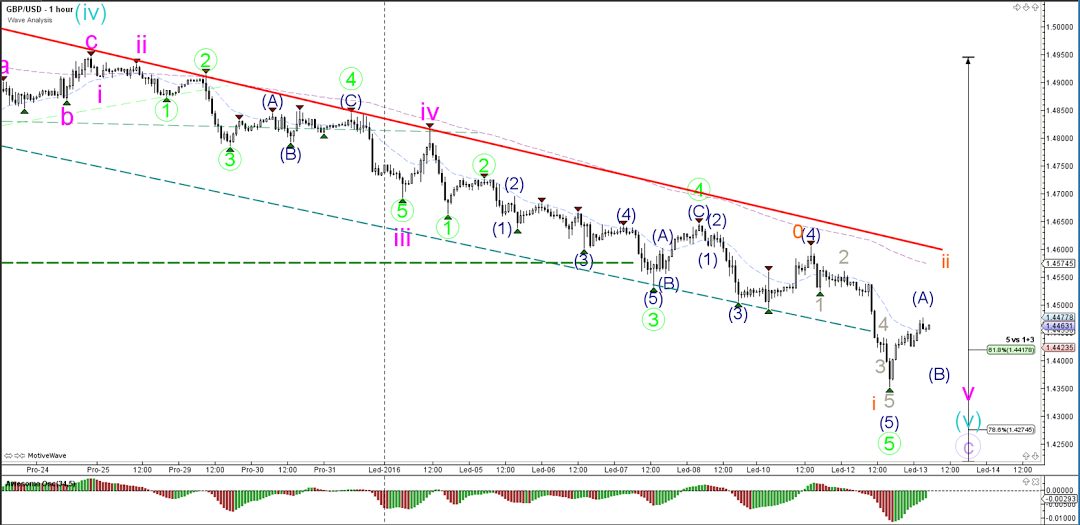

1 hour

The GBP/USD seems to have completed multiple 5th waves with the recent lower low. However, in a strong trend price can build extensions that are push the trend further, so an alternative wave count could be a wave 1-2 (orange) for instance. For the moment an ABC correction (blue) seems to be the path of least resistance.

USD/JPY

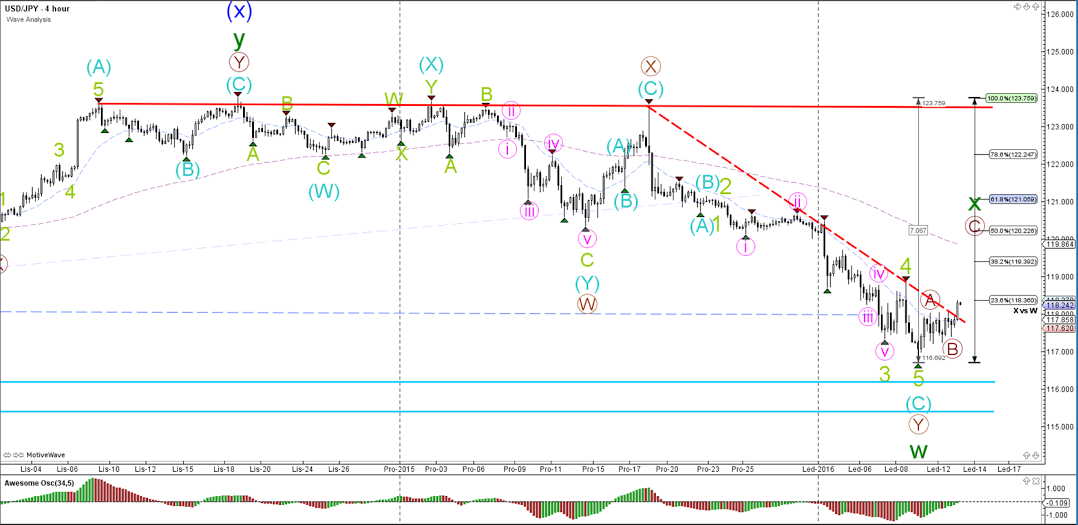

4 hour

The USD/JPY broke above the resistance trend line (dotted red) after building 5 waves and approaching new support levels (blue) from a daily chart. This could cause price to make a bullish bounce, which seems best explained by a potential wave WXY (green) formation.

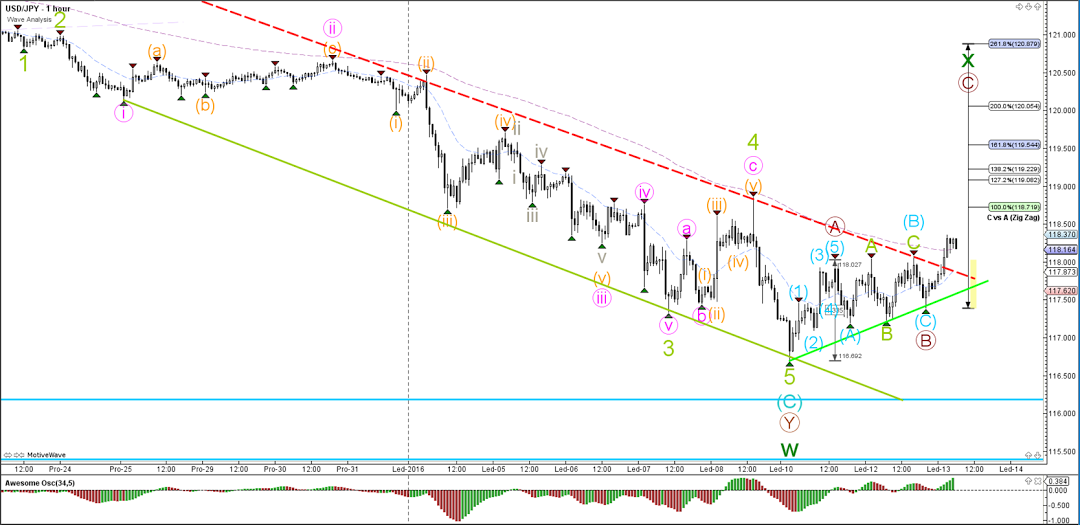

1 hour

The USD/JPY seems to have completed the AB part of a larger bullish ABC zigzag (brown).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.