The greenback plunged against all of its G10 majors on Monday and early Thursday with only exception the Japanese yen. The euro was broadly lower due to concerns for the consequences to the European Union of a possible Brexit while the British Pound gained ground versus the other G10 currencies.The intraday oil prices rally lifted the commodity currencies with AUD/USD surging near 1.7% and USD/CAD plunging near 1.6%. The USD/JPY is traded at its lowest levels since October 2014.

U.S. dollar tumbled

The U.S. dollar tumbled on against almost all of its major counterparts on Monday following the failed attempt of the major oil producers to face the oversupply of the oil at the meeting held on Sunday in Doha, Qatar. Moreover, the Housing Market Index of the National Association of the Home Builders dialed to rise up to 59 as expected in April, keeping the growth of the housing sector stable. This week the U.S dollar will not be the dominant currency as the economic calendar is pretty calm with only news regarding the U.S. housing sector.

Euro under pressure from Brexit consequences

The euro was under pressure in Monday’s trading session as the European Union started to worry what of the consequences of a possible Brexit. As the EU referendum looms, the policymakers worry more about the consequences on the union and the currency started to reflect the concerns. The single currency fell against all the major currencies with only exception the Japanese yen that weakened severely during the Asian session.

EUR/USD – Technical Outlook

EUR/USD moved higher during yesterday’s session to give another test to the 1.1300 level. Since then the price is trading in a consolidation mood slightly above the 50-SMA on the 4-hour chart. In the next couple of days, some important data are coming up for EUR, including the PMIs figures, Inflation rate, and the important ECB policy meeting. As it stands, if yesterday’s buying pressure continues, I expect the metal to challenge the 1.1410 barrier. Technical studies support the notion since the stochastic oscillator has entered the oversold area while the MACD is ready to step in a bullish territory. On the other hand, if the bears manage to resist, then it might drive the battle back towards the 1.1170 area.

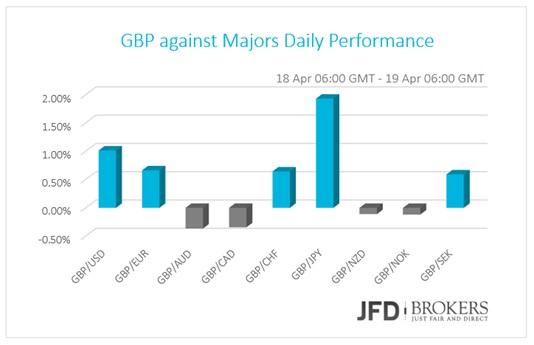

A big week ahead for the pound

The sterling was the best-performing currency against the majors on Monday despite the muted economic calendar. The Chancellor George Osborne talked about the consequences of the Brexit once more. This week will be volatile for the GBP cross pairs as the economic calendar is pretty crowded with economic news. Today, the Bank of England governor Mark Carney will speak at the Lord Economic Affairs Committee hearing regarding the general economic outlook. Tomorrow morning, the UK Employment Report will be released and on Thursday, the market expects March’s Retail Sales.

GBP/USD – Technical Outlook

The pound is looking pretty strong against the dollar at the moment, having broken above the key level of 1.4200, a previous level of support. Today’s speech by Gov. Carney and tomorrow’s employment data is likely to have a significant impact on the direction of the pair, therefore, we should prepare for more volatility than usual. As it stands, if the buying pressure continues to push the price higher, I would expect the price to test once more the strong key level at 1.4330, which coincides with the descending trend line. From there, I would expect a battle to take place between both market forces (bulls and bears) and if the bulls are strong enough to hold the price above 1.4280, then we could see a rebound from these levels and a potentially move towards the 1.4380 level.

USD/JPY – Technical Outlook

The USD has risen for a third consecutive day against the JPY as the market awaits the release of the U.S. Building Permits and Housing Starts for March. The USD/JPY pair managed to bounce from the 107.70 area and it seems that the bulls are gaining some momentum following the sharp sell-off the previous month. Therefore, the next level to watch will be the 109.80 barrier, with a break above that to open the way towards the key resistance level at 110.70. On the other hand, if the bulls fail to push the price above 109.80, then I would expect further consolidation between the latter level and the 107.70 level.

USD/CAD – Technical Outlook

The USD/CAD pair is under bearish pressure as is approaching the key support level at 1.2740. In addition, the pair is trading within a downward sloping channel since December 2015. A decisive violation of the latter level would find the price lying in territories not seen since mid-2015.

Technical studies support further USD depreciation since the MACD crossed below zero and the RSI is in the process of crossing below its mid-level, both of which are bearish. Therefore, the next level to watch will be 1.2570 and then 1.2530. We remain strong CAD buyers.

AUD/USD – Technical Outlook

The AUD/USD pair found strong support at the 0.7500 level, which coincides with the 50-SMA and rebounded higher moving aggressively above the 0.7700 level. In addition, the pair has managed to move above the 200-SMA on the daily chart, suggesting further upside momentum in the near term.

Therefore, if the bulls hold the price above the 0.7700, it may suggest that traders are still bullish on this pair, prompting a move higher towards the strong resistance level at 0.7870. The MACD is moving above its zero line while the RSI moved slightly above 50 suggesting further bullish movements.

USD/CHF – Technical Outlook

USD/CHF is continuing to push lower following the failed attempt to break above the strong resistance level at 0.9680. The pair remains bearish since is moving in a downward sloping channel since November 2015 and the short-term moving averages are moving below the long terms moving averages. With the above in mind, I would expect the selling pressure to continue and the pair to reach 0.9600 in the next couple of hours. Beyond there, the next level to watch will be the 0.9570 and then the key support level at 0.9500.

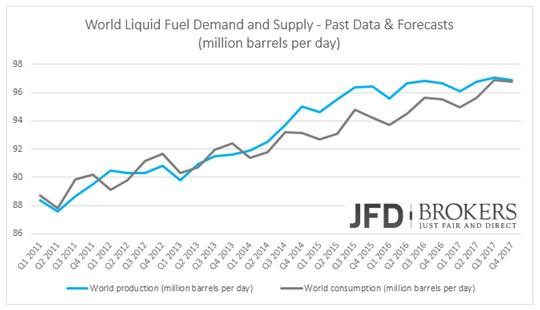

Brent Crude Oil Key Level is $45.00

The Brent Crude oil has been looking a little weak the last few days following the aggressive sell-off started from $45.00. The bearish move came following the break of the $43.00, which prompted a move back towards $40.00. Following that, the crude oil aggressively rebounded from that level and closed the gap open few days ago, following the failed result of the major oil producers meeting on Sunday, in Doha, Qatar, to freeze the oil output. However, the commodity is still in a clearly defined uptrend in the longer term. In the medium term, I would expect the price to test the key level at $45.00. Alternatively, a failure to break above the latter level, could provide an opportunity to retest the key support level at $40.00 (weekly chart), and thus would negate any bullish scenarios for the UK Brent.

It’s worth mentioning, that since the beginning of 2014 the oil production has surpassed the world demand for the oil and according to market forecasts, it will converge again at the last quarter of 2017.

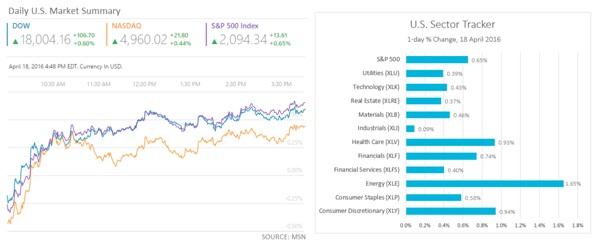

U.S. Indices in Positive Territory following Doha's meeting

The U.S. indices rallied at the beginning of Monday’s session and kept its gains afterwards due to the oil producer meeting in Doha, Qatar on Sunday that failed to clinch a deal to freeze the oil output.

The Dow Jones Industrial Average ended the day above the psychological level at 18,000 for the first time in nine months with Walt Disney (NYSE: DIS, +2.93%) to be the leading gains of the index that added 0.60% at its value or it closed 106.70 higher. The Dow ended the day at 18,004, a level we have to see since July 20, 2015.

All the S&P500 sectors ended the day with significant gains while energy sector has a sharp turnaround! The energy sector plunges at the beginning of Monday session pushing the 500 components index 1.3% lower, however, it turned around and posted gains of 1.65% later, dragging up the S&P500 index to rise by 0.65% or 13.61 points at 2,094, the highest close since Dec 01, 2015.

Meanwhile, the Nasdaq Composite rose 21.80 points, or 0.4%, to end at 4,960.02, after it rebounded on the 50-SMA on the 4-hour chart, recording its highest close since December 03, 2015.

What to watch today

Early today, Eurozone’s Current Account will be released as well as the Construction Output both for February. The ZEW Survey for April will attract attention among the market participants as it will reveal data regarding Economic Sentiment and Current Situation in Germany as well as for the Economic Sentiment in Eurozone as a whole.

In U.S., the Building Permits and the Housing Starts for March are expected to show a slight increase compared to the month before. Afterwards, in New Zealand, the Global Trade Index will be announced give a press conference as to how the RBA observes the current Australian economy and the value of AUD. His comments may determine the short-term direction of the currency. A while later, the BoC Governor Stephen Poloz will also give a public speech.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.