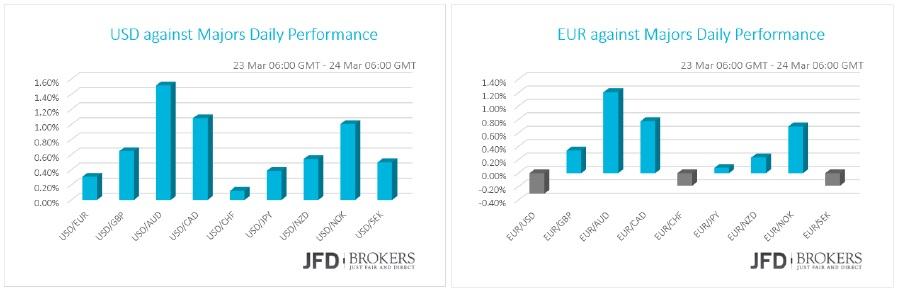

The U.S. dollar has traded broadly higher on Wednesday and early Thursday as various Fed board members are talking about more than one rate hikes in this year. The strength of the dollar acts heavy pressure at the stocks and the commodities driving the commodity currencies to record severe sell‐off on yesterday’s trading session. The British pound is apt to the polls coming out for EU referendum and as the number of votes to leave the common bloc increases, the sterling losing momentum against the major currencies. Eurozone has a choppy session with no significant news on the domestic macroeconomic front out of the political turmoil following the bomb attacks in Brussels.

U.S. Dollar has Traded Broadly Higher

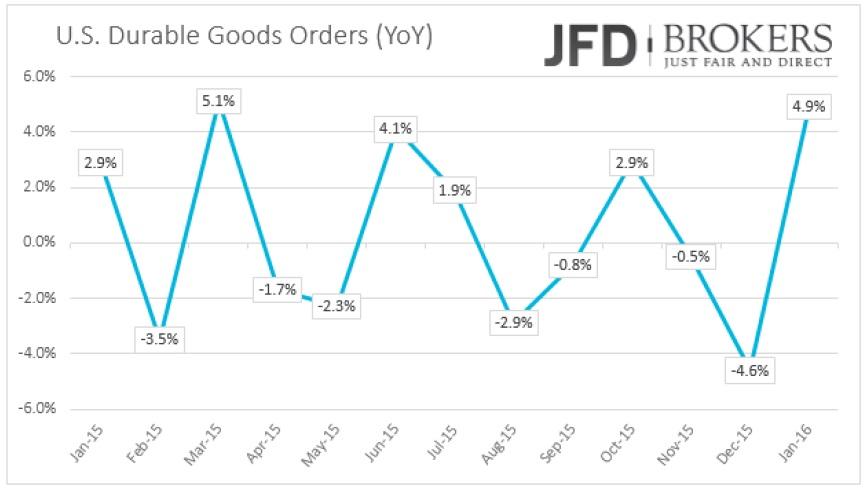

Another Fed member spoke about tightening yesterday, boosting the domestic currency in collaboration the upbeat data came out. The Commerce Department said on Wednesday Home Sales rose 2.0 percent to a seasonally adjusted annual rate of 512,000 units and January's sales pace was revised up to 502,000 units from the previously reported 494,000 units. The U.S. Durable Goods Orders will be released today, with forecasts suggesting a strong decline.

EUR/USD – Technical Outlook

The EUR/USD pair had another tight session, trading below the 23.6% retracement level – March 2016 lows to June 2014 highs –, as well as below the critical level at 1.1220. As we suggested on Wednesday, the pair fell below the latter level and is continuing to move south with the next target to remain at 1.1100. Beyond there would see further sellers at 1.1000 – 1.1030, where the shortterm rising trend line could provide some support to the price action, temporary at least.

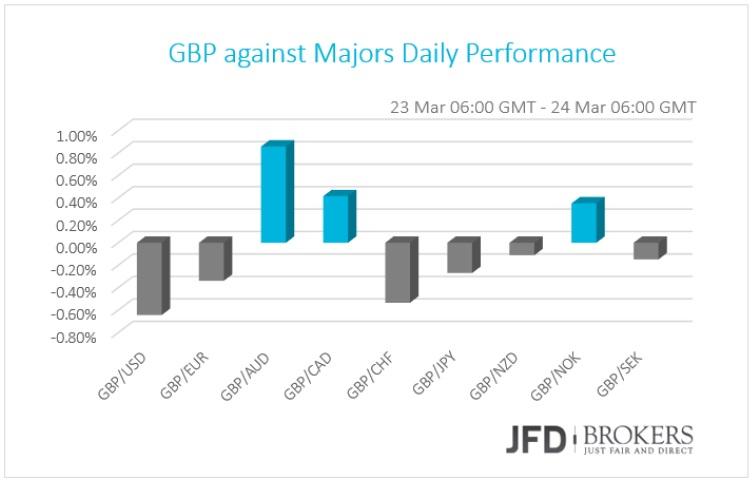

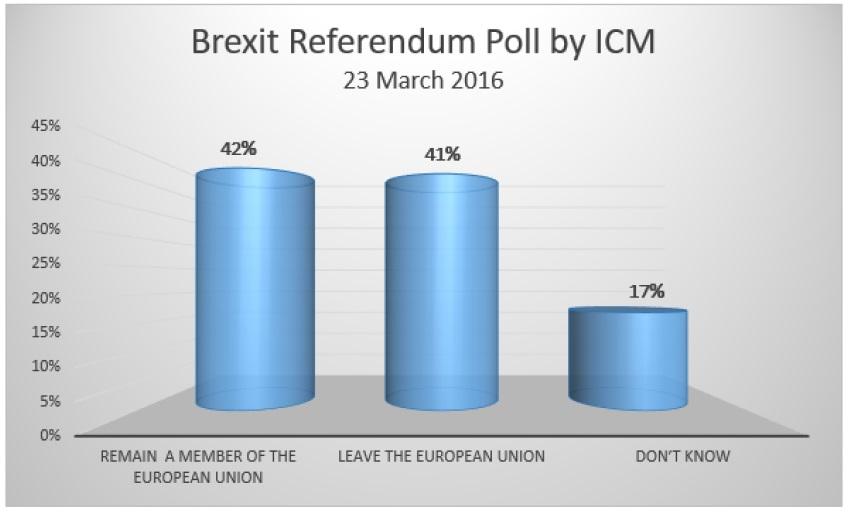

Pound continues to be subdued as Votes for Brexit Rise

Following recent terror attacks in Brussels, the risk in the continental Europe set to extremely high and the number of British citizens will vote for Brexit in June increased, driving sterling to fall heavily in all fronts. The last ICM poll published on Wednesday morning revealed that 42% of respondents want UK to leave the 19‐nation union, while only 41% said that prefer to stay inside the common bloc. The pound is about to set the fourth consecutive negative daily session. The GBP/USD fell near 3% the last 3 days, however, it remains positive for the month +1.16%, following 4 negative months (Feb. ‐2.30%, Jan. ‐3.34%, Dec. ‐2.10% and Nov. ‐2.42%). UK Retail Sales are scheduled for release today and will be closely eyed.

GBP/USD – Technical Outlook

We continue making profits on the GBP/USD pair, following Monday’s report following the aggressive sell‐off below the 1.4350 level, which have helped us lock a profit around 110 pips. This time, the pair plunged below the 1.4100 – 1.4125 zone in early trading, locking around 50 – 60 pips and currently the pair is moving towards the second suggested zone at 1.4030 – 1.4050. Therefore, we remain short on this pair, targeting the aforementioned zone. It should be noted that the pair is close to snap a negative week, ‐2.74% so far, following 3 straight weeks of gains.

Commodity Currencies Under Heavy Pressure!

The AUD/USD pair has broken down and is now testing the critical level at 0.7500. The pair came under pressure and fell after the U.S. Energy Information Administration (EIA) said crude stockpiles rose 9.4 million barrels last week, the expansion in oil inventories saw WTI fall below the $40.00 per barrel level and weighed negatively on the Commodity Bloc of currencies. The pair closed the day down 1.17% and is trading ‐0.46% early Thursday. On the downside, the next level to watch will be now the 0.7415 and then the key support level at 0.7400.

The NZD/USD plunged more than 0.50% and fell below the key support level of 0.6700. The pair slipped for a fourth straight session. It is clear that oil prices are still affecting the commodity currencies. The pair came back in the same range that was trading few days ago. The daily chart looks negative and currently sitting slightly below the 0.6700, which coincides with the 200‐SMA. Going forward, we could be in for further downside pressure towards 0.6650 and lower.

The USD/CAD pair continued to surge yesterday, ending in green for the fifth consecutive session. The pair has posted a daily close above its 50‐SMA and currently sitting above a key level at 1.3120. A sustained move higher would then look to test 1.3300 and the 12‐month rising trend resistance, currently at 1.3330. Above 1.3330 would lead on towards 1.3400 although this seems a stretch too far at this point.

USD/JPY – Technical Outlook

The USD/JPY pair is continuing to push higher currently trading above 112.50. However, the pair is continuing to struggle on the downside near the psychological level of 111.00, following several failed attempts to break below it. There is no data due during the European Session from Japan, but note that late tonight will see the Japanese CPI figures for February and March, which could cause some waves in the yen pairs. Technically, if the buyers manage to sustain its gains above the key support level at 112.00, as well as above the 112.50 barrier, then we could easily see a run towards the key resistance level of 113.00, above which could see a run towards 113.40 and then to the psychological level at 114.00.

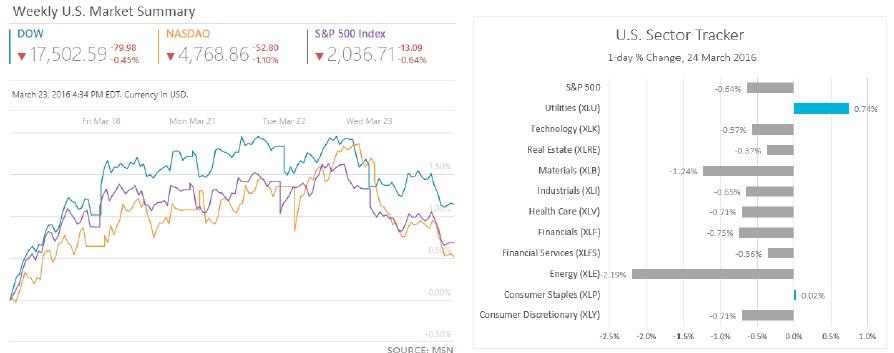

U.S. Indices Closed in Red: S&P 500 Erased Year‐To‐Date Gains

U.S. indices closed Wednesday’s trading session in the red with Dow Jones Industrial Average losing ground, 0.45% down closing at 17,503. The blue‐chip index is about to snap a five weekly winning streak, as the weekly performance currently stands at 0.56%. The Nasdaq was 1.10% lower, also experiencing a negative week after five winning sessions. The S&P 500 managed to erase the modest year‐to‐date gains and turn the performance negative after yesterday’s 0.64% losses to 2,037. The 4% slump in oil prices to $40 per barrel cost 2.19% losses at the energy stock shares.

What to watch today

Early in the morning, the German Gfk Consumer Confidence survey for April will be released – no changes are expected. In Eurozone, the Economic Bulletin and later, the Targeted LTRO will be released. In UK, the Retail Sales for February are coming out. Compared to the last month, the Retail Sales are predicted to slump by 1.0% from an increase of 2.3% prior.

Moving in U.S., the weekly Jobless Claims will be out as usual. The Durable Goods Orders for February, are expected to have decreased by 2.3% versus an increase of 4.7% the flash figure. Overnight, Japanese Inflation Report will hog the limelight.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.