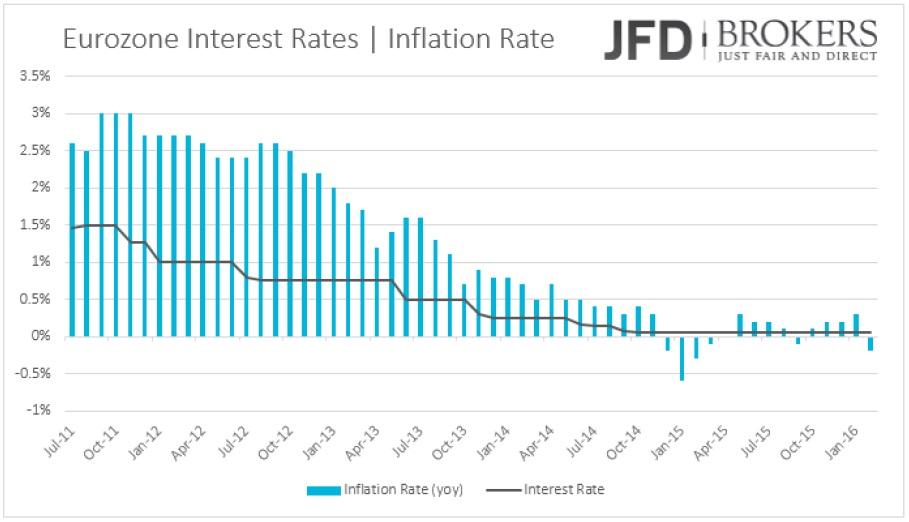

The euro was traded mixed versus the majors ahead of the big day! The ECB will revise the current policy as it scheduled and is widely expected to launch more stimulus. The slow economic growth and the stacked consumer prices amid the gloomy global outlook rush the 19‐nation union to use the available tools to boost the economy. The inflation fell back into negative territory in February at ‐0.2% even further below bank’s target of just below 2%, while the GDP remained near 0.3% for the last two quarters.

In December, the central bank surprised the market by cutting the deposit rate to ‐0.3% and the market is now widely expecting the bank to enter further the negative territory with a reduction of 10 basis points. The interest rate stands at 0.05% and is not expected to be reduced further for now while the other tool the bank is expected to use is the Quantitative Easing program. In December’s meeting, they extended the program until March 2017 and is very likely to expand it further at today’s meeting. Moreover, the ECB is likely to cut inflation and growth forecasts and underlined the drop of the inflation rate to a 10‐month low.

The direction of euro in the foreign markets heavily depends on Mario Draghi's speech. If the ECB president hinges that further stimulus will take action at a later stage, I would expect the sell‐off to be limited, while if he underlines that the bank is done easing, surprise with a non‐expected easing tool or even ease more sharply the already applied measures the euro will suffer severe losses.

EUR/USD – Technical Outlook

The EUR/USD pair remains very heavy ahead of the ECB policy meeting, with the pair trading below the significant level at 1.1030, a level that we consider being a turning point for the pair. The 1.1030 barrier is a significant obstacle for the bulls since it coincides with the 4‐hour 200‐SMA, the daily 200‐SMA, as well as the 50‐SMA on the weekly chart. Technically nothing has changed for the pair. On the upside, the first resistance will be seen at the important level at 1.1030 and then again at the previous session high of 1.1058. On the other hand, a dovish ECB outlook would drive the pair towards 1.0940, which includes the 50‐SMA and then to the psychological level of 1.0900. This should provide a decent hurdle, but a break of which could then open the way to 1.0825, February low. Technical studies support the notion since the 50‐SMA achieved a cross below the 200‐SMA and the MACD oscillator is falling, ready to step in a negative territory.

RBNZ Surprised with a Rate Cut; Kiwi Plunged

The Reserve Bank of New Zealand surprised the market on Wednesday with the unexpected rate cut of 25 basis points to 2.25%. The kiwi plunged immediately after the announcement versus its major peers, ending the day at 1.33% lower against the euro and 1.60% versus the greenback. The reason drove the policymakers to that decision was the below 1% ‐ 3% inflation target range and the gloomy global outlook. The RBNZ Governor Graeme Wheeler said that the weak growth in China and the other emerging markets, as well as the slow growth in Europe, deteriorated the global outlook. He also stated that “further policy easing may be required to ensure that future average inflation settles near the middle of the target range”. The central bank forecasts suggest one more reduction to the borrowing costs in 2016, to underpin economic growth and achieve to send inflation near 2% midpoint by early 2018.

EUR/NZD – Technical Outlook

EUR/NZD raced to a high of 1.6588 from a low of 1.6150 during yesterday’s session, penetrating all of our suggested targets; 1.6235 on the downside and 1.6360 & 1.6475 on the upside, after the RBNZ cut its official cash rate by 25 basis points to 2.25%, an unexpected move for the market. In particular, the pair declined and reached the first suggested target at 1.6235 and then bounced off from the suggested area to record an aggressive rally above 1.6500, after having taken out the suggested target at 1.6360 and 1.6475 – more than 150 pips of profit!

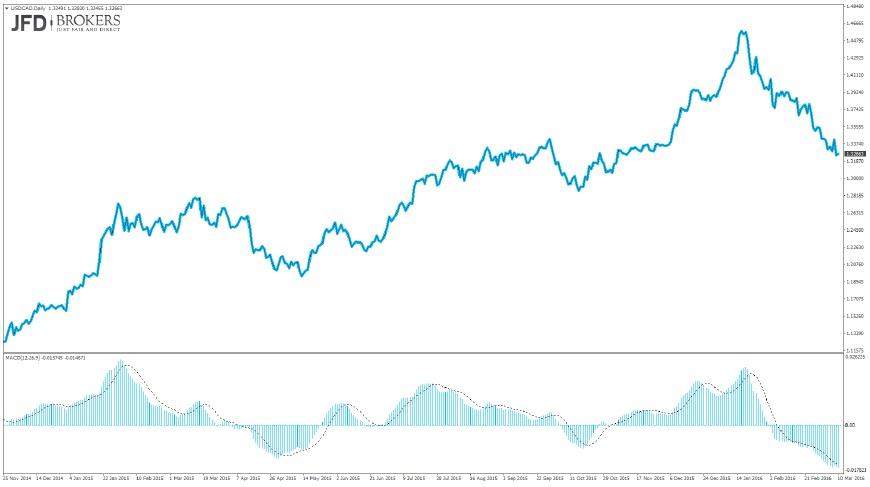

Bank of Canada Left Interest Rates Unchanged for now

The USD/CAD plunged to a three‐month low on late‐Wednesday after the Bank of Canada opted to leave its benchmark interest rate unchanged at 0.5%. The bank’s decision was not a surprise. The overall message from the statement on monetary policy is that the central bank indicated that the global economy has progressed largely just as the bank expected back in January. The greenback has slid more 5% against the loonie since it peaked in mid‐January, around 1.4700, though it remains up 30% against the loonie over the past three years. Going forward, investors await Canada's New Housing Price Index data for January, scheduled to release later today, as well as, the Capacity Utilization for Q4. It should be noted, that the Bank of Canada's next scheduled rate announcement is April.

Going forward, investors await Canada's New Housing Price Index data for January, scheduled to release later today, as well as, the Capacity Utilization for Q4. It should be noted, that the Bank of Canada's next scheduled rate announcement is April 13, when it will also release its quarterly monetary policy report.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.