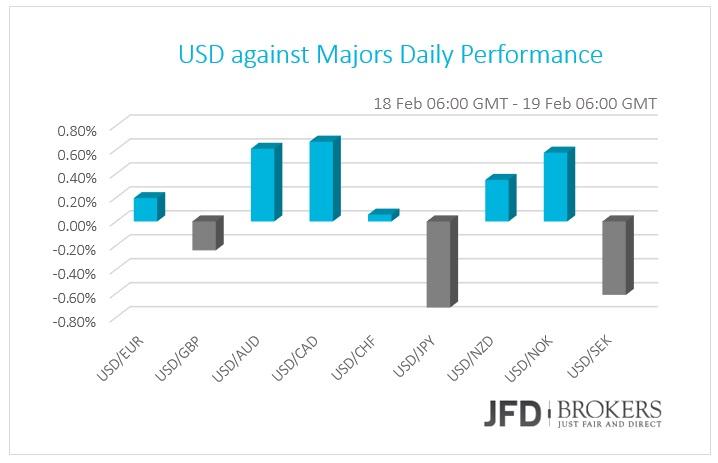

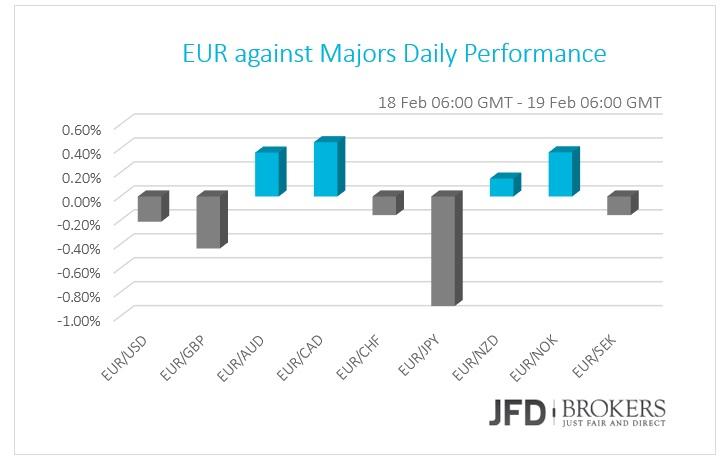

The markets have been relatively steady the last couple of days, with the greenback being mixed against its G10 counterparts. The U.S. dollar is pretty much unchanged against the euro as it remained in a tight range the last couple of days, trading slightly above the psychological level of 1.1100. Gold surged more than 2% during yesterday's session and managed to sustain its gains above the psychological level of $1,200. The Canadian dollar experienced the biggest losses among the G10 currencies after Japan’s exports fell for a fourth straight month, followed by a negative figure in the all industry activity index. The greenback lost further ground to the yen despite yesterday’s data that showed that Japan’s exports fell for a fourth straight month, followed by a negative figure in the all industry activity index. However, the U.S. dollar managed to recover against the commodity currencies, such as the AUD, CAD and NZD. It should be noted that the Canadian dollar experienced the biggest losses among the G10 currencies. The Organisation for Economic Co-operation and Development (OECD) cut its global and U.S. economic growth forecast and called for “urgent” action to spur growth. U.S. indices slipped during yesterday’s session following a three-session rally. Main losses of Healthcare, Consumer Service and Oil & Gas sectors led shares lower.

EUR/USD Daily Outlook

The EUR/USD pair has had another solid session on Thursday, climbing from a low of 1.1070 to finish at 1.1120, after seeing a session highs of 1.1147. The pair now has completed six consecutive negative sessions, extending the weekly losses to 1.30%. Friday will be a bit thin for data although the U.S. Consumer Price Index may cause some waves. According to the 4-hour momentum indicators further losses look possible, where the initial targets will be at 1.1030 and then 1.1000, which includes the 200-SMA. The lower timeframes are still showing some bullish divergence so some caution is warranted on the upside. Therefore, in a case of a pullback to the topside the next level to watch will be the 1.1175, slightly below the 50-SMA on the 4-hour chart.

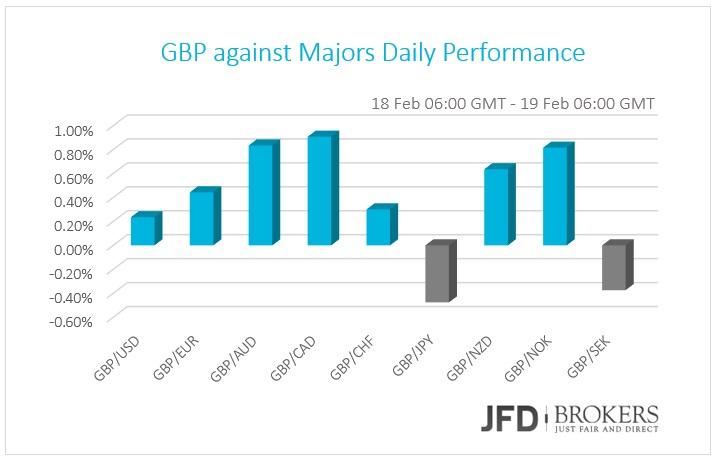

GBP/USD Daily Outlook

The British pound is unchanged today against the dollar after a choppy day of trade between the strong support level at 1.4245 and the key barrier at 1.4400. The latter level is a significant as it includes the both the 50-SMA and the 200-SMA on the 4-hour chart. Technically, the range that the pair has been traded the last couple of days leaves the outlook pretty much unchanged, although the 4-hour chart do suggest a pullback to the upside, with the next level to watch being the 1.4430. On the downside, support will be seen at 1.4245 and then at 1.4125 – 1.4150 zone.

USD/JPY – Technical Outlook

The USD/JPY pair is back down at 113.00, and with the momentum indicators looking negative we could now be in for a test of 112.00. The Japanese yen managed to sustain its gains despite the negative data that came early Wednesday where Japan’s exports fell for a fourth straight month.

Imports fell by 18% from a year earlier to 6.2 trillion yen. Looking ahead, the pair may bounce from the key support level of 113.00 ahead of the U.S. CPI, otherwise expect a choppy session below the aforementioned level. On the upside, the level to watch will be the 113.75, which coincides with both the 50-SMA and the 200-SMA on the 1-hour chart.

XAU/USD Outlook

The precious metal surged more than 2% and held above the all-important $1,200 level. We expect the current gold price rally to continue and to reach $1,300.

The precious metals prices have been under pressure the last month mainly led by speculation that the Federal Reserve would not be able to hike U.S. interest rates due to concerns about the economy. It is very significant the weekly candle to turn positive – to close above $1,232 today – and if the bulls achieve these then we should wait for a further upside pressure.

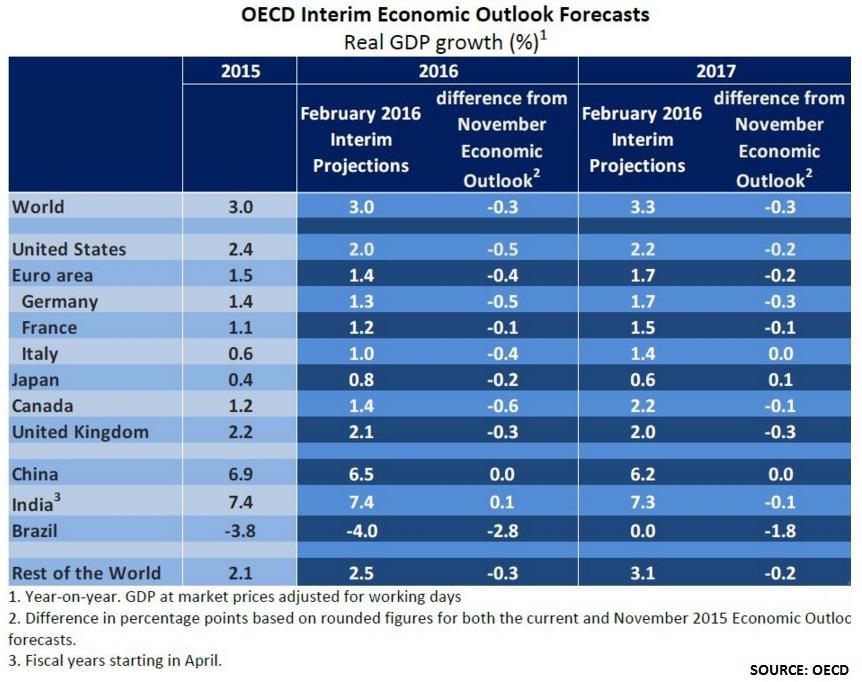

OECD cuts its global forecast

The Organisation for Economic Co-operation and Development (OECD) cut its global and U.S. economic growth forecast and called for “urgent” action to spur growth. The OECD cut its estimates for global growth to 3% this year and 3.3% in 2017. The OECD downgrade was especially sharp for the U.S., now forecasting 2% growth in 2016, down from its previous 2.5% estimate, and 2.2% in 2017, down from 2.4%.In the euro area, 1.4% growth is expected this year and 1.7% in 2017, down 0.4 and 0.2 percentage points, respectively. UK growth is now forecast at 2.1%, down from the 2.4%. In Japan, OECD projects growth of 0.8% this year, down from its previous forecast of 1%, and 0.6% in 2017, down from 0.7%.China’s economic forecast was unchanged at 6.5% this year and 6.2% in 2017. India, which imports a lot of its energy, saw its forecast for growth revised up from 7.3% to 7.4%.

The focus now will turn to Shanghai where the Group of 20 finance ministers and central bankers will meet next week.

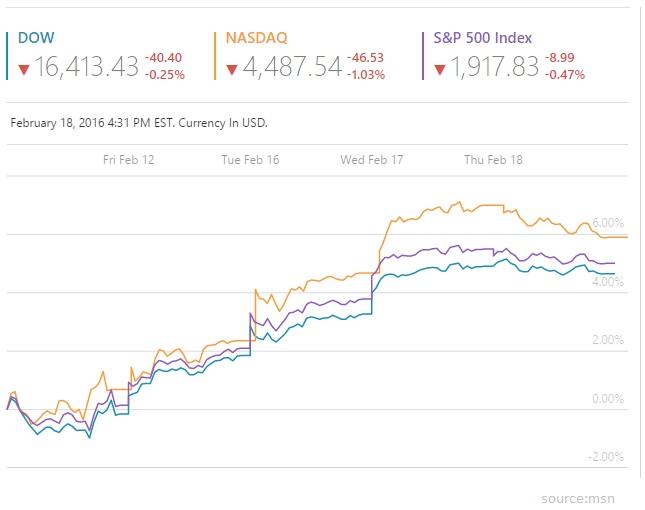

U.S. Indices

U.S. indices slipped during yesterday’s session following a three-session rally. Main losses of Healthcare, Consumer Service and Oil & Gas sectors led shares lower. At the close in NYSE, the S&P 500 index fell 8.99 points to close below the 1,920 level, while the Dow Jones index plunged 0.25% to end the day at 16,413. The Nasdaq Composite index fell 1.03% to finish the day below 4,500.

The worst performance of the session were Wal-Mart Stores Inc. (WMT) which plunged 3% and Goldman Sachs (GS) which fell 2.13%. Apple (AAPL) was also down 1.86 points to end the day slightly above the critical level of $96.00.

Both, the Dow Jones and the S&P 500 are testing the 50-SMA on the daily chart, near 16500 and 1935, respectively. A break above there would suggest that the bias has changed to bullish. In a case of a pullback, I would expect the Dow Jones to test 16245 and then 16000, and the S&P500 to test 1900.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.