The Asian stocks tumbled once more worrying the markets if a new global recession is near. The Japan’s index fell by 950 points its biggest intraday loss since May 2013 while the Japanese yen soared to a 14‐month high versus the U.S. dollar. The European shares have also seen significantly lower on the global concerns while the UK plans to narrow the deficit and turn to high surplus is in danger.

The market hangs on Fed Yellen’s testimony on Wednesday as the traders continue to question to the ability of the Federal Reserve to continue its tightening policy. The U.S. central bank raised its benchmark interest rate in December, after nearly a decade but now it seems that is not in shape for further rate rises.

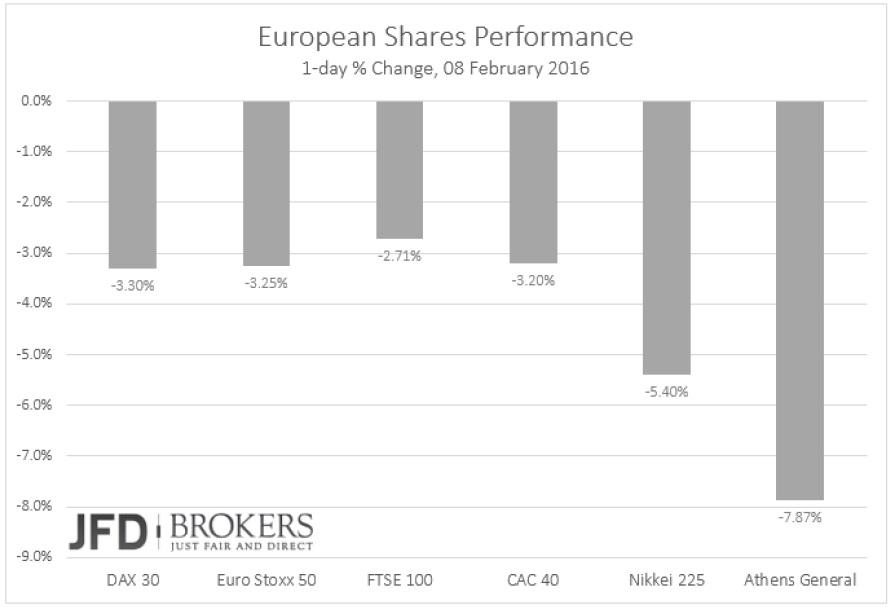

European Equities plunged

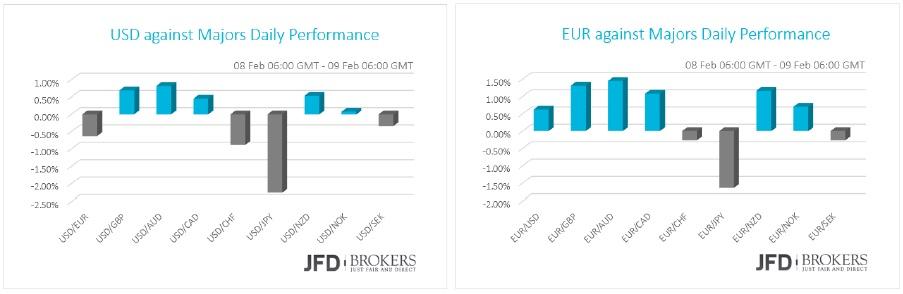

The single currency rose against the majority of the G10 currencies on Monday and early Thursday as the European equities plunged. On Monday, German DAX 30 closed 306.9 points down, London’s FTSE 200 plunged 158.70 points while the CAC 40 tumbled 134.4 points. As Greece is going through another economic review by country’s lenders, the Athens Stock Exchange General Index fell by 7.9% or 464.23 points, the lowest in 25 years.

Athens Stock Exchange tumbles to 26‐year low, DAX30 under selling pressure

European stocks fell heavily on Monday, led by banking stocks on persistent fears of a global economic slowdown. Greek stocks tumbled during yesterday’s session to close nearly 9% lower, with bank shares losing almost 25% of their market value. The Athens stock exchange closed down 7.9% at 464.23 points, a 26‐year low. The plunged in the Athens Stock Exchange which collapsed on Monday was mainly driven by rumours that the government was calling for early legislative elections.

A similar story with the German DAX 30 index which came under pressure during yesterday’s session and plunged below the psychological and critical level of 9400. It should be noted that the German index turned negative for the YTD ‐17%, as well as for the last 1 year as it stands at ‐20%. It’s a significant development that the index is trading below the weekly 200‐SMA. Having in mind the above, the next level for the bears will be the 8900 level and then the 8760 barrier.

CAC40 is Under Selling Pressure

The CAC40 is also under selling pressure, currently testing a critical level around 4065. The French index is also trading below the weekly 200‐SMA, as well as below the monthly 50‐SMA, which it’s a quite bearish development. The French index is negative for the YTD ‐12.30% and is down 6.20% so far for February. The next level to watch will be the psychological level of 4000.

EUR/USD ‐ Technical Outlook

Technically there is not too much change, and with virtually no economic data due from either the EU or the US today could be a rather range‐bound affair, with direction looking likely to be driven by technical factors. To the downside, minor support lies at 1.1150 and comes ahead of the first Fibonacci support at 1.1120 (23.6% of 1.0520/1.1240). The obstacles for the bulls today will be the critical level of 1.1240, with a break above it to open the way towards the psychological level of 1.1300

IMF warns: UK Economic plans are vulnerable

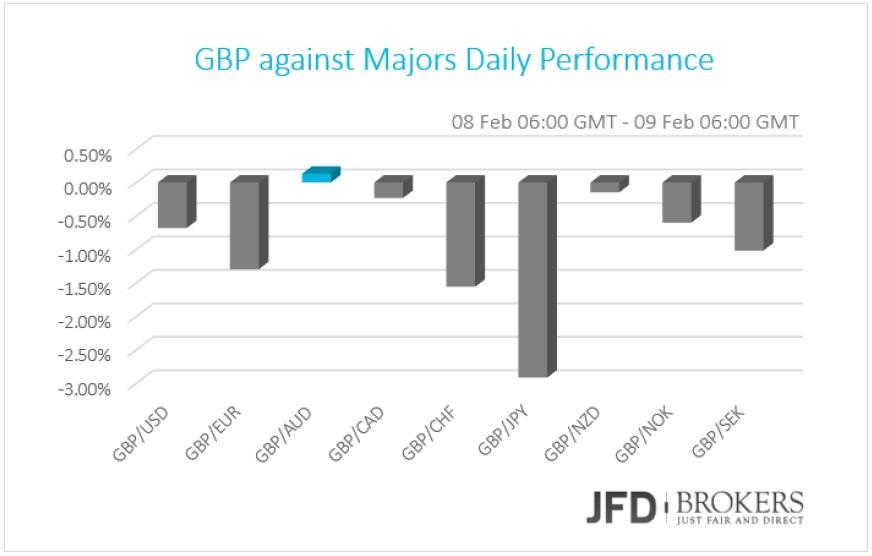

The pound lost ground against the majors on Monday and early Thursday as the IMF warns that plans of the UK Chancellor of Exchequer George Osborne to reduce the country’s deficit are very vulnerable. A tumble of the UK shares can wipe out £2bn forcing the chancellor to raise taxes or make fresh spending cuts to reach its surplus targets.

GBP/USD ‐ Technical Outlook

GBP/USD remains under heavy pressure and currently sits just above the major support at 1.4400 after having fallen from the earlier session high of 1.4520. Ahead of the release of the UK Trade Balance the 200‐SMA on the 4‐hour chart is likely to hold, near the 1.4500 barrier, but a strong reading would most likely see this taken out, prompting for a run towards 1.4560 and then to 1.4630. To the downside, the initial support will arrive at the day’s low at 1.4360, below which there is not too much to prevent it heading back towards 1.4300.

Yen Gains Momentum as Safe‐Haven Currency

The USD/JPY is traded in its lowest levels over a year ago showing signs of risk aversion. The global uncertainty and the gloomy economic outlook favours the safe‐haven currencies like Japanese Yen. The Japanese currency is now in a stronger position than it has been after Bank of Japan adopted a negative interest rate policy. It’s notable that the Japan’s index fell by 950 points its biggest intraday loss since May 2013 while the Japanese yen soared to a 14‐month high versus the U.S. dollar.

USD/JPY ‐ Technical Outlook

U.S. dollar fell sharply in early trading, particularly against the Japanese yen. The USD/JPY plunged below the psychological level of 116.00 and the price has been choppy below that level as the bulls are trying to lift the price above the latter level, following the strong rebound from the 23.6% Fibonacci level around the 114.60 area. The intraday traders could participate in a trading range game and bet on the strong support of 115.00 while the short could participate in a failure swing pattern which could add a further selling pressure to the pair, which could prompt a more aggressive move towards the 113.00 area.

Gold ‐ Technical Outlook

The precious metal surged during yesterday’s session breaking the descending trend line which started back in 2012. This came as a surprise since a lot of traders booked their profits around the $1,170 level. Following the test of the descending trend line the precious metal retraced slightly below the $1,170 level, however, following he retest of the trend line, from above this time, it gained momentum and surged aggressively above the $1,190 level. Having in mind the above, the next target and obstacle for the bulls will be the $1,200 level and then the $1,235 barrier.

Silver ‐ Technical Outlook

XAG/USD is looking bullish at the moment as is trading above the psychological level of 15.00. It’s remarkable that for the last three weeks the silver added more than 10% to its value, as the white metal rose for a third consecutive week after rebounding from the 13.60 level, which coincides with the medium‐term ascending trend line which started back mid‐February 2015. It should be noted that that silver is up 11.30% so far this year. Bearing the above in mind, the next target for the bulls will be the 15.60 level, inside swing, and then the 16.50 barrier, October highs.

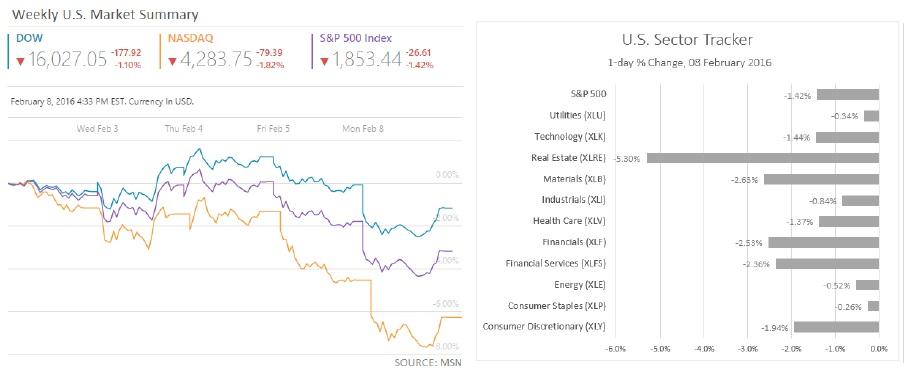

U.S. Indices in Red on Domestic and Global Concerns

The U.S. indices ended in red as they reflected the global slowdown concerns and deeper the uncertainty of Fed next moves. Fed’s Yellen testimony will be decisive for the near future of the U.S. equities. The S&P 500 was 1.42% down with all its components share sectors negative performed. The Dow Jones industrial average ended 1.10% down and the Nasdaq plunged by 1.82%.

Economic Indicators

During the European day, the Switzerland unemployment rate is expected to fall slightly in January to 3.3% from 3.4%. On a quiet day in terms of economic data from the Eurozone, figures on Industrial Production, Trade Balance and Current Account for Germany will be released at 7:00 GMT. While these numbers are not the most closely followed by markets, they have reflected some interesting developments in recent months. During the mid‐European session, the focus will be on UK Trade Balance for December.

In the U.S., the JOLTs Job Opening Report (JOLTS) is expected to show 5.480M job opening in January from 5.431m the previous month. That would show a relatively healthy job market following the U.S. nonfarm payrolls report. The National Federation of Independent Business (NFIB) small business optimism survey for January is forecast to rise to 95.8 from 95.2. Moreover, the market expects Wholesale Inventories to show a turnaround to 0.1% mom in December from ‐0.3% mom in November.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.