The U.S. dollar depreciated more than 1% versus most of the majors on Thursday and early Friday as the U.S. durable goods contracted more than expected and the commodity currencies rose on the back of the rising oil prices that managed to surpass $35.00 per barrel!The only exception is the Japanese yen that slumped versus the U.S. dollar as the Bank of Japan surprised the market switching to negative interest rate monetary policy!

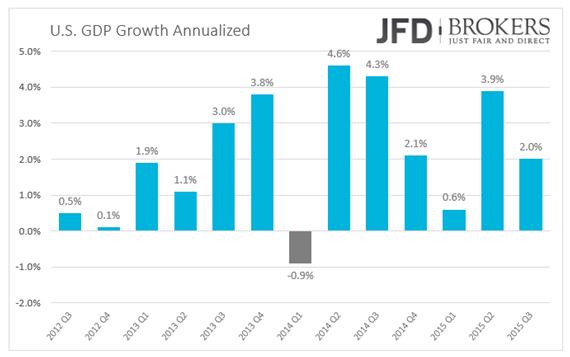

The U.S. durable goods decreased by 5.1% in December, the biggest decline since August 2014 while they were expected to have decreased just by 0.6%. The durable goods orders ex-transportation also declined by 1.2% from -0.1% forecasted. Today, the USD traders are remain tuned for the GDP release which is very important for Fed’s future changes to the monetary policy.

Decreased Sentiment Across the Eurozone

The euro also inched down against its major counterparts on Thursday and early Friday, as the fundamental news came out showed the sentiment in various sectors across the Eurozone deteriorated. The consumer sentiment remained at -6.3 as expected while all the other indicators, services sentiment, business climate, economic sentiment and industrial confidence declined more than expected.

UK economy grew by 0.5%

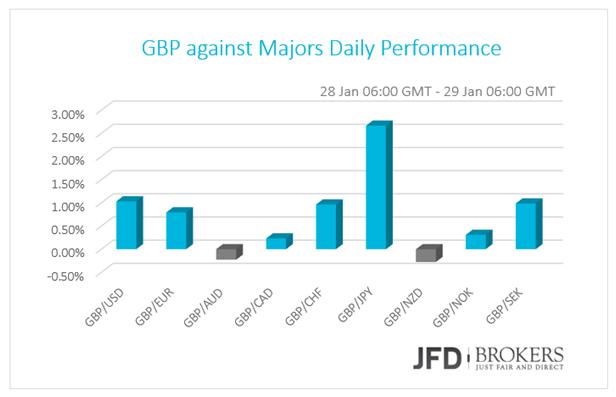

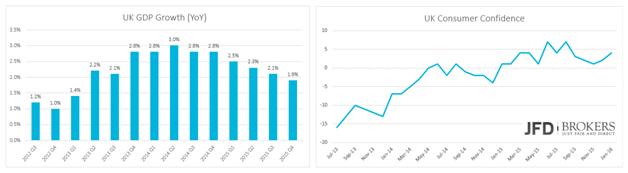

The British pound rose against the other G10 currencies as consumer confidence is at the highest has been the last five months in January and the first estimation of the GDP growth met expectations of 0.5% for the fourth quarter, quarter-over-quarter. The indicator improved since the quarter before that grew by 0.4%. However, the year-over-year indicator shows an economic growth of 1.9%, as expected, but the lowest since the first quarter of 2013! The Gfk consumer confidence came out early on Friday morning at 4 versus forecasts to decline to 1 from 2 before.

The GBP/USD is currently on a rebound started nearly above the 1.4060 support level. The British pound was facing heavy sell-off against the buck since early in December and this is the first breath of the pair since then. Currently, the pair is finding support on the 100-SMA on the 4-hour chart slightly above 1.4350. If the bulls maintain the price above the aforementioned level, I would expect the pair to test the strong resistance level of 1.4570 which coincides with the 200-SMA on the 4-hour chart before it continuous its move in either way. Otherwise, if the pair manage break below the 1.4210 and the 50-SMA, further declined towards the 1.4060 are expected.

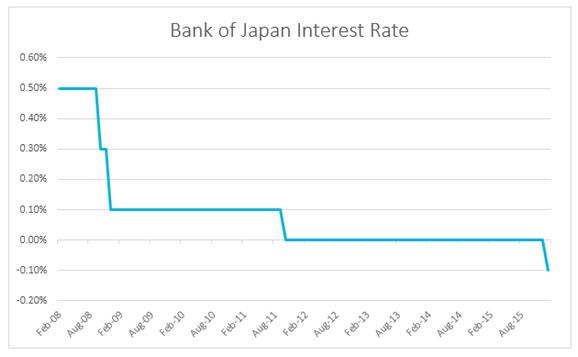

Bank of Japan Adopt Negative Interest rate Policy!

The Bank of Japan surprised the market early in the European morning as it cut the benchmark interest rate unexpectedly below zero! The interest rate is now -0.1% from 0.1% has been since October 2010, to restrain the domestic economic growth from the volatile markets and the global growth headwinds. It’s notable that Japan has been in recession until the first quarter of 2015, but managed to grow at a pace of 0.7% and 1.6% in Q2 and Q3 respectively. The bank statement indicated that “The BoJ will cut the interest rate further into negative territory if judged as necessary”. Despite the surprise, I expect that move to help inflation rate to meet bank’s 2% target sooner.

The BoJ Governor Haruhiko Kuroda said that the negative interest rate was not in the initial easing measures, but the expansion of the asset-buying program was. However, an unexpected voting of 5-4 from the BoJ policy board surprised the market. Even though the central bank maintained its pledge to expand its QQE program (Qualitative and Quantitative Easing), for now, left the program unchanged.

Following the decision, the USD/JPY jumped to the strong resistance level and psychological level at 121.00 from 118.40 has been before, which means that the Japanese Yen plunged more than 2% against the greenback. On the other hand, the Nikkei 225 index surged nearly 3%.

Brent Crude Oil above $35.00 After a plunge over than 60%, the Brent Crude Oil price found strong support near 27.10 and rebounded upwards with enough momentum to overpass the obstacles appeared. The oil price broke above all of the three 50, 100 and 200-SMAs on the 4-hour chart and continues to rise. However, I expect the pair to face a stronger resistance near the psychological level of $36.00 which coincides with the 50-SMA on the 4-hour chart. If the oil price manage to pass that level, I would expect it to remain the significant zone between $36.00 and $38.10 for a while before it moves in either way. On the other hand, if the price fails to penetrate the 50-SMA on the daily chart and the aforementioned level, a decline to $31.80 is possible. The MACD oscillator supports the bullish momentum of the oil at both the daily and the 4-hour timeframes.

Economic Indicators

Today, the U.S. and Eurozone data will capture the traders’ attention. In Eurozone, the flash inflation rate for January is coming out and is expected to rise up to 0.4% from 0.2% the previous month. In the US, the flash GDP growth for Q4 will be released. The quarter-over-quarter figure is forecasted to reveal a growth of 0.8% from 2.0% before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.