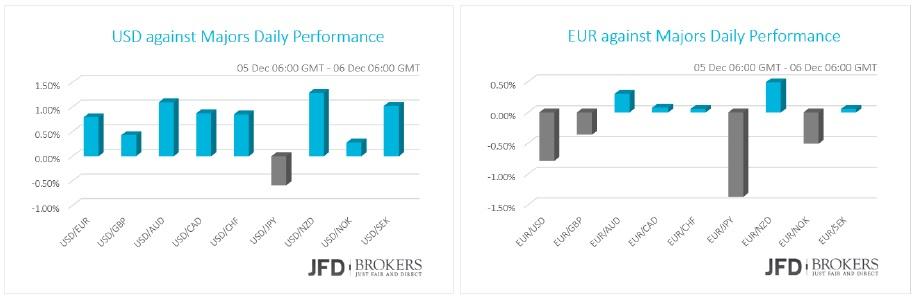

The dollar gained ground against all the major currencies, except the Japanese yen, as risk aversion continues. The latest events in China, the geopolitical tensions in the Middle East and the North Korea’s latest nuclear test lead traders to buy U.S. dollars and Japanese Yen. During the period from 06:00 GMT time on Tuesday to 06:00 GMT on Wednesday EUR/USD performed â€0.80% while EUR/JPY plunged by 1.40%.

Today, the market will look at the FOMC minutes of the historical meeting on December 15â€16 where it set the end of the sevenâ€year era of nearâ€zero borrowing costs. The importance of the minutes hovers around the policymakers’ thoughts behind the future gradual policy tightening. It’s worth noting that the Fed Chair Janet Yellen at the press conference after the last meeting in December stated that the “future policy actions will obviously depend on how the economy evolves.â€

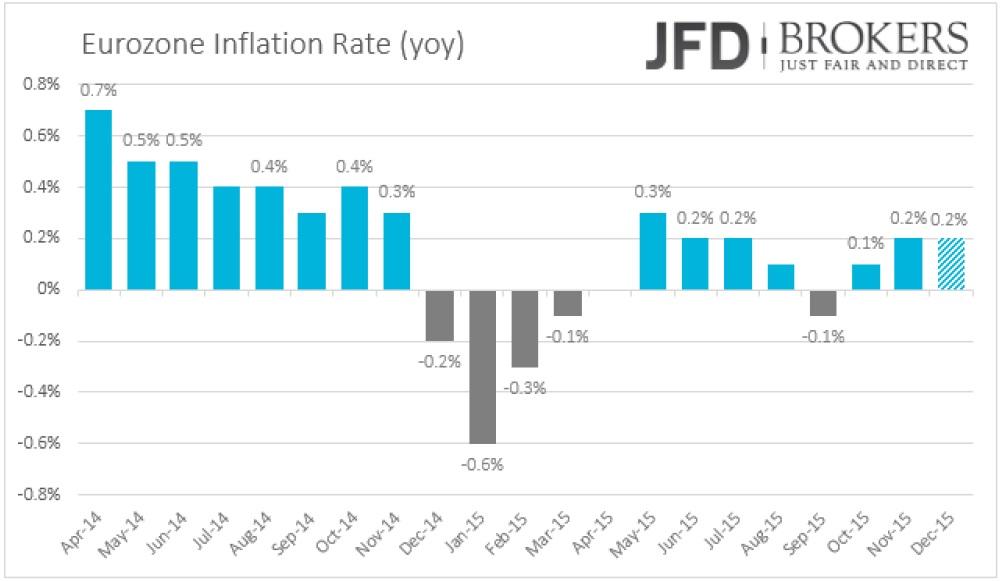

The single currency plunged against the greenback, the sterling, the Japanese yen and the Norwegian krone while it was marginally unchanged versus the Canadian dollar and the New Zealand dollar on Tuesday and early Wednesday. Following the below expectations flash inflation rate for Eurozone in December, North Korea announced that tested a hydrogen bomb overnight and will not give up nuclear capabilities unless U.S. drops its hostile foreign policy towards the country. This is extremely bad news for the market as the geopolitical risks deteriorated alongside with investors’ sentiment. The Eurozone’s inflation was expected to show an improvement in December, although, the preliminary figure revealed that remained on a stable pace at 0.2%, in December, compared the same month the year before.

Following the weakness of the consumer prices to show improvement, the EUR/USD managed to break below the psychological level of 1.0800 and the 4â€hour 200â€SMA that provided support to the pair slightly above the aforementioned level. A battle between the two forces around the 4â€hour 200â€SMA ended in favour of the bears that are seen to lead the pair towards the support level of 1.0700. If the bulls fail to sustain the price above the 1.0700, I would expect the pair to fall further to 1.0660. Alternatively, if they take control over the price, the 4â€hour 200â€SMA is likely to provide significant resistance to the slightly above the 1.0800 level.

GBP/USD: Profit Locked on 1.4635!

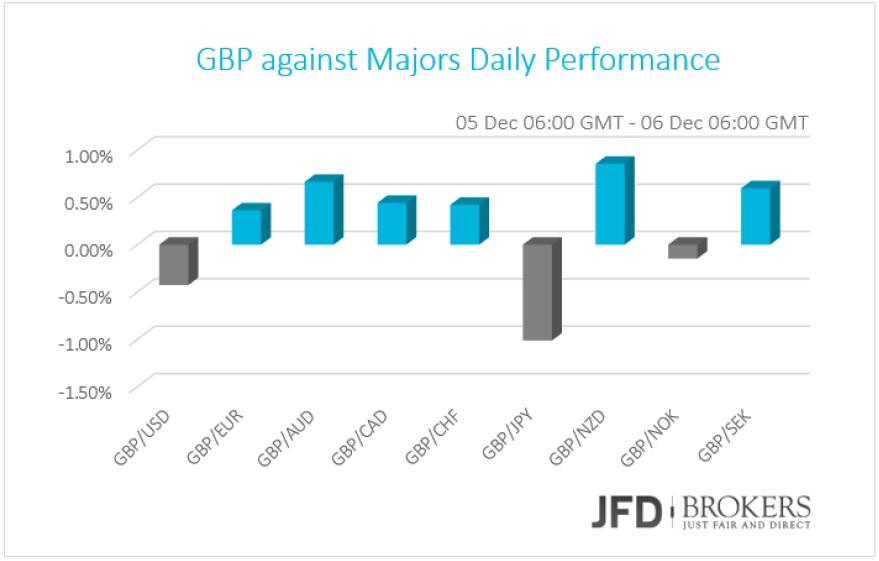

The sterling was broadly higher on Tuesday and early Wednesday, with significant losses only against the Japanese Yen. The construction PMI returned back to the “normal†levels for the country in December, to 57.80, after a weak figure in November of 55.30.

The GBP/USD broke below the lower boundary of the sloping channel has been traded in since June of 2015. Currently, the pair is traded below the 1.4800 and the 4â€hour 50â€SMA after it reached our suggested target in yesterday’s report of 1.4635 (New Year Started with a Surprise from China; Dow Jones Suffered Severe Losses). As we said in our previous reports, we feel that there is no room for long opportunities and therefore, having in mind that the dollar is considered a safeâ€haven currency on the risky recent developments across the nations, I will remain bearish on this pair with the next target being the 1.4570 barrier.

USD/JPY – Technical Outlook

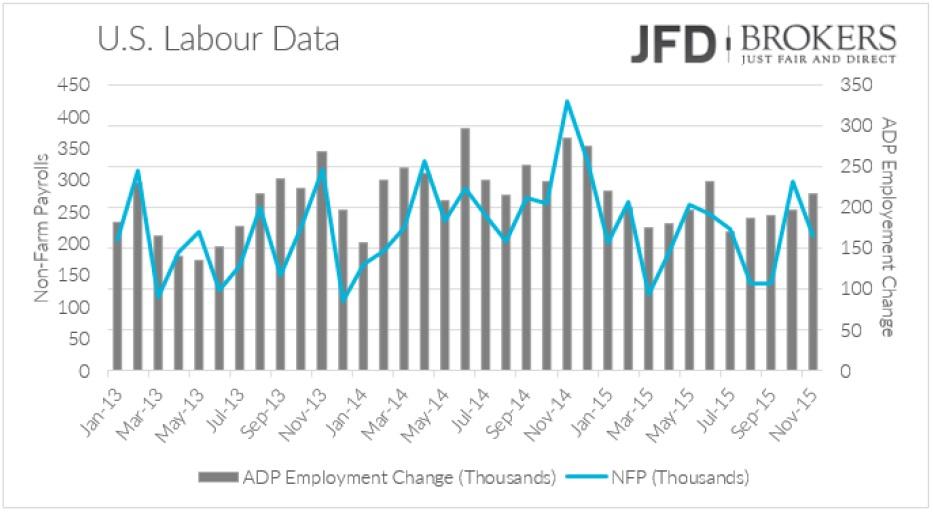

Over the last couple of months, the USD/JPY pair has established and traded within a trading range roughly around the key level of 121.00, whilst moving down to support at 118.00 and roughly up to 125.00. The pair is now traded slightly above the lower boundary of its wide range and on the third negative day in a row. The RSI fell below 30 while the MACD crossed below its trigger line in negative territory, strengthening my conviction that we are likely to see a further selling pressure in the upcoming days. In the bigger picture, a clear break below the 116.00 would signal a trend reversal sign, prompting a move towards the 112.00 level. For now, I would expect the pair be around the 118.00 level until Friday when the U.S. NFP is due to release or a new earlier fundamental push. A negative impact could push the pair towards the 116.00 level, which I expect to hold, at least for now.

AUD/USD Looks Bearish in the Long Term

Following the peak at the 1.1070 back in July 2011, the AUD/USD pair plunged by 38% to 0.6900 in September 2015. The pair penetrated easily the 50â€month SMA but found some resistance to break below the 200â€month SMA. The sellâ€off halted on the psychological level of 0.6900 where it rebounded towards 1.7400. Following the strong support from the aforementioned level, the Australian dollar posted three winning months in a row against the greenback and continued with a black candle in January 2016 which is still in process. Currently, the monthly performance of the pair stands at â€1.50%. The pair is looking pretty weak at the moment, having broken below the aforementioned obstacles, as well as the failed attempt to break higher few days ago. If we see a close outside the range of 0.6900 – 0.7400, it should give us a big clue about what the bias in the market actually is. If we see a break lower, further support should be found around 0.6250. Below here further support should be found around the psychological and critical level of 0.6000. On the other hand, a break higher would suggest the bias is still bullish in the market, following the retracement above the 0.6900, prompting a move back towards 0.8070.

Gold continues to gain momentum

The precious metal continues to rise amid the geopolitical worries, after finding strong support around the $1,045 the last few weeks. Looking in the shortâ€term picture, the yellow metal has clearly gained some momentum, currently being in the process to create the fourth consecutive positive daily candle, after China’s and North Korea’s recent actions and above $1,060. The bulls have managed to overcome both the 50â€SMA and the 200â€SMA on the 4â€hour chart and is now testing the critical resistance level of $1,082, following failed attempts during yesterday’s session. If the bulls are strong enough to push the price further up, I would expect an extension towards the $1,090 barrier, an area tested a few times the previous month. A failure to retest the latter level should prompt a move lower towards the $1,060 and then at $1,045, where a battle is expected by both market forces. Note that on the bigger picture, the metal is trading in a range and despite numerous attempts to break out of the sideways channel, all the attempts have failed.

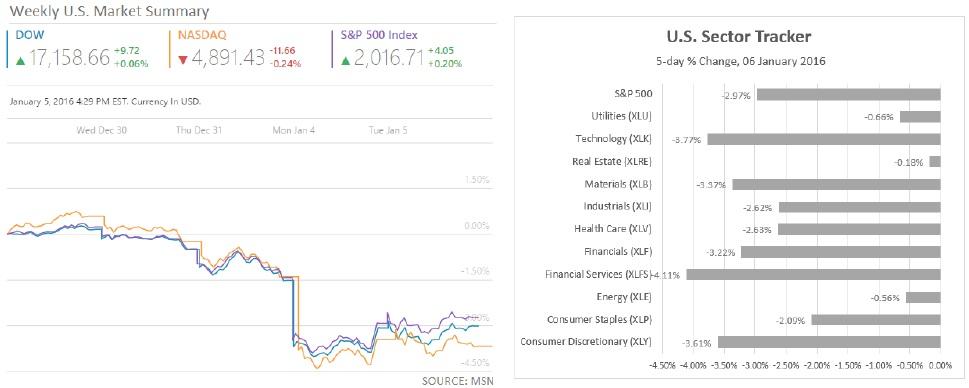

U.S. Indices closed mixed

After the triple digits losses on Monday, all of the indices moved in a tighter range. The Dow Jones Industrial Average and the S&P 500 closed the second trading day of the year with small gains of 0.06% and 0.20% respectively. The worst performed Dow constituent was Apple Inc. (NASDAQ: AAPL) with losses of 2.51% followed by Walt Disney (NYSE: DIS) with losses of 2.02% while the higher recorded by Walâ€Mart Stores (NYSE: WMT) of 2.38%. Nasdaq closed slightly lower at 4,891.

Economic Indicators

On Wednesday, the Markit Economy will release the final December’s Purchasing Managers Index for the services sector and the composite indicators for U.S., Eurozone, UK, Germany and France. Going forward to the second half of the trading session, the ADP employment change for December is expected to show that the pace of hiring in the private sector slowed down in December.

The ISM Nonâ€Manufacturing PMI for December will be printed. During the night, in Australia, the Building Permits and the Trade Balance for November will be published.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.