AUD Rose on Strong GDP; BoC Policy Meeting and Yellen's Speech in Focus!

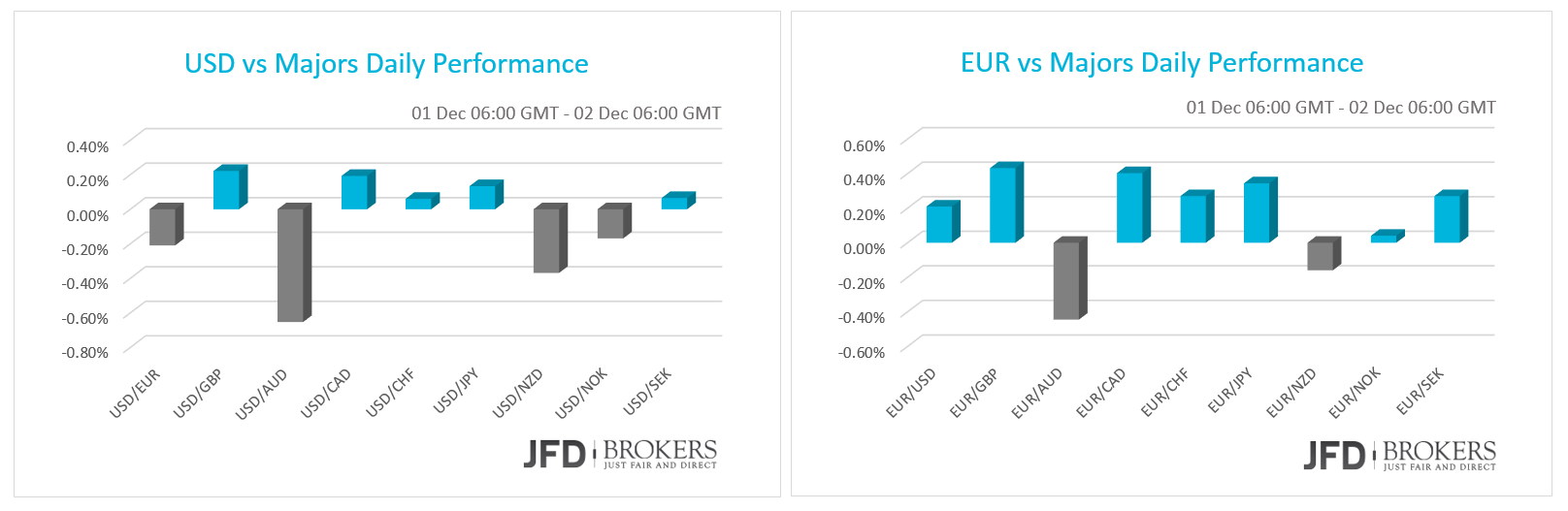

The volatility in the greenback continued to be thin on Tuesday as all the investors eye the Fed Chair Yellen speech today, for confirmation that the odds for December’s rate hike are still high.

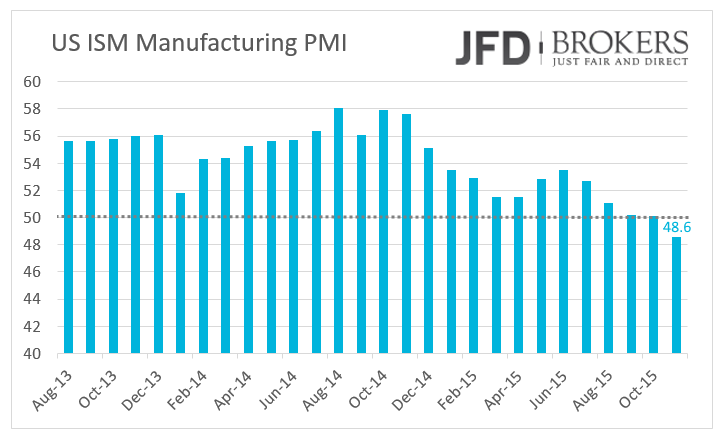

The US manufacturing sector contracted in November, falling to 48.6, its worst levels since June 2009, when the economy was still in the midst of a recession. Note that the readings below 50 indicate contraction.

Euro traders await Inflation rate and ECB policy meeting

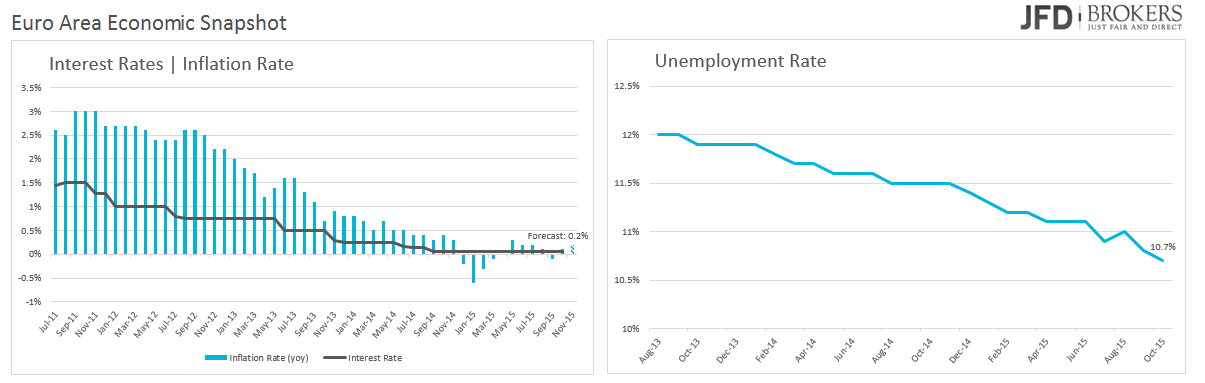

The euro halted a five-day losses against the U.S. dollar on Tuesday, ahead of some significant data coming from the Eurozone today, as well as ahead of the all-important ECB meeting tomorrow. As the Eurozone recovery faces a slowdown, it’s widely expected that the ECB president, Mario Draghi will announce further loosening of monetary policy on Thursday, a move which can shake the markets. Eurozone’s unemployment rate fell to 10.7%, the lowest since January 2012. The German unemployment also surprised positively, as it fell to a record low and the employment people rose by 13k well above expectations of 5k. Today the euro traders will closely monitor November’s final inflation rate, as the soft numbers worry the investors. The data released on Tuesday didn’t trigger much volatility in the EUR/USD pair, as since it fell below the 1.0900, it moved in a range of 300 pips in the last 4 weeks.

On the daily chart, the technical indicators turned higher, but remain below their mid-lines, suggesting for a short-term recovery, whilst the price is aiming to recover above its 50-SMA on the 4-hour chart. If the recent pullback extends and remains above 1.0600, then it can continue advancing towards the psychological level of 1.0700. Alternatively, any move lower should see the pair target 1.0525, finding support along the way around 1.0560.

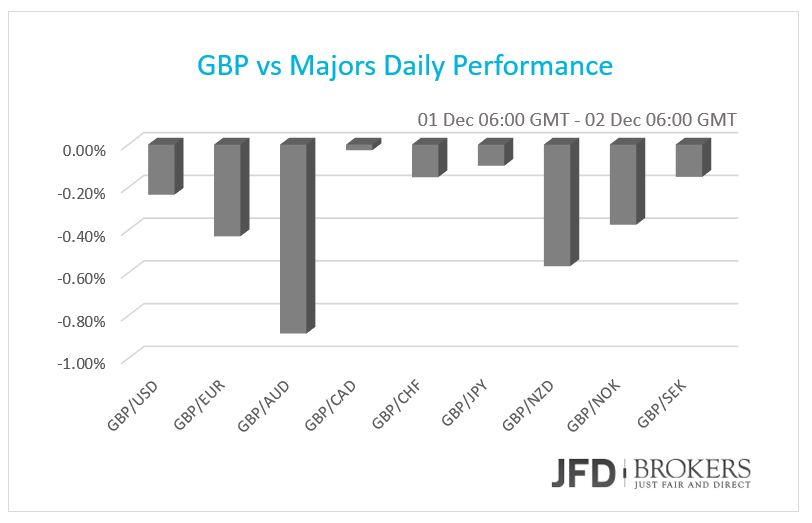

Pound remains in a weak tone

The sterling was broadly lower against the other G10 currencies as BoE Governor Mark Carney avoided to discuss economy or monetary policy in the speech had yesterday. The Manufacturing sector plunged to 52.7 in November from the record high of 55.5 the month before according to the Markit Purchasing Managers' Index (PMI). In addition, the major banks of UK passed the annual stress tests which means that are strong enough to withstand a crisis scenario and prolonged deflation.

The GBP maintains a weak tone against the USD, as it moves below some significant levels, including the psychological level of 1.5100, as well as, the 4-hour 50-SMA and the 200-SMA. The pair came under pressure and fell below the key support level of 1.5030 a few days ago, however, the bulls found the strength and recovered from the psychological level of 1.5000, which includes the lower boundary of the downward sloping channel that started back in mid-2015.

Going forward, the 4-hour chart shows that the MACD is moving upwards, near the zero and trigger lines, whilst the RSI is testing its mid-level. In the same chart, the momentum indicators have recovered from near oversold readings. Therefore, with the above in mind, I would expect the pair to test the 1.5030 level, and more likely the 1.5000 barrier in the next couple of hours. However, I will change my stance from bearish to neutral-bullish, since the momentum indicators are indicating a slowdown in momentum.

Australia’s GDP surpassed expectations!

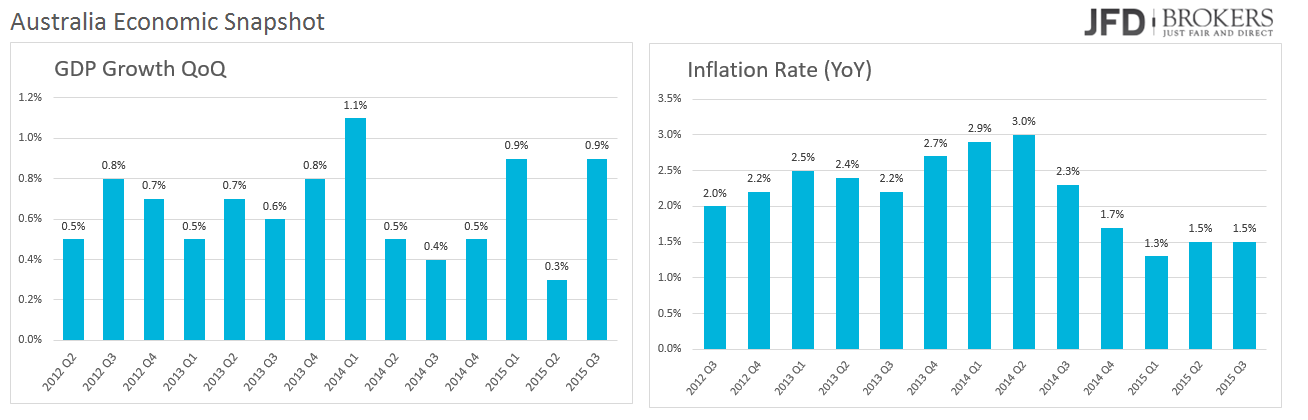

The Australian dollar was the best performed major currency on Tuesday, posting the second day in a row after the Reserve Bank of Australia left the interest rates unchanged, the GDP outperformed figures and RBA Governor Glenn Stevens comments. The GDP has expanded by 0.9% percent in the third quarter, compared to the upward revised growth 0.3% the quarter before justifying the RBA Governor’s statement that after the absence of the mining sector growth has been a little disappointing but it is "quite respectable." He also said that inflation is on the way up, towards the central bank’s target of between 2% to 3%.

The Australian dollar surged for a second consecutive day, catching a 250 pips rally vs the US dollar since it rebounded from the daily 50-SMA and the 4-hour 200-SMA, near 0.7170. The AUD/USD pair rose more than 1% after the RBA left the cash rate on hold at 2%. Technically, the 4-hour chart shows that the price is back above its daily 50-SMA, whilst the technical indicators recovered positive territory, suggesting strong buying interest defending the 0.7000 mark. The key to watch for a trend reversal will be the 0.7400, which coincides with the daily 200-SMA.

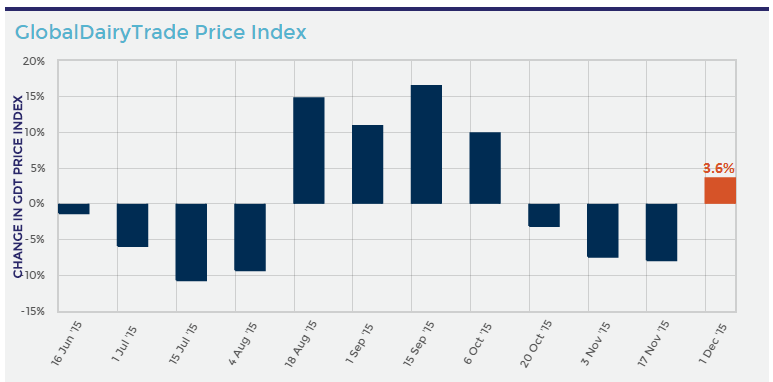

NZD higher as dairy product prices rose by 3.6%

The New Zealand dollar rose due to the dairy prices that has picked up for the first time since early in October. The Global Dairy Trade Index recorded gains of 3.6% after the greatest decrease of 7.9% over the last months on the previous auction.

The NZD rose for a second consecutive day against the USD following the strong rebound from the 0.6430 level. The NZD/USD is holding above the lows of the month, but for the time being it is still trapped below the psychological level of 0.6700. If it is able to close above here then the next target becomes 0.6800, towards the highs of October. A reversal should find support around 0.6620, which includes the 4-hour 200-SMA and then down at 0.5570.

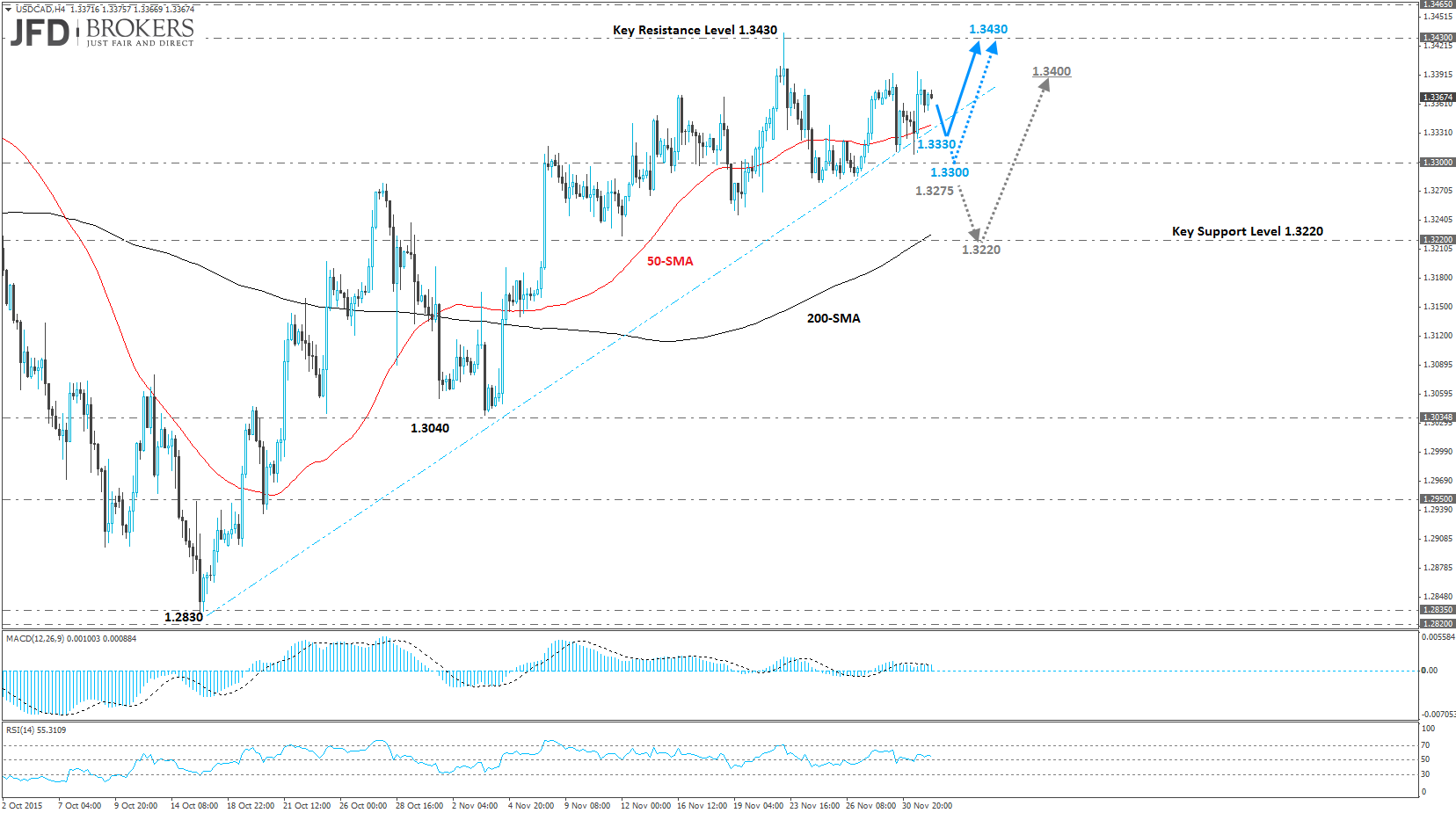

USD/CAD ahead of the BoC policy meeting

The Canadian dollar was almost unchanged versus the majors after the GDP report that revealed the Canadian economy contracted by 0.5% in September versus expectations to have remained flat. The Annualized GDP was also disappointing as showed a growth just by 2.3% less than the forecast of 2.4%. Today, the CAD traders are widely expecting the Bank of Canada to keep the monetary policy unchanged, however, the rate statement will accompany the interest rate decision will be closely watched for cues about the economic future.

The USD/CAD pair remains stuck in a tight range slightly above the psychological level of 1.3300 ahead of the BoC policy meeting due later in the day. So far today an attempt to break the key resistance level of 1.3400 has been defeated. On the longer-term picture, the USD confirmed the bullish bias against the CAD, following the break above some significant obstacles, including the daily 50-SMA and the 1.3300 level. With both the MACD histogram and stochastic moving higher, the momentum indicators are supporting the bullish sentiment. However, we should watch for a pullback towards the 1.3330 level, where the 1-hour 200-SMA and the ascending trend line both are ready to provide a significant support to the intraday bulls. Below here, the psychological level of 1.3300 could prove to be a strong obstacle for the short- and medium-term. Therefore, short and medium term holders should watch that closely.

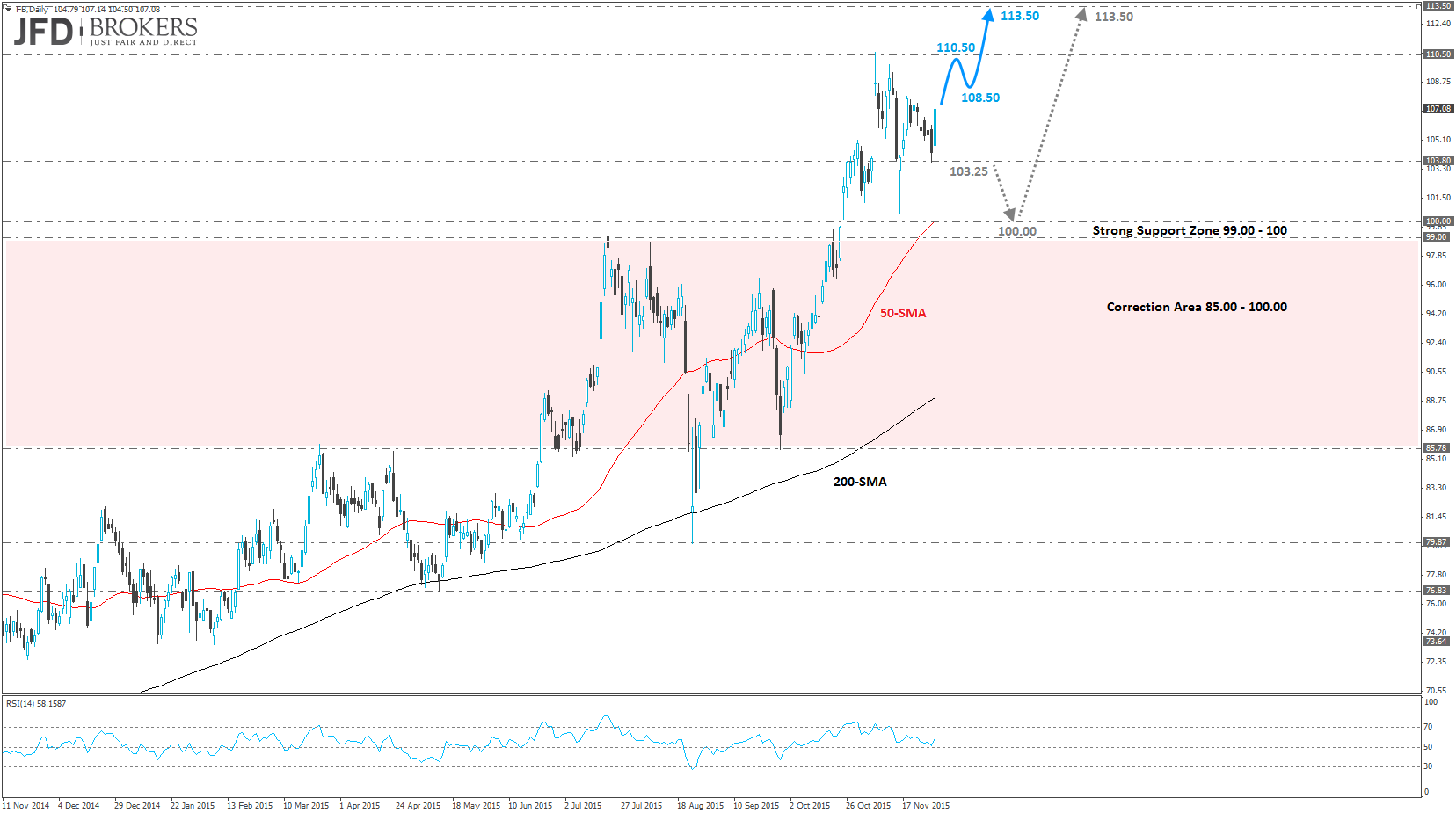

USD/JPY – Technical Outlook

Not much movement in USD/JPY with prices trading within 122.20 – 123.60 in the past month. The daily 50-SMA and the 200-SMA are ready to provide a significant resistance around the 121.70 barrier, the most possible target if we face a pullback, while to the upside we cannot spot any significant obstacles. Therefore, a break through here should make a move towards the 124.20 barrier while a turn lower would head towards the aforementioned target, before testing support around 122.20. However, with daily indicators turning upwards, it looks like the buyers are back in charge here.

U.S. Indices gained momentum

After two positive consecutive months, the US indices entered the last month of the year on a good mode. Following the weak manufacturing figures, all of the three indices rose nearly 1%. Dow Jones Industrial Average rose up 168.43 points towards 17,900 with United Health Group Inc. (NYSE: UNH) the best perform stock with gains more than 3%. The S&P500 pushed up 1.07% mainly by the energy related stocks. The high-tech index Nasdaq appreciated by +0.93% to 5,156.

99% of Facebook shares - $45 billion - to charities!

Facebook Inc. (NASDAQ: FB) shares surged 2.76% during yesterday’s session and snapped a three positive months in a row. The month of October the share price recorded a rise of 13.43% while it added 2.23% to its value the previous month. The FB shares are now trading above the psychological zone of $99.00 – $100.00, and as long as the bulls maintain the price above that zone I would expect a further pressure towards the $120.00 level.

Yesterday, CEO Mark Zuckerberg made an announcement saying that he will give away 99% of his shares, valued at around $45 billion, to the charity that he and his wife Priscilla Chan founded. So, with such move, I believe that it will add value to Facebook’s integrity.

Economic Indicators

During the European Session, Germany is going to provide a Retail Sales report as well as the Euro Zone will release the preliminary Consumer Price Index and Producer Price Index figures. Most likely the inflation indicators will show no increase. On a yearly basis, the inflation rate is expected to show a small increase by 0.2% from 0.1% the previous month while the producer prices are expected to show a larger decrease than before. Going forward, the Bank of Canada will announce its interest rate decision alongside with a rate statement.

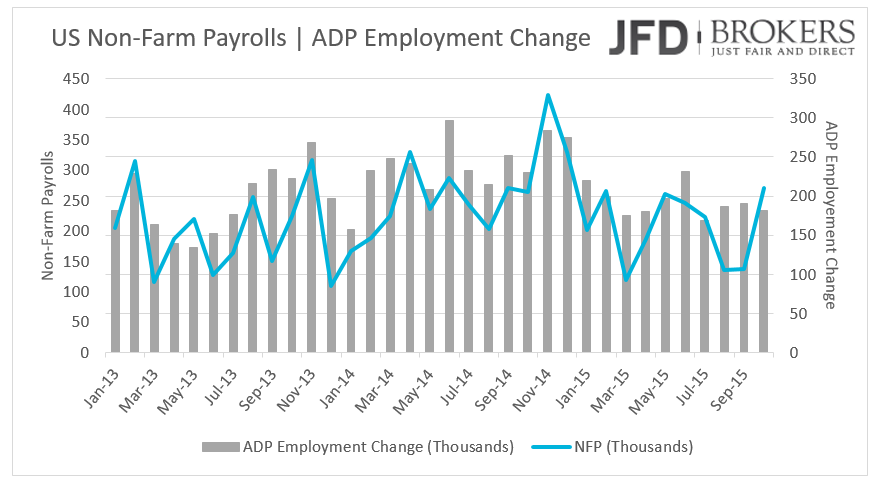

In US, the ADP Non-farm Employment Change will be closely eyed for cues about Friday’s Non-Farm Payroll report. The Fed Chair Janet Yellen will have a press conference in Washington regarding the Economic Outlook.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.