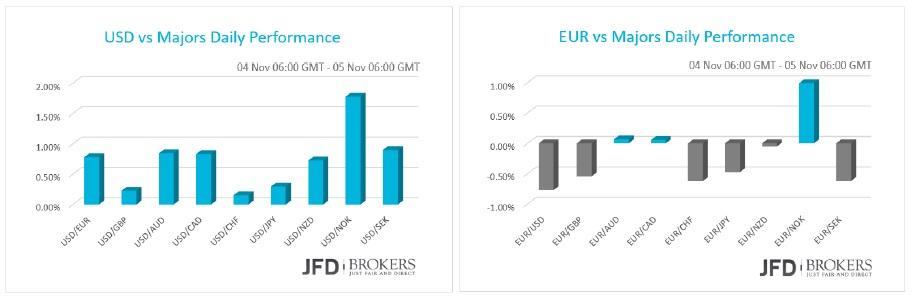

The US dollar was traded broadly higher on Wednesday following Fed Chair speech! Janet Yellen stated that interest rates could increase in December if the economy continues to support the move, as Fed expects. Yellen was very confident for the economy and pointed out the rising wages and the moderate job gaining that contribute to a strong labor market. The US ISM Non‐Manufacturing PMI signaled further growth for the economy as it expanded beating the expectations to slow down. The services sector surpassed market forecasts and continues to post gradual and healthy growth. The ADP Employment Change in October showed that the non‐farm private employment added 182k jobs in October missing forecast to have added just 180k. The Non‐Farm Payrolls report tomorrow is expected to show that both the public and the private non‐farm sectors added 180k jobs, the highest over the last three months. The dollar index rallied up 0.81% on Wednesday due to the dollar appreciation on the hawkish remarks.

Euro to fall further on Draghi’s speech

Today, the European economic events will trigger more volatility than usual to the shared currency. On Wednesday, the single currency lost ground versus most of the majors on the weaker than expected growth in the manufacturing and services sector in Eurozone as a whole and in Germany. Moreover, as Fed considering its first rate hike over more than a decade in December, ECB is about to re‐examine its stimulus programme and left the door open for further monetary easing that could lead to negative interest rates. Today, European Commission will release its economic growth forecast. Based on the inexistent growth I would expect ECB to lower the forecasts, something that could drive the euro even lower from the three‐months low the EUR/USD is currently traded. The ECB president Mario Draghi is not likely to say something new at his speech today, but to remark again the bank’s willing to evaluate the economic recession momentum that it seem to be meagre and tis plans to take actions for further stimulus. He is also highly anticipated to comment on the economic forecasts that would be released before.

The EUR/USD has fallen for a fourth day retreating from the key resistance level of 1.1100 and is now on track to deliver its fourth consecutive negative week. Following a positive opening at 1.31% up the first week of October, the pair recorded three consecutive red weeks, losing more than 3% of its value and is now trading negative ‐1.30% a day before the all‐important US NFP report. Despite seeing plenty of volatility in the pair the last 2 days, which saw it break below the psychological level of 1.1000, the markets are anxiously anticipating the US NFP report which is due tomorrow. Investors are on the watch for any indications as to whether the U.S. central bank could begin raising its interest rates. That being said, I think we could see the pair continue pushing towards the 1.0800 level. If we see a daily close below the key level of 1.0800, it would be very bearish, prompting a move back towards the 1.0650 hurdle. The MACD oscillator indicates negative momentum while the Relative Strength Index alongside the Stochastic Oscillator fell in an oversold territory, suggesting further weakness.

Super Thursday for Sterling! BoE Policy Meeting, Minutes & Inflation Report

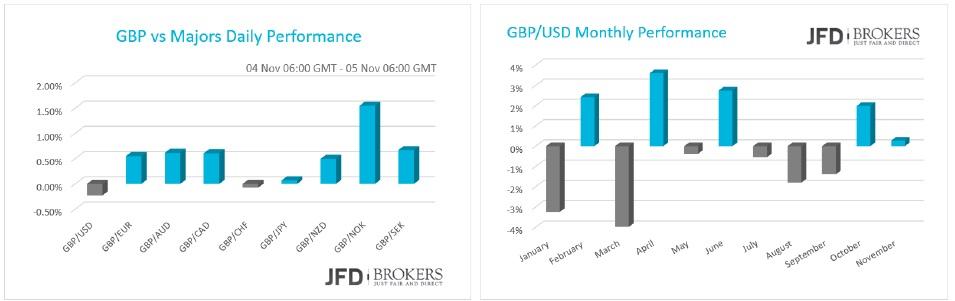

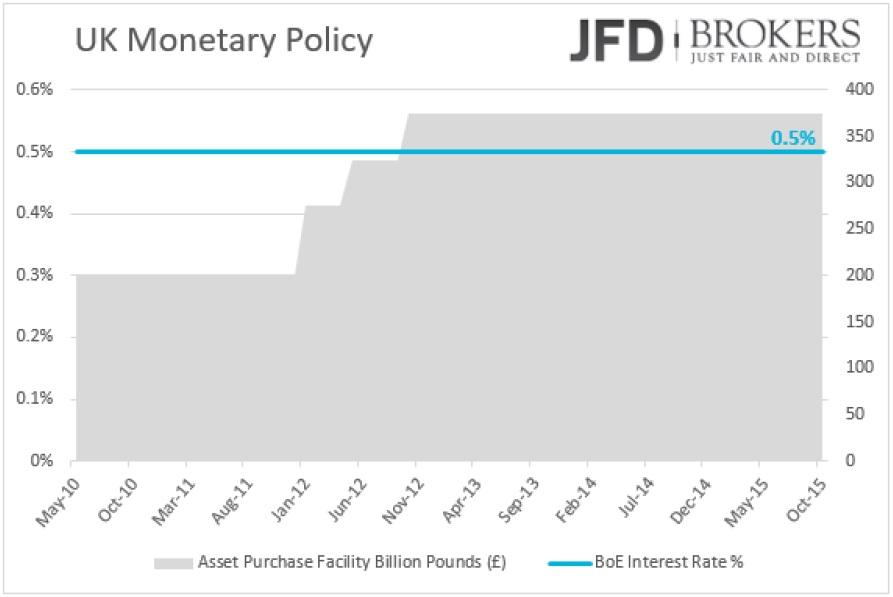

A big day for the sterling today! A policy meeting will revise the interest rate decision accompanied from the BoE meeting minutes, the quarterly inflation report and the monetary policy statement! The pound recorded limited daily gains since Monday and continues to this apace on Wednesday, ahead of its big play. From a macroeconomic view, the UK economy showed significant improvement since the last policy meeting on October. Even though, the policymakers are not expected to raise interest rates in the upcoming meeting, an upgrade to the central bank forecasts could raise the confidence and heighten the British currency. The unemployment rate decreased, and the average earnings growth picked up, compared to the data was available in the last meeting. The Retail Sales fueled up by the highest pace in more than a year. The services and manufacturing sectors brighten the growth outlook. On the other hand, the GDP slowed down its expansion and consumer confidence suffered as well.

The GBP/USD pair has been moving lower this morning following a strong sell‐off the last couple of days, where we saw the pair losing more than 0.3% of its value. This comes off the back of a period of weakness driven by the last US Federal Reserve meeting which surprised the markets with a hawkish policy statement, driving the dollar higher against its major rivals. However, I would expect the volatility to pick up today since the BoE will host its second “Super Thursday”. There are no changes expected to the benchmark interest rate so the focus will turn to the balance of voting members and inflation.

Technically, over the last couple of months the pair has established and traded within a trading range roughly around the key level of 1.5350. However, in the last couple of weeks, we’ve seen a lot of pressure on the top of the sideways channel, with the pair spending a large part of yesterday trading below. Four attempts by the bulls to break through the 1.5500 level have failed this week, signalling that the bears might retake control, following a positive October, where the pair closed +1.98%. The key to watch to the upside will be the 1.5500 – 1.5510, while on the downside will be the 1.5350 barrier. The latter level is a significant since it coincides with the 50‐SMA and the 200‐ SMA on the daily chart. The pair needs to actually extend beyond 1.5100 support level (mediumterm holders) to be able to catch up momentum, eyeing 1.4900 as the immediate medium‐term target. The upside remains well protected by the 1.5500, with an unlikely break above favoring a test of the 1.5650 level.

USD/JPY – Technical Outlook

After around 3 months of consolidation, the dollar looks to have finally broken higher against the yen this morning, having forced its way through the top of the sideways channel. It has also taken out the 200‐SMA on the daily chart. Assuming we get a daily close above the 121.75 this would be a strong bullish signal and I’d expect to see it move towards the psychological level of 123.00. There’s very little resistance between the current level and that so the move could be fairly rapid. Alternatively, if the pair fails to break back above 121.75, we should see further pressure on 121.50, followed by 121.00.

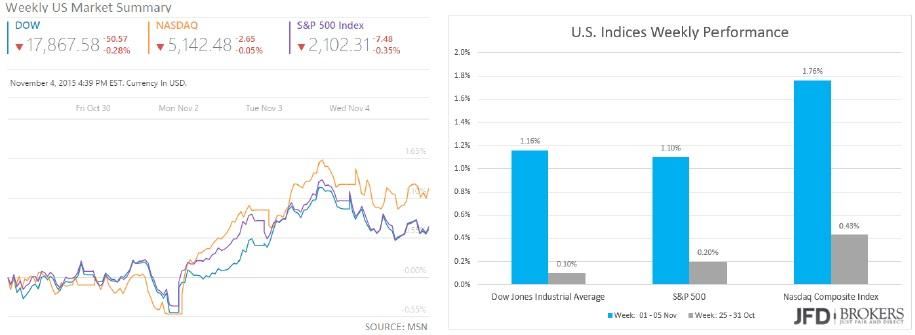

U.S. Indices Slipped to hints for Fed rate hike!

Following the Fed Chairwoman statement for a possible rate hike in December, that drove the USD higher, the U.S. stocks edged lower. The U.S. indices retreated from record high levels on Wednesday. Dow Jones slipped by 0.28% and S&P500 by 0.35%. The high‐tech index was marginally lower by 0.05%. The non‐farm payrolls report on Friday is expected to have a direct impact on the U.S. indices as it has a catalyst role for the Fed rate hike decision.

The Dow Jones Industrial Average index has regained all of the ground lost in the last week of August and ultimately challenged the crucial 18000 resistance level last night. It is very significant that the index is moving upward the last six weeks, where we saw the index adding more than 2000 points following the strong rebound from the 16000 level. This ended the correction phase and it now seems that the bulls can enjoy another run towards the all‐time highs at 18360. Note that the index is gaining ground the last few weeks while the US dollar is appreciating against its majors rivals the last few days.

Economic Indicators

Today the European Commission will release the forecasts for the economic growth, a while after the publication of the reviewed Economic Bulletin. The Bank of England will post its quarterly inflation report which will attract considerable attention as it will be out a few hours before the monetary policy committee will vote for the interest rates. As usually, the decision will be accompanied with the BoE minutes which reveal the thoughts of the committee members behind their votes. The speech from the BoE Governor Mark Carney a couple of hours after the minutes is expected to affect the pound significantly. During the night, BoJ Governor Kuroda will hold a press conference.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.