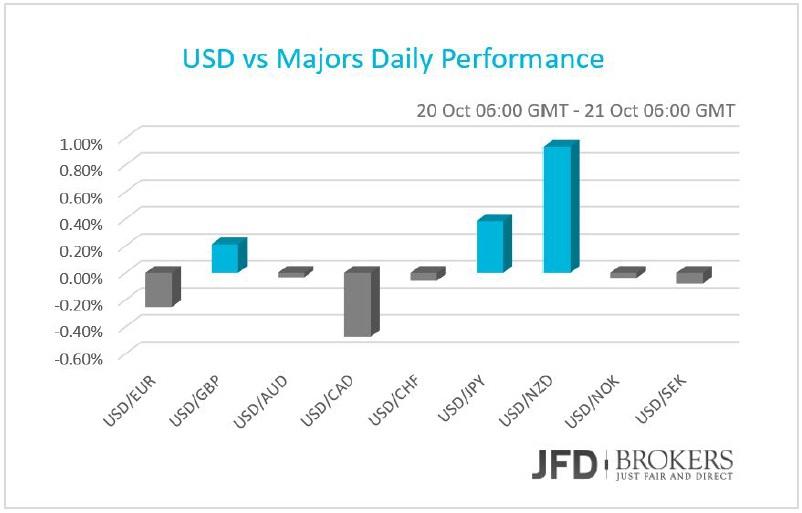

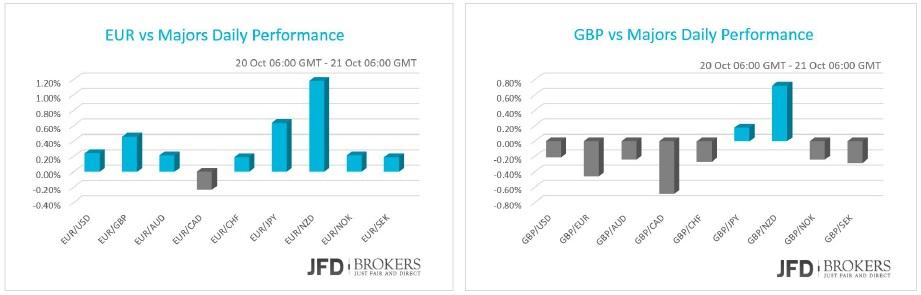

After a day with limited volatility in the market, the greenback was virtually unchanged against most of the G10 currencies, decreased against the euro and the Canadian dollar while it surged versus the New Zealand dollar than plunged after the dairy auction.

The New Zealand currency dragged down by the Global Dairy Trade (GDT) auction that dropped the dairy products prices. The GDT Price Index fell by ‐3.1% that reflected immediately at the country’s currency.

The shared currency edged higher against almost all of the major counterparts on Tuesday and early Wednesday despite the absence of market affecting news ahead of ECB meeting on Thursday. On the other hand, the sterling slumped against almost all of its G10 peers as the BoE Governor Mark Carney said that may be needed to preserve the financial stability. He also commented on the UK exit from the Eurozone and defended the central bank’s independence.

Bank of Canada – Policy Meeting

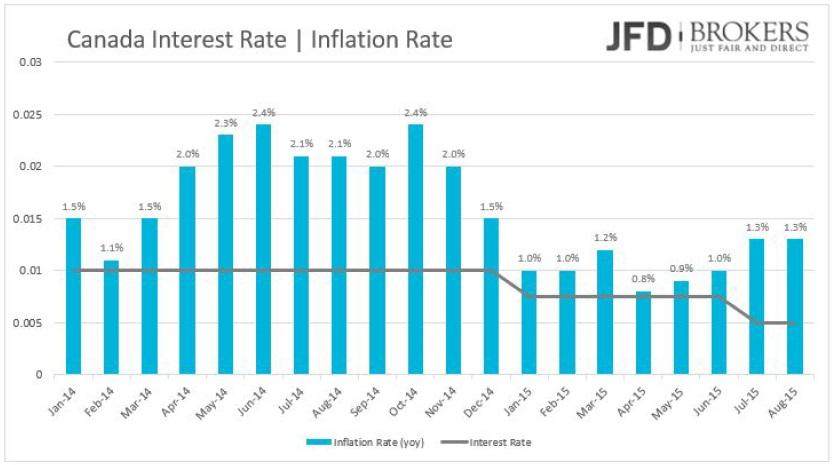

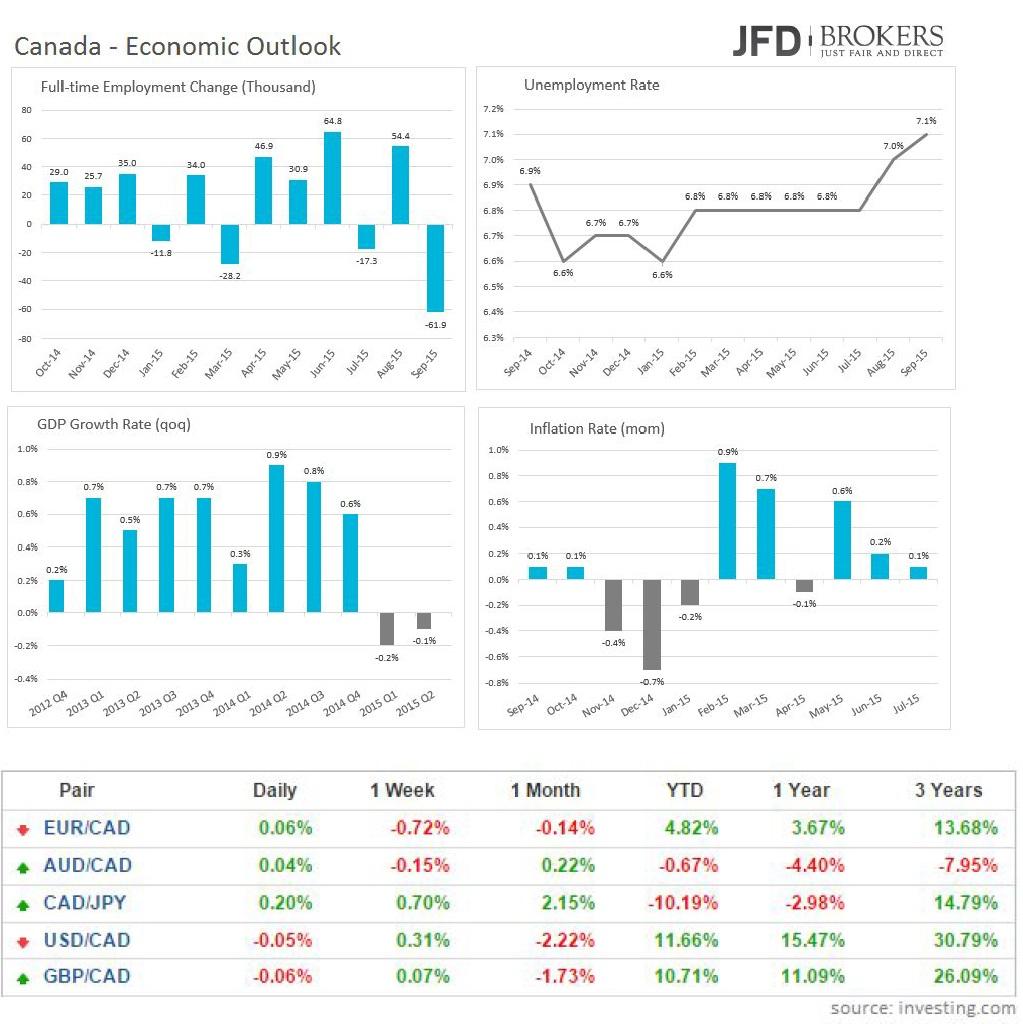

The U.S. dollar fell severely versus the Canadian dollar as the Canada ensured the Justin Trudeau managed to ensure its Parliamentary majority on Monday’s elections and promised for fiscal stimulus. This may change today’s Bank of Canada’s decision as the new Prime Minister Justin Trudeau may have a different opinion regarding monetary policy. The Bank of Canada slashed its benchmark interest rate twice in 2015 and is not expected to cut interest rates one more time.

However, the macroeconomic front for Canada has worsened more from the previous meeting. The unemployment rate picked up with a huge decline in full‐time employees. More than 60,000 lost their jobs. The Retail Sales ex Autos stagnated as well as inflation rate on a monthly basis. Moreover, GDP contracted by ‐0.1% in Q2 following ‐0.2% in Q1. The trade deficit expanded in August more than twice July’s deficit. Manufacturing Production continues to narrow while building permits decreased.

USD/CAD – Technical Outlook

The USD/CAD continues to move higher for the second consecutive day, holding steady slightly below the key level of 1.3000. Given the clear break below the latter level, I expect to see a return to 1.2900. For the time being the pair is finding support at the 1.2970 level, temporary at least. The 4‐hour 50‐SMA has been tested on a few occasions during the rally and the response at this level each time has been quite bullish, since the price crossed above the 50‐SMA few days ago.

However, the recent failed attempts above the 1.3080 barrier and more recently above the 1.3050, shows that the market remains cautious ahead of the BoC meeting later in the day. On the daily chart, the pair has been under correction since its peak at 1.3460. Since then, it fell more than 2.5%.

With the above in mind, in order to gain any real traction again, we need to see all of these levels broken – 1.3015, 1.3050 and 1.3080 – otherwise we could see a slow grind lower with the pair testing the 50‐SMA, around 1.2950 and then the psychological level of 1.2900. Finally, volatility is expected to pick up within the upcoming short period with the BoC policy meeting.

Economic Indicators

On Wednesday morning, traders will watch closely the UK September’s public net sector net borrowing. Beyond that, the spotlight of the day is the Bank of Canada policy meeting. The central bank cut its benchmark interest rate twice in 2015, 25bp each time to 0.50%. In this meeting, no changes in the monetary policy are expected. Even though, I would expect the Canadian dollar to be affected from the press conference will follow. Overnight, the national Australia bank’s business confidence for Q2 will be out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.