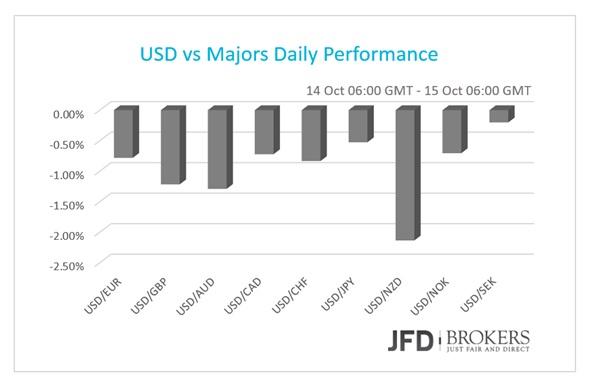

The buck has faced one more appalling trading session on Wednesday after the harsh retail sales report and the Fed Beige book that repel further a Fed rate hike. The U.S. dollar plunged against all its G10 peers with more than 2% losses against the New Zealand dollar and more than 1% versus the British pound and the Australian dollar.

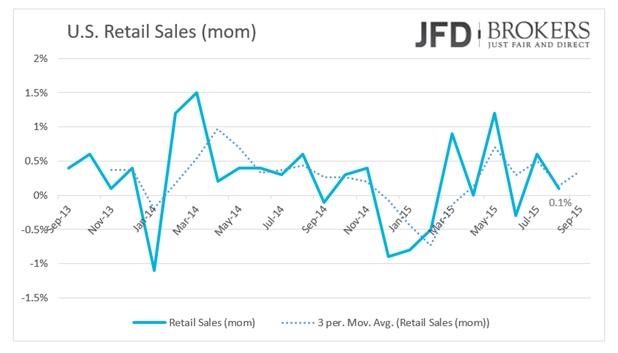

The retail sales on a monthly basis grew just by 0.1% in September below market’s expectations for a growth of 0.2%. Moreover, the previous month figure revised down to 0.0% instead of the first forecast of 0.2%. The retail sales excluding autos shrank by 0.3% missing predictions for a slight growth of 0.1%. On top of this, producing prices on a monthly basis fell by -0.5%, the steepest decline in 2015. The Fed Beige book, a review of the economic activity from Fed, revealed that the economy has a modest growth from mid August to early October and that the wage growth is subdued.

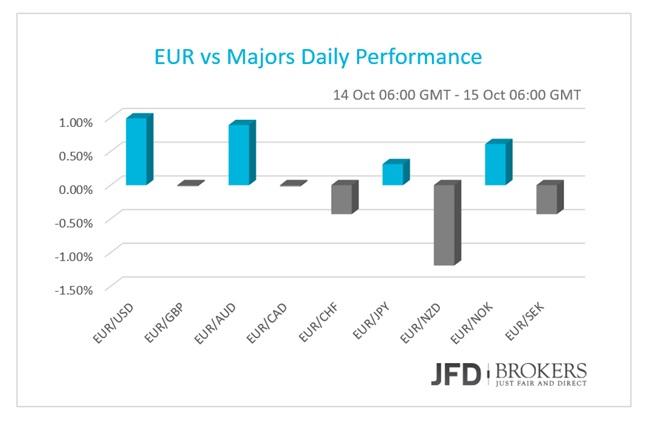

Euro mixed as Germany lowered growth forecast

The single currency was traded mixed against the other major currencies on Wednesday and early Thursday following August’s weak industrial production that dropped by -0.5%, as expected. In Europe, Germany has lowered its growth forecaster for 2015, following the economic slowdown in China as well as in the emerging markets. In April, the German government had forecast growth of 1.8% this year in Europe’s largest economy. That has now been downgraded to 1.7% while the forecast of 1.8% growth next year has been remained unchanged.

The EUR/USD pair continued to surge yesterday, ending in green for the second consecutive session. The pair has posted a daily close above the 1.1400 barrier, as well as, is now moving above the key level of 1.1450, which is a very bullish sign. In addition, the pair is moving above the 50-SMA and the 200-SMA on both the 4-hour and daily charts, adding to the bullish picture. We remain long on this pair targeting 1.1500. Medium term and long term traders they should target 1.1700 and 1.2000.

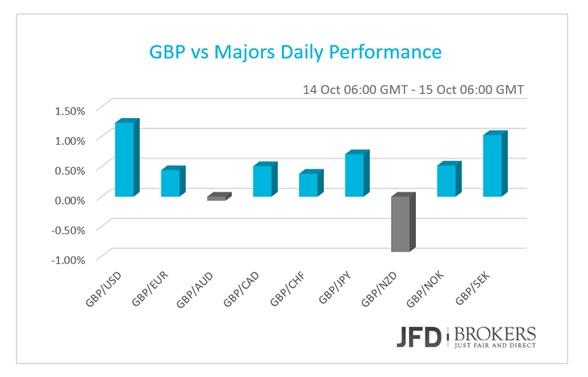

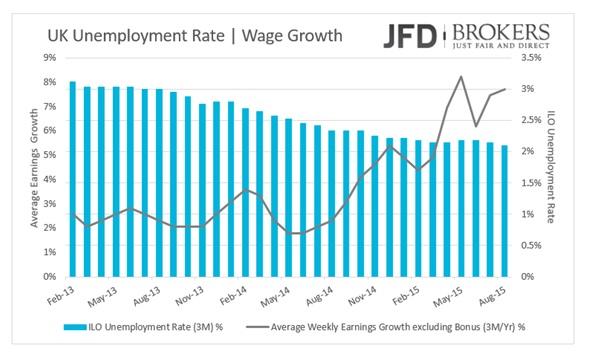

Pound surged on 7-year low unemployment rate

The sterling surged against most of the other G10 currencies as the country’s unemployment fell to seven-year low at 5.4%, surprising the market. The wages picked up by 3.0% in August slightly below than anticipated but above last month’s figure. On the other side, the claimant count change in September rose more than expected, a negative sign for the economy as it has negative implications on the consumer spending which in turn discourages economic growth.

The GBP/USD rose 1.5% in yesterday’s session, this is the most in five months, after U.K.’s unemployment rate fell to the lowest level since mid-2008, while wage growth unexpectedly slowed. The pound surged 250 pips against the dollar following the report, managing to recover Tuesday’s losses, when a report showed Britain’s inflation rate turned negative in September for the second time since 1960. The pair is now trading above the key resistance zone of 1.5450 – 1.5470 and if the buying pressure continues then I would expect the bulls to push the price further up and to challenge the 1.5550 level. Aside from this, we are currently seeing a lot of pressure near the psychological level of 1.5500, which coincides with the descending trend line that started in mid-August

AUD/USD rallied upwards after inflation expectations and employment report

The Australian dollar rallied upwards against the U.S. dollar after the consumer inflation expectations and the employment report released. The consumer inflation expectation for October is 3.5% over the Reserve Bank of Australia target to be between 2.0% - 3.0%. The jobless rate remains steady at 6.2% while the participation rate slipped marginally to 64.9% from 65.0% and the employed people decreased by 5.1K.

The Australian dollar has recovered all of the losses seen earlier in the week against the U.S. dollar, now is trading at slightly above the 0.7300 level. That upward and aggressive move forced us to record a loss as we were expecting the pair to continue moving south. It seems that the bears were not strong and lost the battle near the 0.7200 level, where the 50-SMA on the 4-hour chart proved to be significant. Now the next test for the pair will be the 0.7380, Monday’s high. On the other hand, if we see some profit taking below that area, then we would expect the price to retrace towards the 0.7300.

USD/JPY - Technical Outlook

USD/JPY is under pressure near the 119.00 level, as investors are feeling the pressure of further dollar weakness. The pair is ready to exit the range of 118.60 – 121.00 which started back in mid-August. A decisive break below the 181.60 level could confirm the bearish momentum and I would expect the price to test the psychological level of 116.00. I think, it's pretty clear that we are getting in a correction phase in this pair since most of the momentum indicators are overbought and also the weekly MACD is falling, ready to cross in bearish territory; this will be the first time since November 2011.

Gold near a 4-month high

Gold held near a 4-month high on early-Thursday on the sluggish economic data from China and the uncertain environment around dollar and Fed. Spot gold added more than 1.5% to its value during yesterday’s session, adding to its monthly gains which at the moment stands at 6.28%, the best since December 01, 2014. We remain bullish on gold, having locked more than $50 in gains the last 2 months, targeting the psychological level of $1,200.

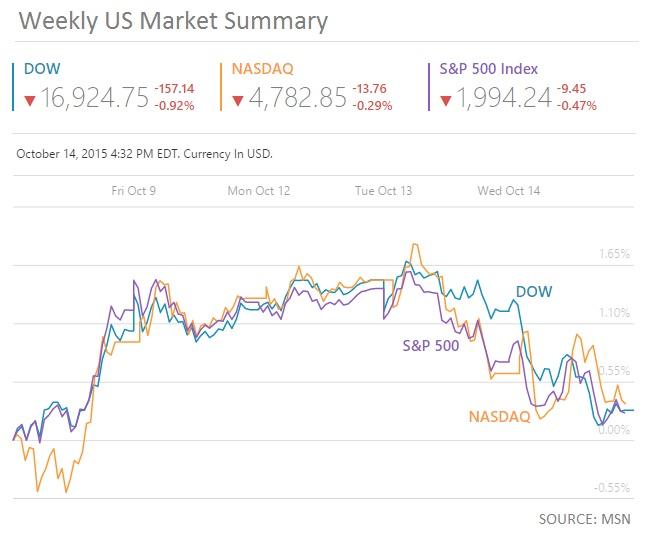

U.S. Stocks dive following weak Earning Reports

Most of the U.S. stocks were under pressure on Wednesday’s trading day, on the releases of a lot of earnings reports. All the three major U.S. indices closed negative. Nasdaq Composite index fell 0.29%, Dow Jones Industrial Average lost 0.92% of its value, -157.14 points, while the S&P500 index slumped by 0.47%.

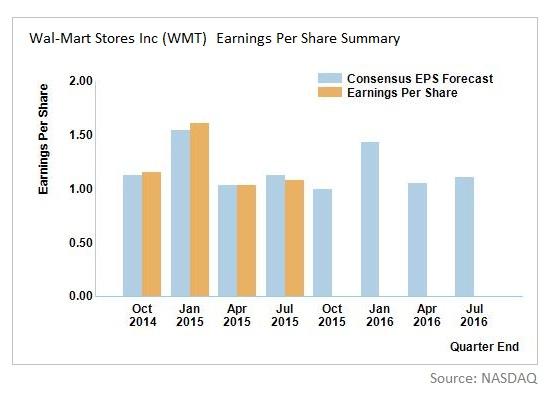

The biggest drag stock for both the last two aforementioned indexes was the Wal-Mart Stores Inc. (NYSE: WMT) that dropped more than 10% to $60.03, the biggest one-day change in years and has its worst trading day since January 2009, after the company released a weak forecast for its earnings per share in fiscal 2017, dropped by 12%! It’s notable that the decline erased roughly $22 billion off the retailer's market value.

Another big drag stock to the downside for the S&P 500 was the JPMorgan Chase & Co (NYSE: JPM) which fell 2.5% to $59.99 after the bank reported disappointing third-quarter results late on Tuesday.

After the last developments in the stock market the Standard & Poor's 500 profits forecasted to have dropped more than 4% in the Q3 compared to a year ago, according to Thomson Reuters data.

The Wells Fargo & Co (WFC.N) fell 0.7% to $51.50, while the Bank of America Corp (BAC.N) rose 0.8% to $15.64 both following results. Among other big decliners, the stock of Boeing Co (BA.N) slashed by 4.3% to $134.22.

Earnings Reports schedule

Goldman Sachs (NYSE: GS 179.36) is due to announce its 3Q 2015 earnings today. The stock is trading roughly below the key level of $180.00 and its 1-year return is 0.45%. Also, Citigroup (NYSE: C 50.72) and Philip Morris (NYSE: PM 84.47) will announce its Q3 2015 earnings late in the day.

Economic Indicators

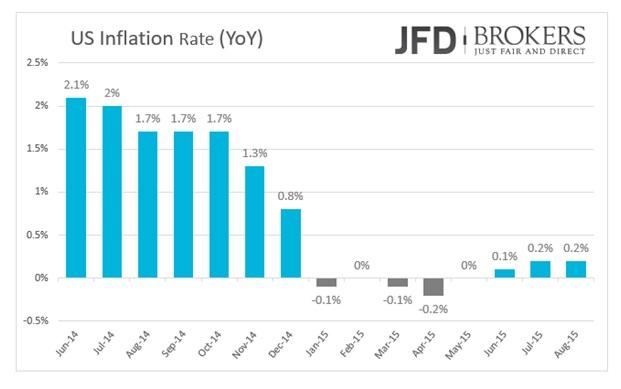

The U.S. inflation rate will the spotlight of the day. The market expect the indicator to have slumped slightly in the negative territory again by -0.1% on a yearly basis, from 0.2% before.

Speeches from three Fed and FOMC policymakers, James B. Bullard and William C. Dudley and Loretta J. Mester will follow. Later in the day, New Zealand will release its Inflation Report for Q3. Overnight, the Reserve Bank of Australia will release is Financial Stability Review.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.