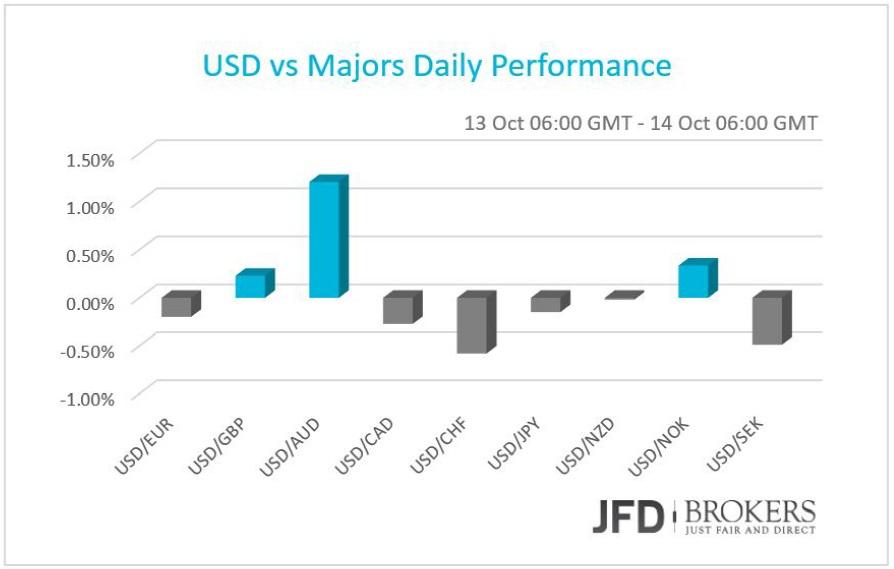

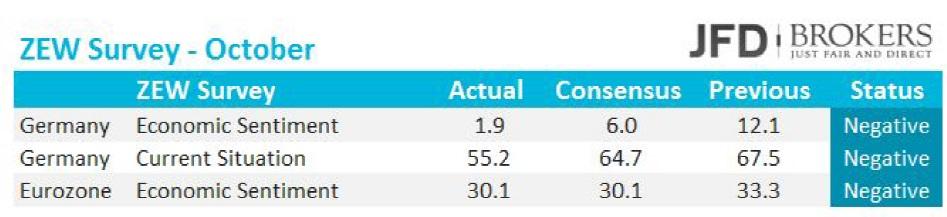

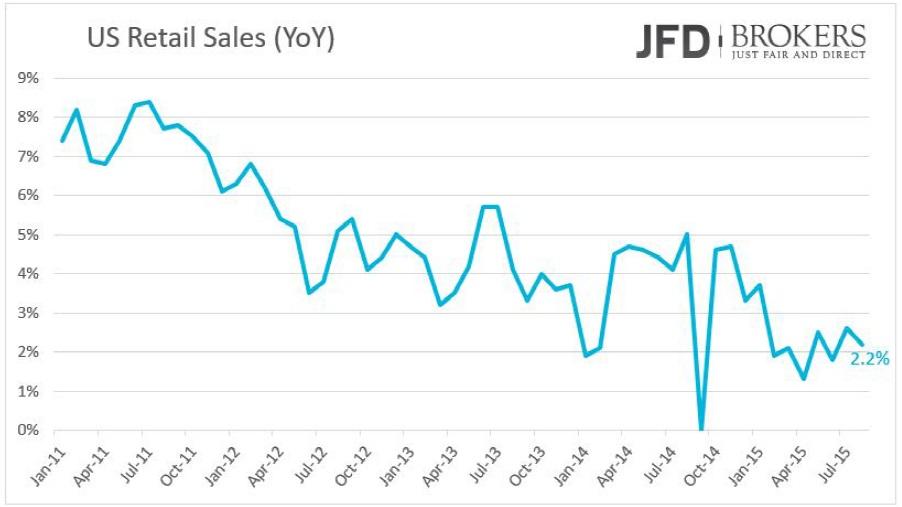

The greenback was virtually unchanged against the other currencies on the lack of market‐affecting news from U.S macroeconomic front. Despite that the U.S. business optimism for September surpassed expectations, it didn’t have a positive impact on the currency value. The USD traders will closely eye the retail sales for September that are scheduled to be released later today. Euro was slightly higher against most of the major currencies despite the downbeat data from ZEW Survey. UK inflation rate came out negative, even worse than the market forecast for stagnant consuming prices.

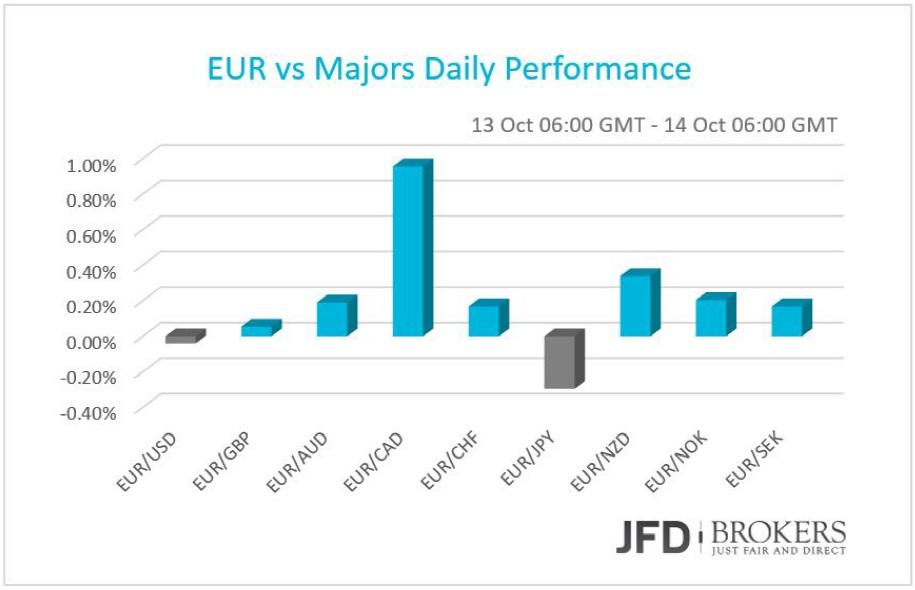

Economic Sentiment plunges in German and Eurozone

The shared currency was traded marginally higher against most of the major currencies and surged against the Canadian dollar for the second straight day on Tuesday. However, the data released yesterday were not optimistic about the Euro Area. The German inflation rate remained zero in September year‐over‐year, as expected, while the German ZEW Survey revealed decreased economic sentiment for October and for the current situation too. After the recent scandal in the German automotive sector, people’s sentiment dived below than anticipated. In Eurozone, October’s economic sentiment slumped as well, as expected.

EUR/USD – Technical Outlook

The EUR/USD is continuing to climb higher this morning, after breaking through the 1.1340 resistance level, as well as, the 50‐SMA and the 200‐SMA on the 4‐hour chart. We did see some choppiness around 1.1400 following the release of the German ZEW Survey, with the pair finding resistance slightly above the psychological level of 1.1400. Below here, both the 50‐SMA and the 200‐SMA are continuing to provide support from below near the 1.1250 level. However, following yesterday’s false break out above the 1.1400 level there is little real change to the outlook and for the time being, with the short term charts giving little hint in either direction, a neutral stance is required.

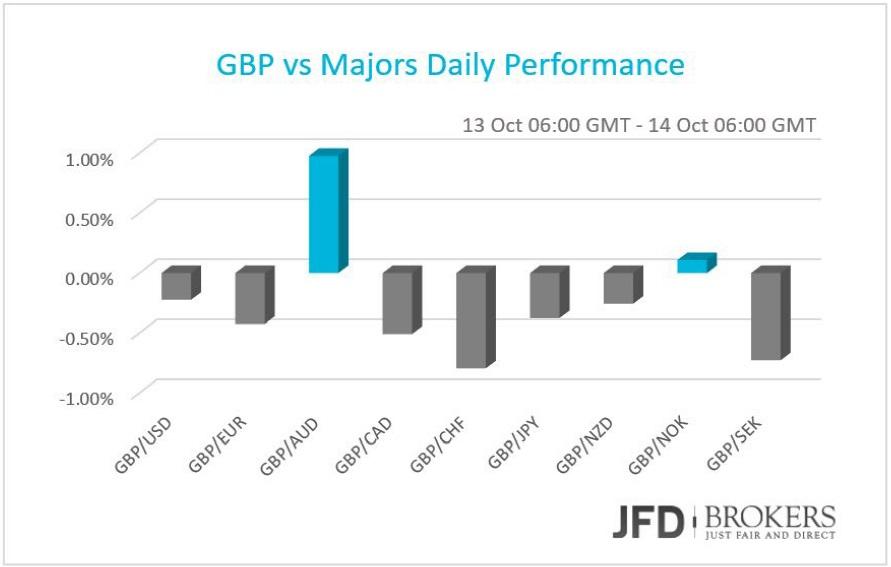

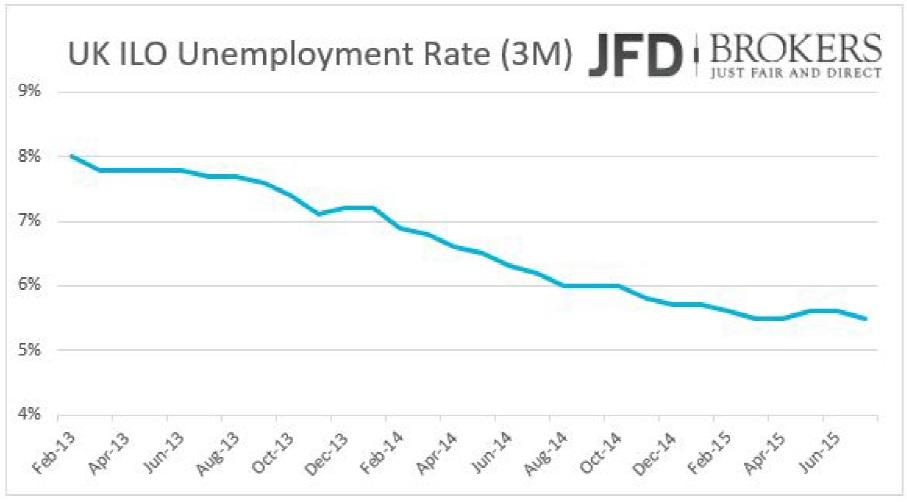

Pound dropped as the UK has slid back in deflation

The British Pound dropped severely against its G10 counterparts following the announcement that the country slid in deflation again, after a four‐month battle to keep its inflation rate away from the negative territory. The market was expected final inflation rate for September to be zero, but the indicator missed expectations surprising on the downside and pushing away the optimism Bank of England to raise interest rates in 2015. Beyond that, earlier this month, the Bank of England stated that inflation rate will take longer than expected to pick‐up, and the bank has pointed to wage growth. The British employment report is coming out today and is expected to affect considerably the GBP cross pairs.

GBP/USD – Technical Outlook

Sterling is making its way back towards the psychological level of 1.5100, after finding resistance for a second time around 1.5390 and following the UK inflation figures. The GBP/USD plunged after data showed U.K. inflation turned negative in September. Inflation in UK has dipped below zero for the second time this year, reducing any pressure on the BoE to raise interest rates in remaining 2015.

The GBP/USD ended the day negative at 0.63% following a break below the 4‐hour 200‐SMA during the aggressive sell‐off, which started from 1.5390. With price currently breaking below 1.5300, I am looking for a move towards 1.5200 for a retest and ultimately back to 1.5100 by the end of the week. We continue to see higher lows as the pair is struggling to break above some significant key resistance levels including the 1.5660 and 1.5820 levels. Having said that, volatility is expected to pick up within the upcoming short period with the release of the UK job figures.

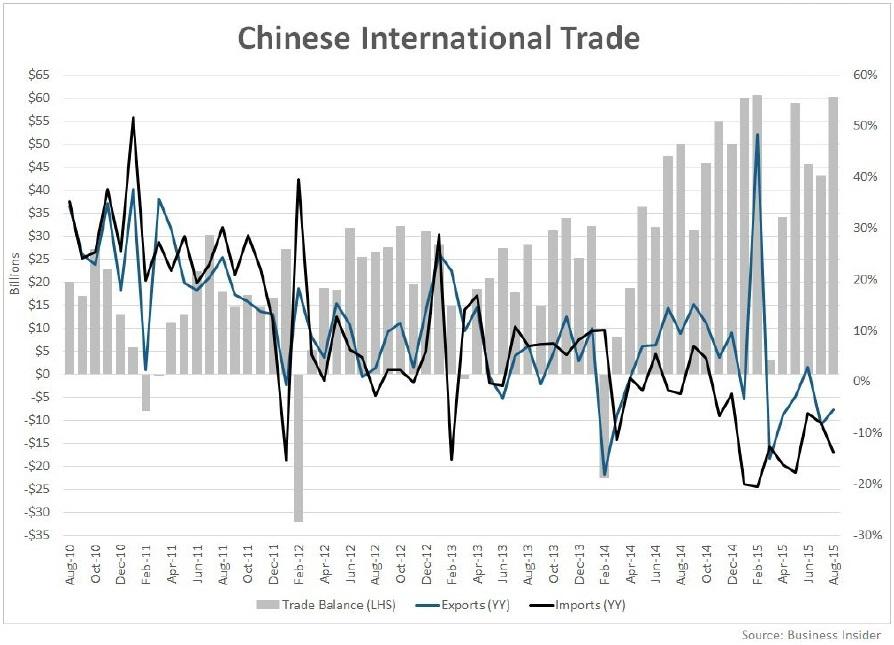

China’s Imports Tumbled dragging down the Australian dollar

On Monday overnight, Australian dollar started to drop against the other major currencies after China revealed a significant shrink at its exports for the eleventh consecutive month. China is the second largest trading partner of Australia, after the United States. Chinese exports plunged by ‐ 17.7% year over year, even worse from the forecast to have plunged by ‐15.5%. On Tuesday overnight, the decreased China’s inflation rate added further pressure to Australian dollar cross pairs.

AUD/USD – Technical Outlook

The Australian dollar has sold off sharply overnight as it dropped over 1.5% versus the US dollar, euro and pound. The AUD/USD pair fell after reaching a two‐month high at 0.7382, coming back below the key support level of 0.7280. On Thursday, we saw the pair breaking above the 0.7280 level, closing the week positive at 4.09%, however, following the aggressive sell‐off last night, the pair is now on track to deliver a negative week as it lost more than 1.5% from its value so far this week. Having said that, I would expect the sell‐off to continue and the price to reach the psychological level of 0.7100 by the end of this week. This level is significant as it includes the 200‐ SMA on the 4‐hour chart, as well as the 50‐SMA on the daily.

EUR/AUD – Technical Outlook

A similar picture prevails in EUR/AUD where the Australian dollar suffered heavy losses during yesterday’s session. The pair returned back in the range that was trading the last couple of months between the 1.5650 and 1.6250. Having in mind the above, I am now expecting the pair to continue trending upwards, with a move back towards the psychological level of 1.5900 likely in the coming days. For the bulls to reach that level they will need to go through the 200‐SMA on the 4‐hour chart and the 50‐SMA on the daily chart.

Gold – Technical Outlook

The precious metal is continuing to push higher early Wednesday after recording a positive session on Tuesday 0.55%, as well as on Monday 0.51%. We saw a brief pullback last week, around the $1,145, before a continuation of the move higher on Friday, where the bulls managed to lift the metal above the key level of $1,150. Since then precious metal continued to move north. With the gold finding support from the daily 200‐SMA and looking like forming a bottom failure swing, it could be about to make it is way back towards the $1,200.

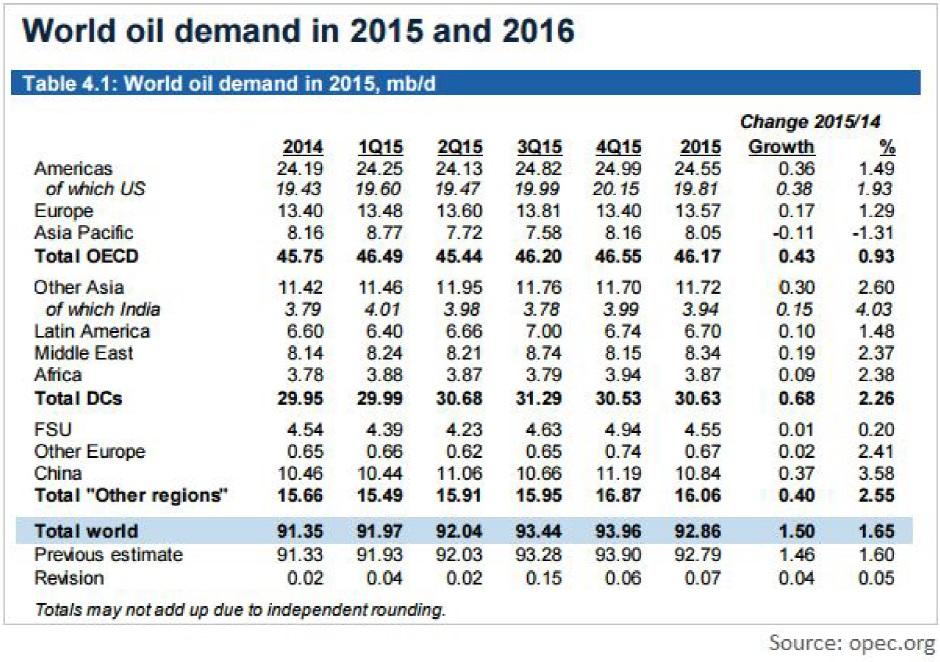

WTI & Brent Oil – Technical Outlook

WTI and Brent oil both fell sharply during yesterday’s session extending their losses and snapping a two‐session losing streak. The move above the psychological level of $50.00 seemed to be temporary for the WTI as it failed to hold above it following the aggressive sell‐off which started after it tested the 200‐SMA on the daily chart. A similar picture prevails in Brent where it failed to sustain its move above $50.00, plunging below the 4‐hour 50‐SMA. Following the heavy sell‐off in the Crude oil, I would expect the prices to remain under pressure in the near term. The main reason for that is because global supply and demand for crude did not change much over the past few weeks as we are still in oversupply. On the chart below, you can see that the world demand for 2015 as well as the estimates for 2016.

U.S. Indices closed lower after a series of consecutive losses

The three most popular U.S. indices edged lower on Tuesday’s trading session after multiple days of consecutive gains. Dow Jones Industrial Average slipped slightly by ‐0.29% following seven winning sessions in a row. The top winner stock of the index was again the UnitedHealth Group Inc. (NYSE: UNH) with gains of +1.25%. It’s noteworthy, that only five stocks out of the thirty that contained in the index closed positive. The Nasdaq composite index and the S&P500 added losses of ‐0.87% and ‐ 0.68% to their values respectively.

Economic Indicators

In the morning, the UK scheduled economic announcements will hog the limelight. The employment report for September will be published, expected to show that the UK economy added 2.3K jobs in September from ‐1.2K the month before. The unemployment rate for the three months to August is predicted to have remained at 5.5% while the average earnings are forecasted to have increased by a steeper pace than the two previous months.

In Eurozone, traders will keep a tab for industrial production for September which is anticipated to have slowed down in August. In US, traders will cautiously eye the retail sales for September and business inventories for August.

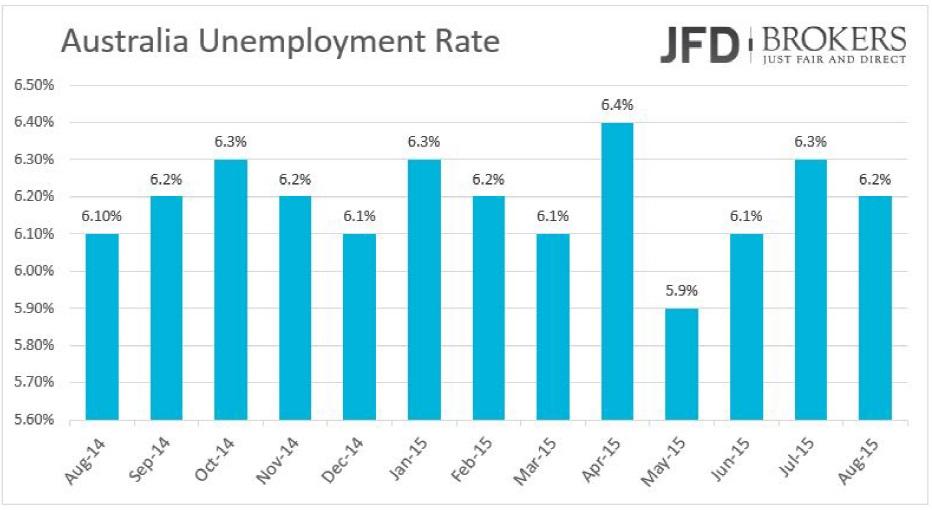

The Fed’s Beige book will also be out. During the night, the Australian employment report will capture traders’ attention. The Australian economy is forecasted to have added 5k jobs in September fro17.4k and the unemployment rate is expected to have picked up slightly to 6.3% from 6.2% before. Australian consumer inflation expectations for October will also be out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.