USD Mixed Ahead of FOMC; Cable: First Target Locked at 1.5300, Bulls Eye 1.5360!

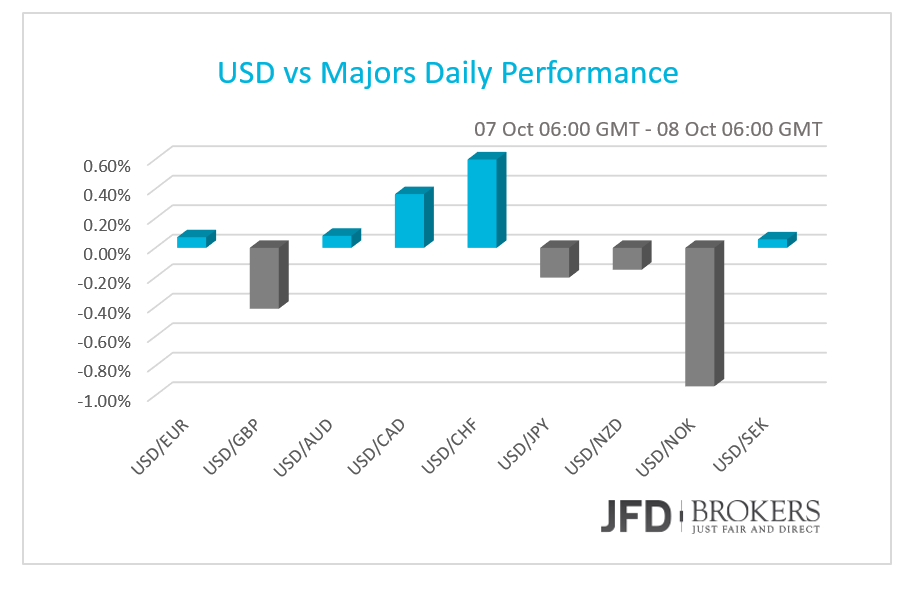

The euro was traded mixed on Wednesday and early Thursday in the absence of significant economic news ahead of the ECB Monetary Policy Meeting Accounts. The greenback was also mixed ahead of the FOMC minutes later in the day! The minutes are expected to provide more clarity why Fed decided to delay an initial rate hike in September and make known the Fed future plans. However, keep in mind, that the last soft Non-Farm Payrolls report may have changed the initial Fed policymakers thoughts.

EUR/USD Technical Outlook

Nothing changed to the EUR/USD pair as it remained trapped in a tight range, roughly around the 1.1260 area. The 50-SMA and the 200-SMA are standing neutral in both the 1-hour and 4-hour charts. Despite the pair continuing to grind lower, the lack of a break of the 1.1200 level suggests the market remains bullish in the short-term and is just waiting for a catalyst, being either the FOMC later in the day or the IMF meeting due tomorrow morning.

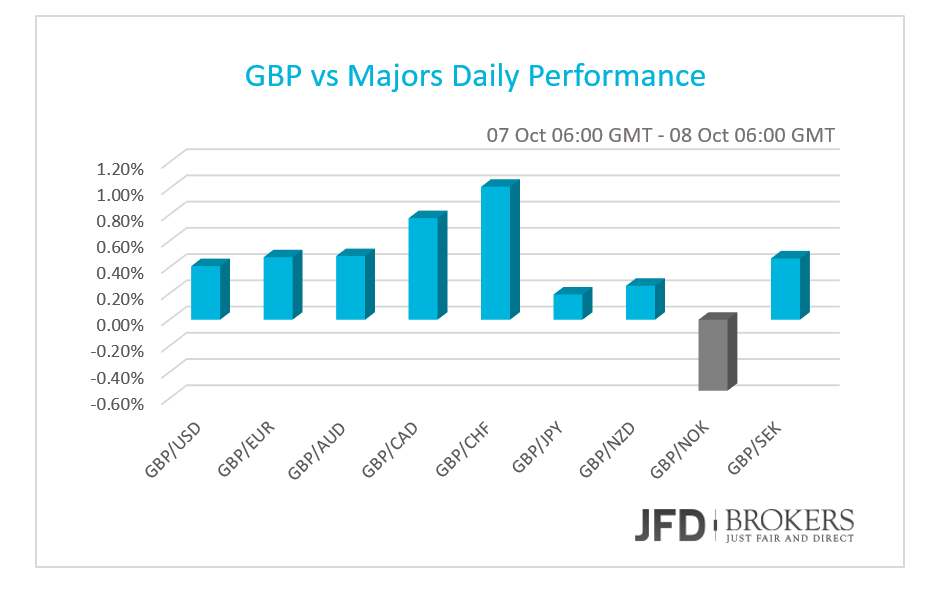

The pound jumped on the strong Industrial Growth!

The sterling jumped against all the other G10 currencies on Wednesday following the better than expected industrial and manufacturing growth in August. Industrial production grew by 1.0%, month over month, the steepest pace since February 2014 while the Manufacturing rose by 0.5% beating expectations to have risen by 0.3% from -0.8% before. The NIESR GDP indicated a steady growth of 0.5% the three months to September as the previous figure indicating the economic growth for the three months to August.

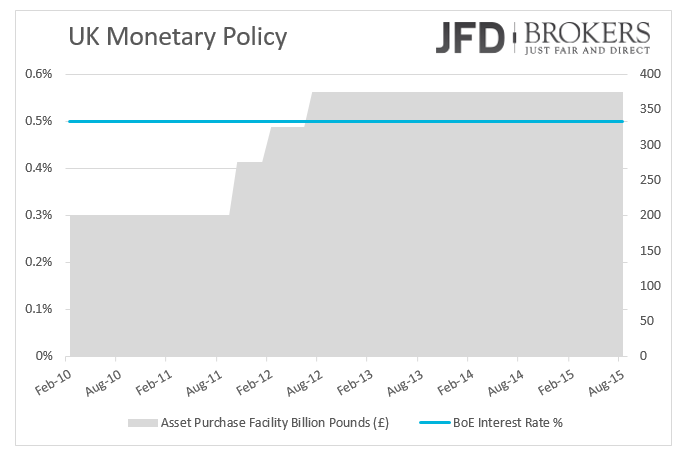

The British spotlight of the day is the Bank of England Policy Meeting. It widely expected the Monetary Policy Committee will vote to leave the policy unchanged. It's notable that the BoE minutes of the meeting are released along with the decision announcement, thus, the general tone of the committee will have a considerable impact of the currency.

Following this yesterday’s report “USD Plunges as IMF has downgraded Global and U.S. Economic Growth Forecast” which we said that we were expecting the GBP/USD to reach 1.5300, the cable gained momentum, rose more than 0.5% and surged above the 1.5300 barrier, currently trading at 1.5315 ahead of the BoE meeting. Going forward, as we stated in the yesterday’s report I would expect the pair to reach 1.5360, therefore I remain strong bullish on this pair. However, in order to confirm this I will need to see a break of the 4-hour 200-SMA, which currently lies around 1.5340.

USD/JPY – Technical Outlook

The USD/JPY pair remains trapped within a very tight range since the mid-August and it is currently challenging the 50-SMA and the 200-SMA on the 4-hour graph. A break below the 118.50 with a daily closing will change the short-term outlook; whilst coming back above 121.75 will bring the bullish picture back into focus.

Gold – Technical Outlook

The precious metal managed to cover much of the early gains and now again negotiating below the 1-hour 50-SMA. The morning decline is particularly strong and this creates the conditions for a further drop when approached some significant support levels. The level of $1,135 is key to understanding whether we are watching for a continuation of the triangle formation, which started back in early-August. Otherwise, a break above the strong resistance level of $1,150 will change the outlook to bullish, prompting a more aggressive move towards the 200-SMA on the daily chart, around $1,165.

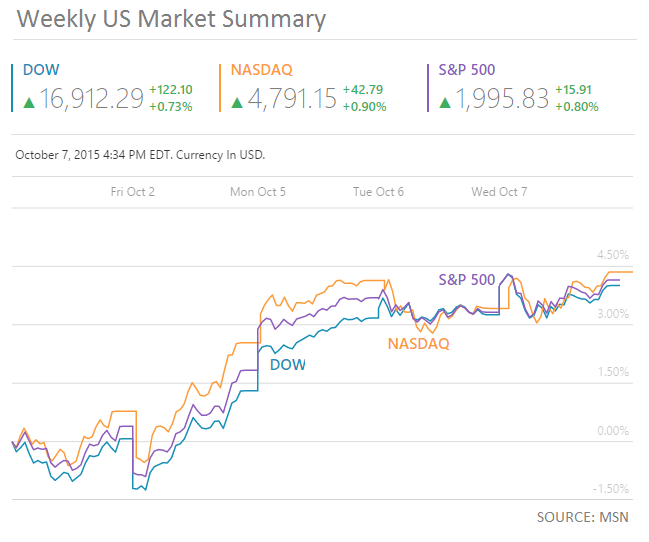

U.S. Indices widely higher

All of the three most popular U.S. indices closed Wednesday’s trading session higher after strong gains of the stocks in the energy sector. Dow Jones increased by +122.10 points, +0.73% with pharmaceutical company Merck & Co Inc. (NYSE: MRK) gained more than 2% and Exxon Mobil Corporation (NYSE: XOM) amid the top gainer stocks with almost +1.7% up. Nasdaq picked up by +0.90% while S&P 500 edged higher by +0.80%.

Economic Indicators

Thursday encloses important economic news! In the morning, market’s attention will turn in UK where the Bank of England Monetary Policy Committee will vote for its interest rate. The market expects one member of the committee to vote for an interest rate hike while the other eight are expected to vote for leaving interest rates unchanged. The BoE minutes and the monetary policy statement will be eyed to details to decipher probable hawkish comments.

The European Central Bank will publish its Monetary Policy meeting accounts. Going forward, in US, the FOMC minutes will be scrutinized by traders for explanations what kept back the Fed policy members to vote for an interest rate hike in September’s policy meeting. However, after the latest NFP report vital data changed that cancel out earlier hawkish thoughts of the policymakers for a rate hike in the upcoming policy meeting or later in 2015.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.