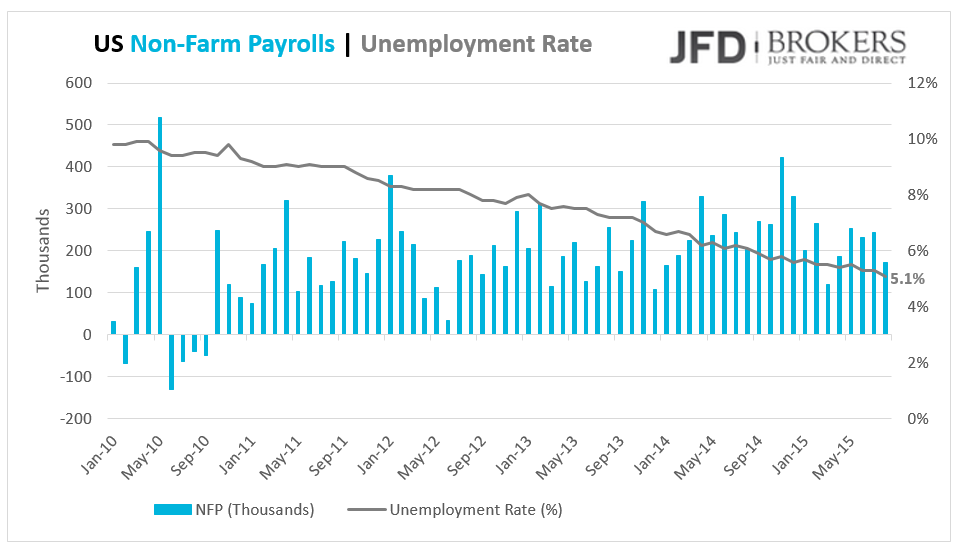

The US economy added only 173k jobs in August missing expectations to have added 220k! The economy added the smallest number of jobs in the last five months. However, the market overshadowed the number easily on the back of the unemployment rate that fell below expectations to a more than 7‐year low at 5.1% from 5.3% before. The average hourly earnings on a monthly basis rose by 0.3%, the steepest pace in the last seven months. August’s employment report sends mixed signals for Fed’s interest rate decision in two weeks.

The euro has recovered against the dollar after falling slightly below the psychological level of 1.1100 following the NFP report. Intraday bias in EUR/USD remains on the downside as the fall from 1.1715 continues. Looking at the daily chart, the 50‐SMA and the 200‐SMA both are providing a significant support to the price action around the 1.1080 level. A break below the 1.1080 level should add further pressure to the pair and would likely move towards the 1.1020 barrier.

Better than expected unemployment and Non‐Farm Payrolls report have given support to the greenback. Amid the release, the GBP/USD pair rallied up to 1.5270 and there the bears took control of the trend and pushed for new daily lows below the support of 1.5200. We expect the prices to continue declining towards 1.5170 followed by 1.5090. On a daily basis, the prices are traded way below the 7‐SMA as this is another signal for strong bearish pressure.

Intraday bias in AUD/USD remains on the downside for the moment. The pair fell below the 0.6980 and is now moving more aggressively towards the psychological level of 0.6900. It is very remarkable that the price is trading below some significant obstacles including the ascending trend line which started back in 2000 as well as below the 61.8 Fibo Level from 2008 lows. We remain strong bearish on the AUD/USD until the end – 0.6200!

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.