The shared currency rebounded from an 11-year low mid-Thursday as investors looked ahead to Non-farm Payroll report due today, which could shed some light on the pace of the U.S. recovery. The single currency hit an 11-year low during the European session after ECB President Mario Draghi said the ECB would not purchase bonds with yields lower than the current deposit rate of -0.2%. However, the euro managed to pare some of its losses against the dollar after the ECB President Mario Draghi said that the recent stream of stronger-than-expected euro zone economic data has led the ECB to revise its economic projections upward. The central bank now expects annual real GDP to increase by 1.5% in 2015, 1.9% in 2016 and 2.1% in 2017.

The market continued moving quietly during the Asian session, keeping its eyes on today’s US Non-farm Payrolls report. The only exceptions were the JPY and NOK which managed to maintain their day’s early gains. The market expects US payrolls to have increased 240k in February and the jobless rate to have ticked down to 5.6% from 5.7%. That would be a slowdown in hiring from the previous month of 257k, but not a cause for concern as it would be exactly in line with the average for the last year.

A disappointing number (below 200k) will help the euro recover against the greenback, while a good number (above 240k) would support the USD and may put the EUR/USD pair under further selling pressure near the key support level of 1.1000. During the week, ADP Employment report showed a gain of 212k, while the weekly Jobless Claims for the week ended Feb. 28 increased by 7k to a seasonal adjusted 320k.

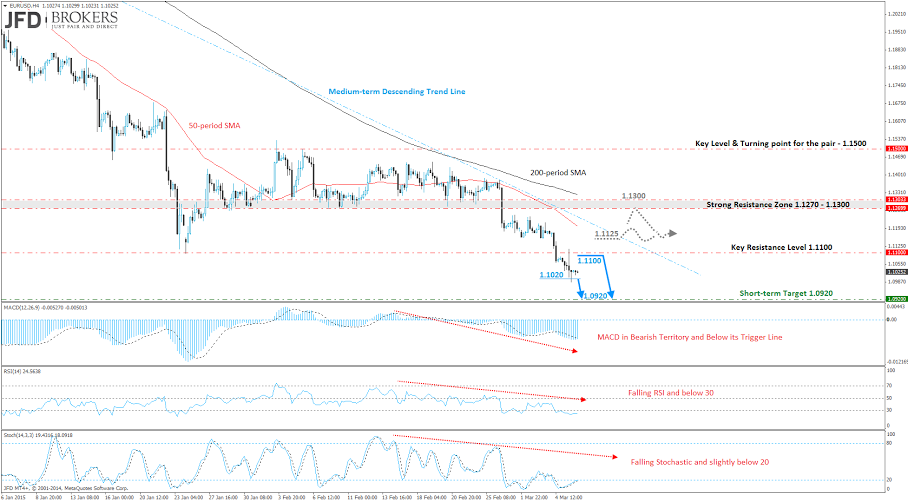

Technically, we have said that a close below the psychological level of 1.1100 would be a very bearish development for the euro, as we have not seen a daily close below that level since September 2003. With the NFP report coming later in the day, we could expect any kind of reaction as the NFP figure will determine the pair’s move and trend direction.

The correction few days ago saw the pair close to around the key resistance level of 1.1500, which technically speaking could be viewed as quite bearish, given the fact that it was a continuation pattern. That said, I remain bearish on the pair since we still see no sign that the pair it’s going to reverse yet, with the next target now being the key support level at 1.0920. Alternatively, given how aggressive the rally has been over the last two days, we could see a brief period of consolidation, above the 1.1100 before a continuation of the move towards 1.0920.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.