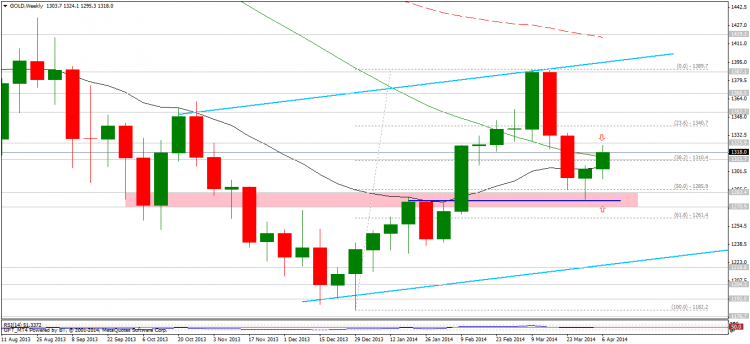

Weekly chart: The bounce from the support at $1280 resulted in further gains and the precious metal arrived at the $1325 resistances. The momentum of this climb is a bit lacking compared to the usual upmoves, but regardless of this further gains are expected above the resistance. If the $1300 level fails to hold then Gold might be sold off to the previous lows.

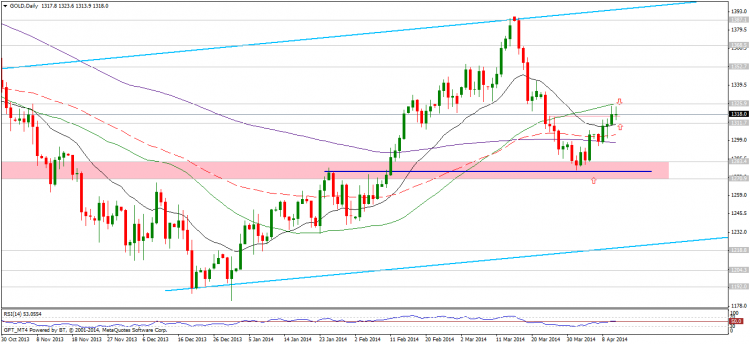

Daily chart: Following the breakthrough of the 200 day moving average Gold continued its climb all the way to the 50 day moving average which resides currently at the $1325 support. These are major resistances which will bar the precious metal from further gains until it manages to break through them with a lot of force and momentum. Until then we might see it drop back towards the 200 day moving average however.

Marketprog Ltd. excludes any liability for any damages resulting from the use of data and information representing the published content or the company website. Analytical reports, evaluations and selections available on the website and as published content are exclusively for informational purposes; they cannot and shall not be considered to represent investment advice or analysis from Marketprog Ltd. or a public offer. Neither shall the content of the website or otherwise published content be considered a call encouraging investment in products researched by the Software embedded in the website or in any published content. All liability and risk in connection with making any investment decision shall be borne by the user irrespective of how the use of the Software embedded in the website, or any published content might have influenced such decision.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.