Market Overview

The new week has begun in a fairly sedate mood. With a lack of steer from Wall Street on Friday (with markets closed for Independence Day public holiday) Asian traders were still able to retain a reasonably positive outlook that came after the strong US Non-farm Payrolls report. In all honesty. However this mood has been balanced by suggestions by the IMF over the weekend that the global recovery could stutter in the second half of the year due to a lack of investment. The IMF warned that it may need to cut its forecasts for global growth This added up to a fairly mixed close on Asia and European markets to trade with only slight losses in early exchanges today.

The strong employment data last week has helped to pull the dollar higher once again in forex trading and this has continued with the early moves today. The Dollar Index is once again advancing, with notable gains being made against the euro, sterling, Swiss franc and New Zealand dollar.

There is little economic data of any note today, so it could take a little while for trading to warm up again after the US was off on public holiday on Friday.

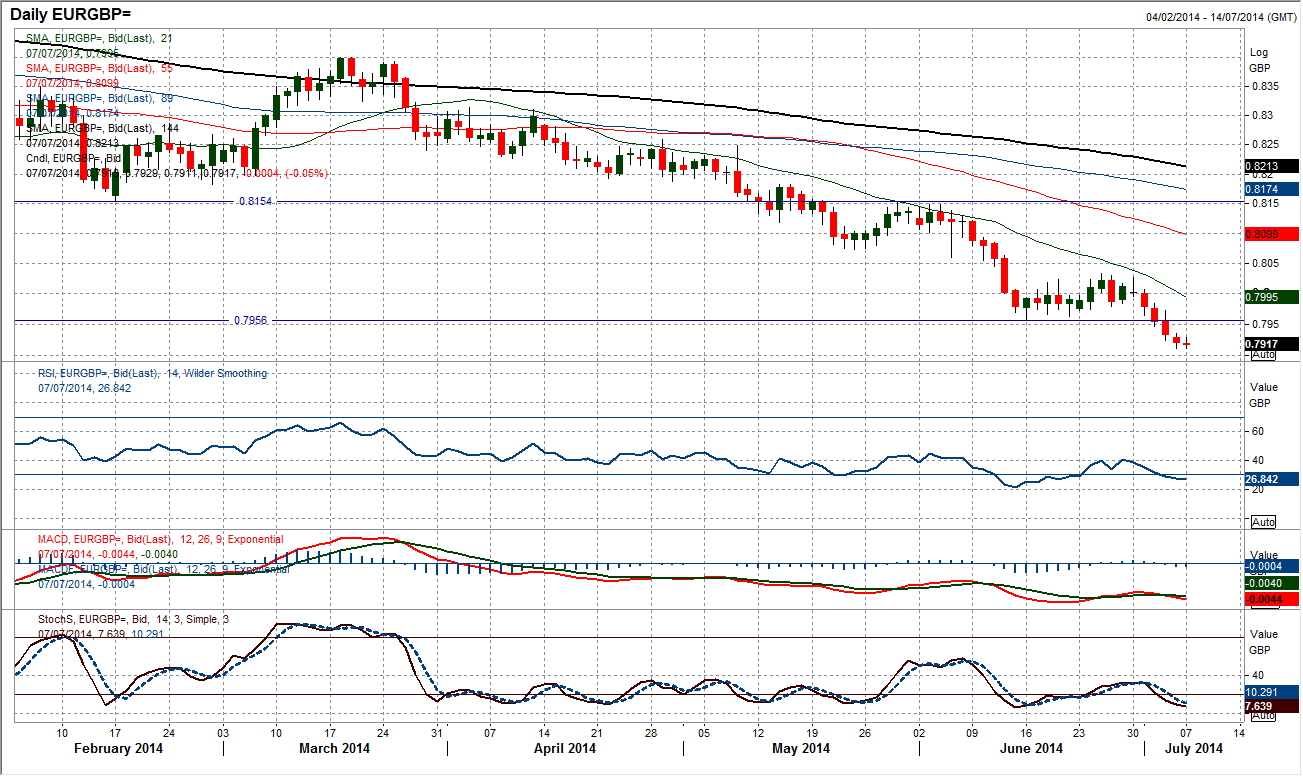

Chart of the Day –EUR/GBP

There still seems to be very little prospect of a recovery for the euro. The downside pressure on the euro may have started to abate slightly in the last couple of days, but there can be very few technical indicators that suggest the euro is not going to come under further selling pressure in due course. One of the few factors that the bulls may be holding on to is that the rate is oversold and this could provide another period of consolidation or even a technical rally. However the falling 21 day moving average is now the basis of resistance at £0.7990 and with the old support turned resistance at £0.7960 it would probably merely be unwinding to help renew downside potential once more. Selling the euro into rallies seems to be the only way to play this chart. Expect further pressure on £0.7890 and £0.7810 in due course.

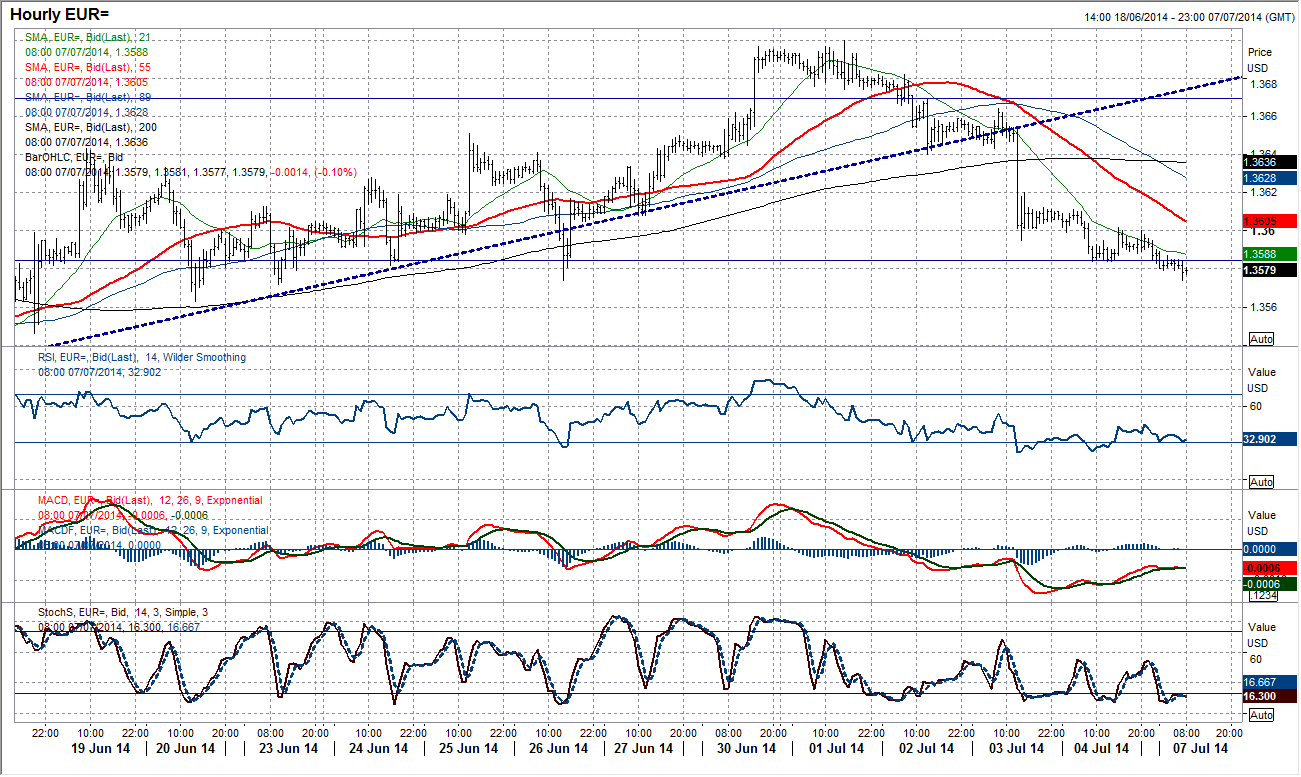

EUR/USD

The pressure on $1.3585 has continued during the Asian trading session today and will remain the primary near term test. This level has previously acted as a key level of both support and resistance, with a consistent move below today turning this once more into a ceiling. The last few days have seen the daily momentum indicators once more turn more corrective and suggest pressure continues to the downside, with the MACD lines turning lower below neutral, while Stochastics and RSI are both in decline. The intraday hourly chart shows the 21 hour moving average (currently $1.3589) has developed into a basis of resistance. It looks now as though rallies are being sold into once more and a breach of the spike low at $1.3574 would now confirm that pressure on $1.3500 can be expected to continue. Overhead resistance is at $1.3640 and $1.3670.

GBP/USD

Although Cable has held up fairly well in the past few days there is still a legacy of the “hanging man” candle from Thursday which is a bearish one day trading signal. Furthermore, the momentum indicators are now rolling over and suggest a loss of upside impetus. The immediate support is $1.7100 which protects sterling from completing a small double top which would then imply a corrective target of $1.7030. I would not see this as the worst development for the medium term as it help to unwind some of the overbought momentum and renew upside potential again. It would also be back into the good band of support $1.7000/$1.7060. The intraday chart shows the consolidation over the past few days whilst also showing the consolidated momentum. One thing to remember also is that in bull markets (which Cable undoubtedly is in) the downside targets do not tend to be met before buyers support and push the trend higher once more. I see near term corrections as a chance to buy sterling.

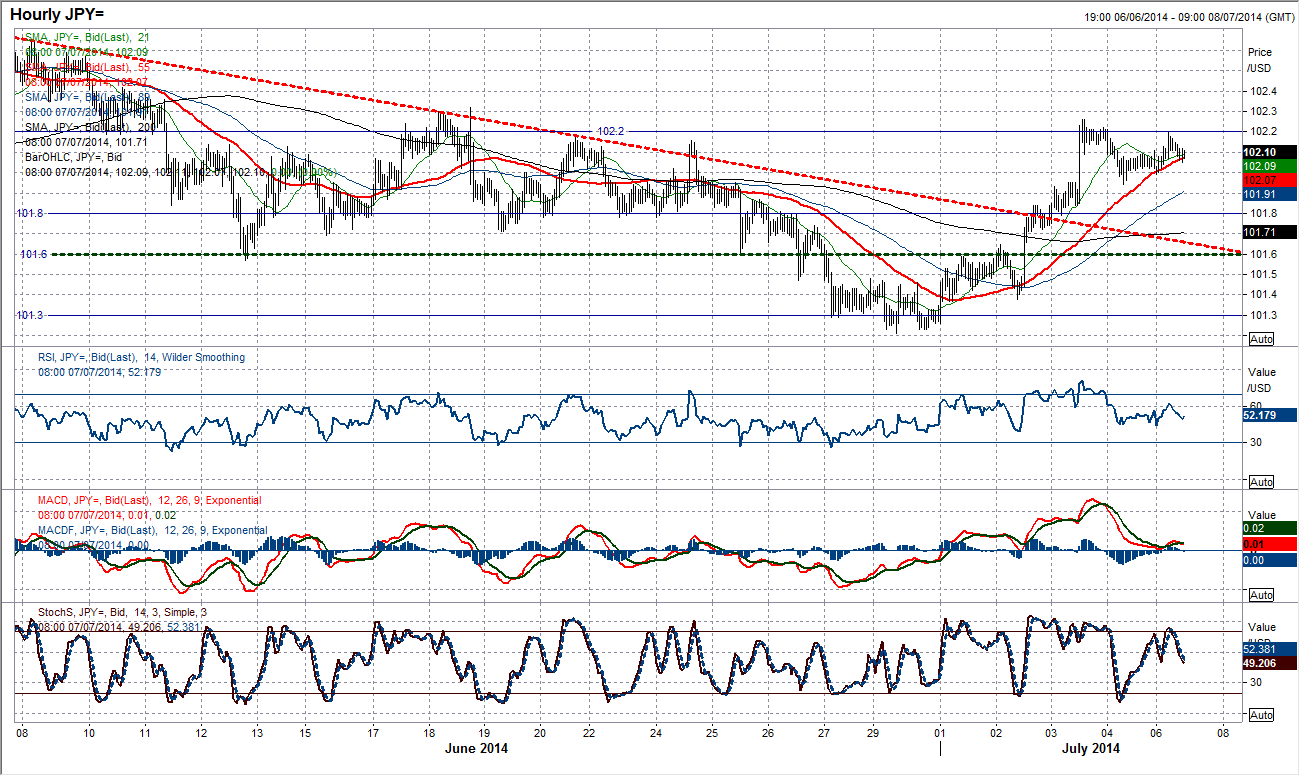

USD/JPY

So it looks like despite all the fluctuations over the past few weeks, Dollar/Yen is once again back to trading around its apparent medium term point of equilibrium at 102.00. The 21, 55 and 89 day moving averages are all within 10 pips of this level, whilst MACD and RSI momentum indicators are in neutral configuration. The recent rally has again stalled around the 102.20 near term resistance and the market has calmed down. This has come as the US has been on public holiday, so the action could hot up once again this afternoon, but for now we await the next near term direction. Looking on the intraday hourly chart would suggest there is a slight bias towards an upside break if the price action over the past few days is anything to go by, in addition to the basis of support now being formed at 102.00 and the hourly momentum indicators retain a positive outlook. A break above 102.20 would open a test of 102.60/80. The near term support comes in at 101.80 and 101.60.

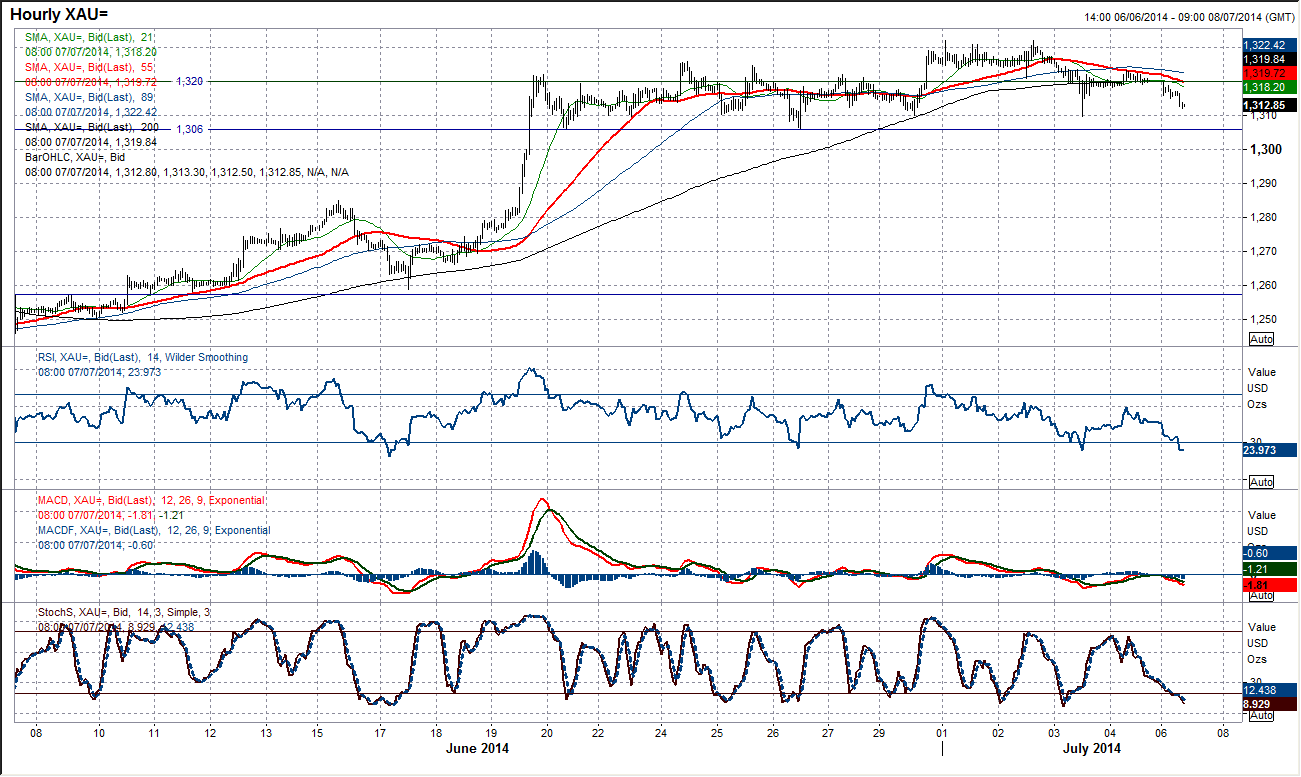

Gold

After the price almost flat-lined on Friday, the early pressure has been to the downside in Asian trading. This is now beginning to take its toll on the momentum indicators which are starting to take on a corrective outlook. The RSI is already at a two and a half week low, whilst the MACD lines are close to crossing over and the Stochastics are also close to giving a sell signal. The key level in the near term is now support at $1306. This level protects a top pattern from forming. This is shown more clearly on the intraday hourly chart where the pressure is growing to an extent where the price is trading below all the hourly moving averages, a near term recovery failed under the resistance at $1325, and hourly momentum suggests downside impetus is building. It would need a move above $1325 to suggest the bulls are fighting back toa want to prevent this top pattern formation. A breach of $1306 would complete a top that would imply $1281.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.