Technical Bias: Bearish

Key Takeaways

US dollar continued its decline against most major currencies, as sellers remain in control.

Dollar sellers await Federal Reserve Chairwoman Jannet Yellen’s speech for further action moving ahead.

US building permits release is also lined up during NY session with forecast slated for a 4.8% rise.

This week’s drop in USDCHF has left the pair at critical crossroads. The pair briefly ticked below the 200 SMA (4H), which represents a major support area. The primary indicators have also taken a sharp turn and pointing lower in the short term.

Technical Analysis

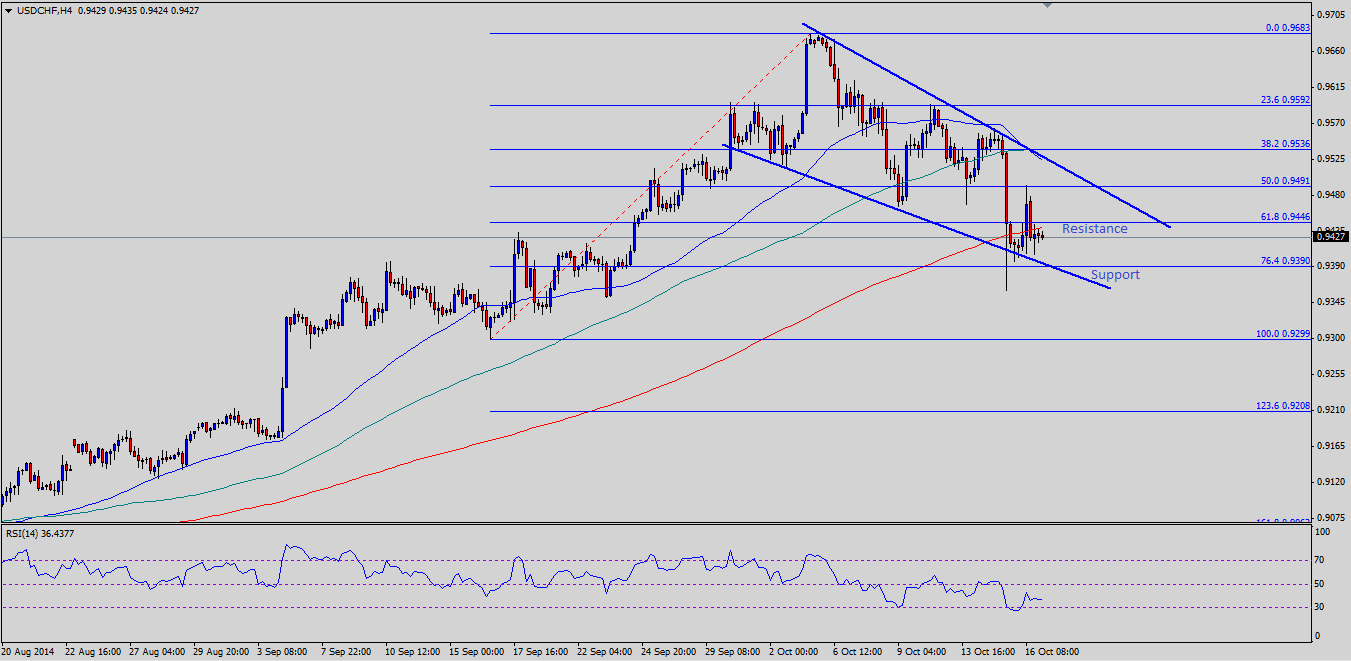

USDCHF settled in the vicinity of the 0.9400 handle where is found support in the form of a triangle. There is a contracting triangle formed on the 4 hour timeframe of the USDCHF pair. Yesterday, the pair bounced time and again from the 0.9400 area, which was around the triangle. The most important point is that the pair managed to close below the 200 SMA (4H) yesterday and formed RSI divergence. If at all the pair manages to recover from the current levels, then it might find resistance around the 0.9440-50 area. An upside momentum should be limited considering the current market sentiment as RSI managed to bounce a couple of times from the oversold readings, but failed to encourage the US dollar buyers.

On the downside, the next level of interest is around the last swing low of 0.9299 where the US dollar buyers might take a stand. However, one cannot deny that the dollar might take a turn at any point of time moving ahead.

Yellen’s To Cause Moves?

There is an important event lined up during the NY session, as the Federal Reserve Chairwoman, Jannet Yellen will be delivering a speech. Her remarks might cause a lot of moves in the US dollar, and that’s why we need to keep a close eye on this one.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.