AUD: Private sector credit gain 0.4% but slightly below 0.5% expected

CNY: China issue a warning to global nations to not interfere with its internal affairs.

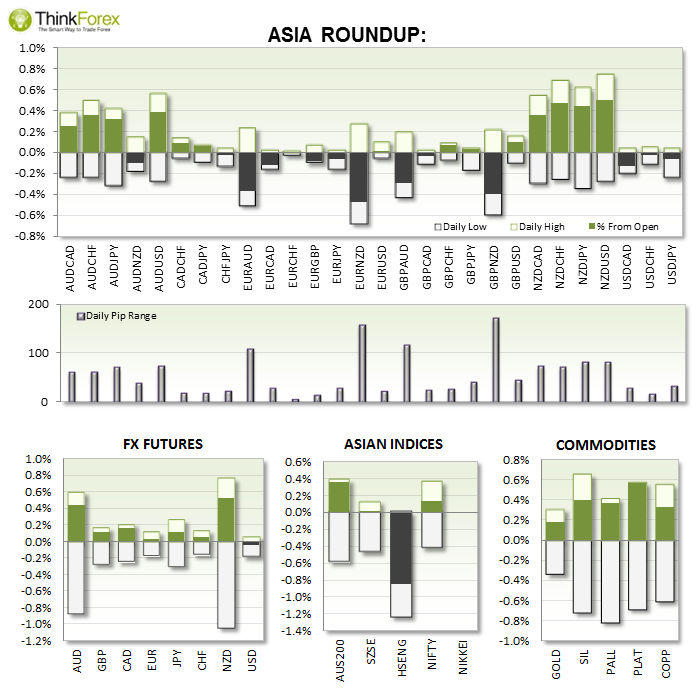

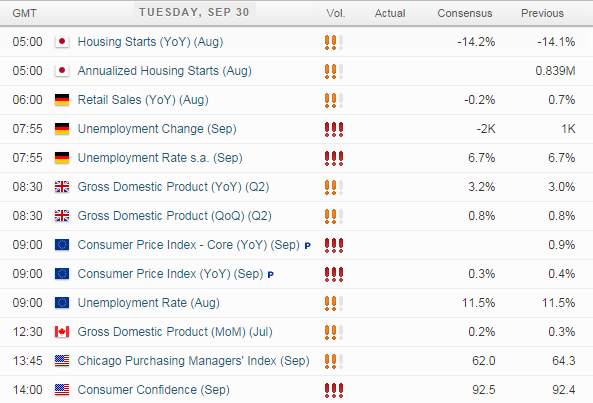

UP NEXT:

GBP: With GDP expected to tick up then failure to deliver could be GBP bearish.

EUR: Data from Europe tonight is the prelude to the important ECB Press conference and Rate Decision on Thursday. Any strength in tonights figures will releive a little pressure from ECB to outlay a firm QE program. However traders are heavily positioned to the short side in hope of stimulus from the Central bank leading up to Thursday, so if we see strong numbers tonight try not to get too carried away on the long side.

CAD: View today's post for a breakdown

TECHNICAL ANALYSIS:

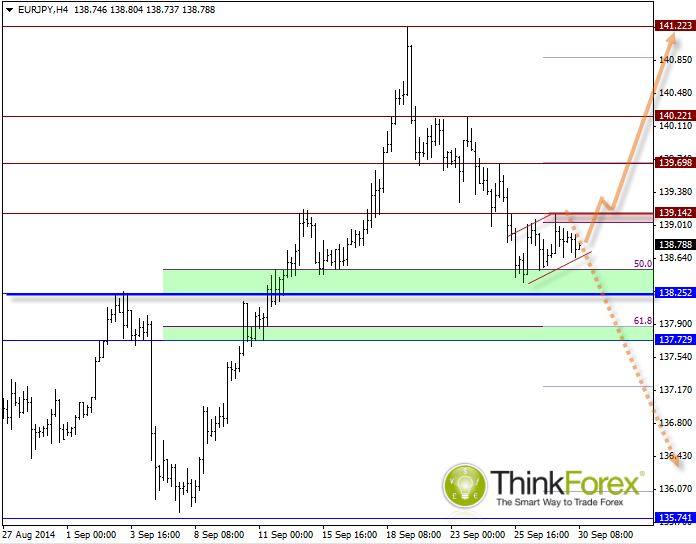

EURJPY: Catalysts are approaching

With tonight's growth data warming us up for ECB action on Thursday we should see a breakout this week.

Technically I suspect price will remain above 138.25 support for the following:

- D1 has produced a Morning Star Reversal pattern with increased volume to suggest buying at these levels

- Price action from the 141 high appears to be corrective (potential double Zig-Zag / Double 3)

For this scenario to play out we would require string growth from Eurozone along with no action from ECB on Thursday (resulting in short covering).

The counter analysis highlights potential for a bearish flag which if confirmed would target 136. For this scenario we would require poor GDP growth and a string plan for QE (to weaken the Euro).

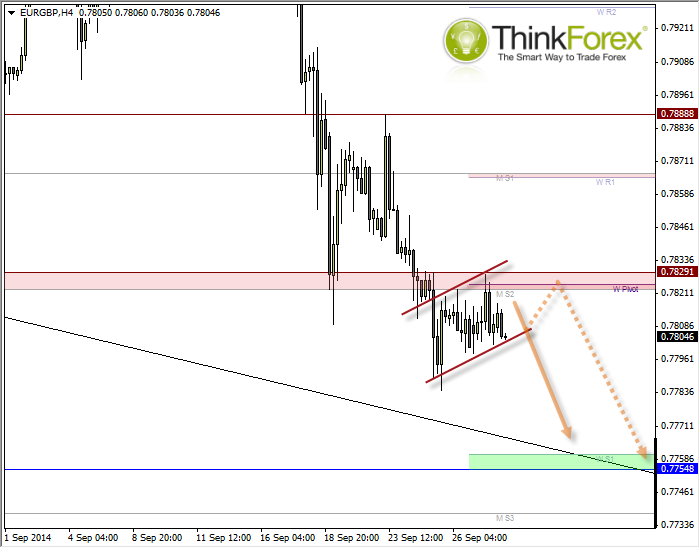

EURGBP: Bear flag below string resistance

We have data from Eurozone and UK tonight so this significantly increases the odds of a movement. Price is within an established downtrend on higher timeframes and has respected resistance around 0.7820, whilst trading within a potential bear flag formation.

We also have a clear profit objective around 0.77.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.