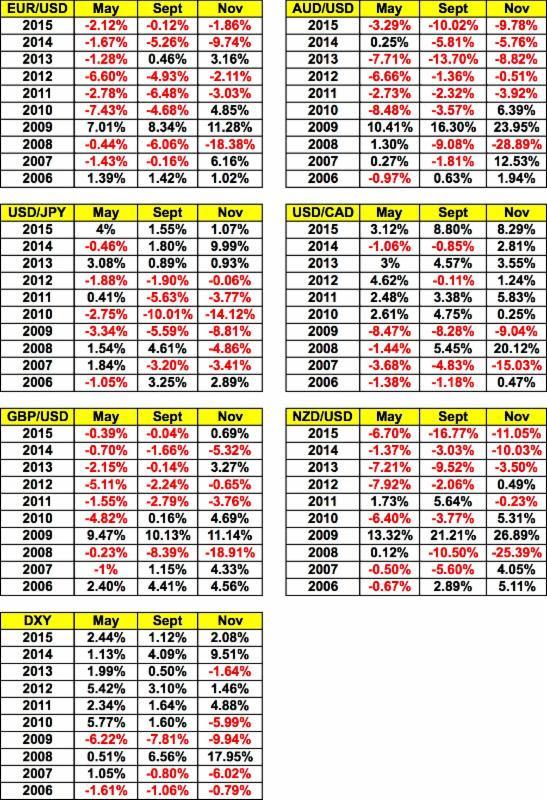

On Monday, we presented our readers with a table illustrating the seasonal performance of the U.S. dollar in the month of May. According to the data (shown again below), May tends to be a very good month for the dollar and as the first week of the month progresses, dollar bulls are regaining control. In 8 out of the last 10 years, the Dollar Index appreciated in the month of May with particularly consistent gains seen in EUR/USD and GBP/USD. Interestingly enough these are two of the currencies that have seen the smallest losses against the dollar. Nonetheless the greenback is rising and enjoying particularly strong gains versus the commodity complex. USD/CAD rose another 1.25% while NZD/USD and AUD/USD extended their losses. Stronger than expected U.S. data helped to drive the dollar higher today but the primary catalyst for the reversal in the greenback has been the decline in commodity prices, which explains why commodity currencies experienced the greatest losses.

Although private payroll provider ADP reported lower employee additions in the month of March, ISM reported stronger job growth in the services sector. Investors chose to put greater weight on the ISM number and rightfully so because it is the strongest leading indicator for non-farm payrolls. With service sector activity growing at its fastest pace in 4 months and the employment component also rising to a year to date high, we're looking for accelerated job growth in the month of April. Factory orders also rose strongly and the trade deficit shrank to its smallest level in 7 years. While its highly doubtful that the Fed will change its mind about leaving rates unchanged in June, regardless of how strong Friday's jobs report is, the U.S. dollar is leading the charge and when positive momentum is met with confirming data, it could actually accelerate gains in the currency. Whereas if the dollar was weak and the jobs number good, the impact on the dollar would be limited.

USD/CAD was driven sharply higher after Canada reported a record-breaking trade deficit. The country reported its worst trade deficit ever as exports hit the lowest level in more the 2 years. The strength of the Canadian dollar and the previous decline in oil prices weighed heavily on Canadian - U.S. trade activity. The surplus with Canada's largest trade partner narrowed to its smallest level since December 1993. The plunge in exports creates big headaches for the Bank of Canada who had been banking on a recovery in the non-export sector to stabilize the economy. The only saving grace is the rise in oil prices last month and the Fed's slower pace of tightening. Unfortunately CAD is still poised for further losses as Canada's employment report on Friday will most likely show a slowdown in job growth after the previous month's exceptionally strong reading.

The New Zealand dollar traded lower on the back of last night's mixed employment numbers. Although employment change grew by 1.2% in the first quarter, which was double expectations, the unemployment rate rose to 5.7% from an unrevised 5.3%. An increase in the first quarter was expected but not one by this magnitude. While the increase can be largely attributed to the rise in participation rate, which is good news for New Zealand's economy, investors still worried that hiring decisions will deteriorate in the coming months as weaker Chinese and Australian economic performance weighs on New Zealand growth. Average hourly earnings also fell short of expectations, increasing the pressure on the RBNZ to ease.

For the second day in a row, the Australian dollar closed below 75 cents. Last night's slightly higher than expected service sector PMI report failed to renew demand for the currency as investors prefer to interpret the sub 50 reading as justification for the Reserve Bank's surprise rate cut. Trade and retail sales numbers are scheduled for release this evening - the weakness of the PMI manufacturing report signals the potential for a disappointing trade number and while the sales component of PMI services increased, the contractionary mode puts retail sales at risk for a downside surprise as well.

Euro ended the day unchanged against the U.S. dollar as softer retail sales and downward revisions to German and French PMI service reports were offset by slightly less dovish comments from the ECB. According to "ECB sources," there's no desire for action before September if at all. Considering that few in the market expect additional stimulus from the central bank in the near term, the impact on EUR/USD was limited.

Sterling continued to fall versus the U.S. dollar and most other major currencies as a softer construction sector PMI report followed yesterday's disappointing manufacturing release. Data for the more important service sector is scheduled for tomorrow and if it falls short of expectations as well, we could see GBP/USD fall to the 100-day SMA at 1.4400.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.