Since the beginning of the year, commodity currencies have been on a tear and after a brief dip, the Canadian, Australian and New Zealand dollars reached for new highs. This morning, the loonie rose to its strongest level in 9 months versus the greenback and while similar milestones have yet to be reached by AUD and NZD both currencies came within 50 pips of multi-month highs today. Reports that Saudi Arabia may have reached an oil production freeze agreement with Russia sent oil prices sharply higher, providing support for all commodity currencies. The improvement in risk appetite also contributed to a move that will likely see new highs for all of the comm dollars. Chinese trade numbers are scheduled for release this evening and after the sharp fall in exports last month along with the near 50% decline in the trade surplus, stronger numbers are expected for the month March. Both the Caixin and the official government release showed an improvement in manufacturing activity last month that is consistent with healthier trade numbers. An upside surprise in China's trade balance report could be just what AUD and NZD needs to hit new highs.

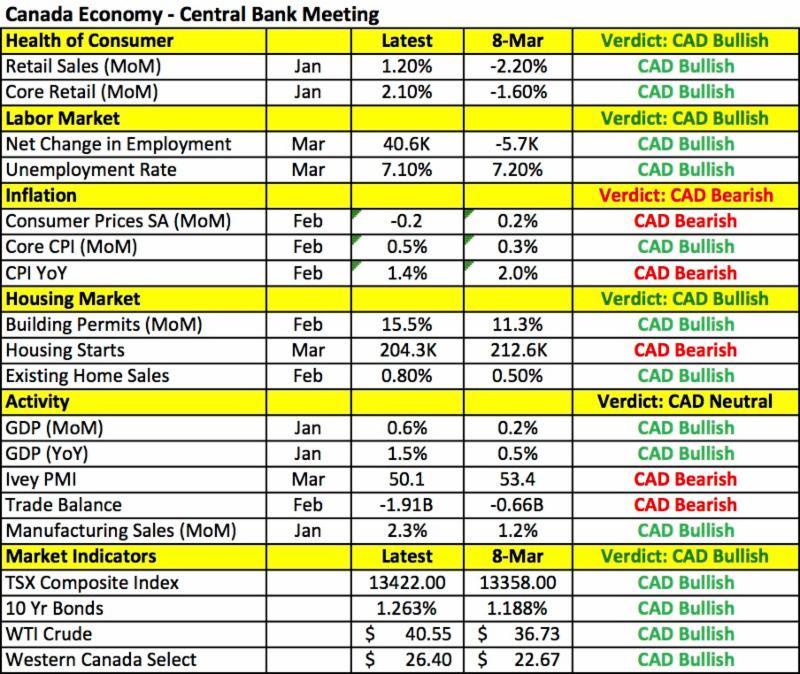

CAD traders on the other hand will be waiting for the Bank of Canada's blessing. The following table shows the extent of the improvements in Canada's economy since the March meeting. Retail sales rebounded strongly, job growth surged, the unemployment rate declined, building permits and existing home sales increased and GDP growth accelerated. While consumer prices fell, core CPI, which is less volatile increased. The only area of concern is manufacturing activity and trade, which saw significant deterioration. However with oil prices up 10% since the last central bank meeting and the Federal Reserve slowing its pace of tightening, the BoC has a lot less to worry about this month compared to March when they weren't all that concerned to begin with. We will still be watching for comments on the currency because with the latest gains it is up more than 4.5% since they last met. If the BoC expresses any concerns about CAD strength, the currency will peak and USD/CAD will make its way back to 1.30. If they sound nonchalant, then the next stop should be 1.2680, the level at which the 20-month SMA and 38.2% Fibonacci retracement of the 2011 to 2016 rally converge.

Although the U.S. dollar is down against all 3 commodity currencies and sterling, it is up versus the Yen, euro and Swiss Franc today. Import prices and small business confidence were the only pieces of U.S. data released and both deteriorated in the month March. We also heard from Fed Presidents Harker and Kaplan - they are not voting members of the FOMC this year but they agree that rates could rise in the near future and policy can truly normalize as we move into the second half of the year. Fed officials, doves and hawks included continue to see tightening in 2016 even though the market is pricing in no rate hike until 2017. Someone's bound to be wrong and tomorrow's U.S. retail sales report will affect these views. We are looking for consumer spending to rise because wages increased, job growth accelerated and we have yet to see that translate into stronger spending. March should be month that happens especially given the improvement in demand that has been reported by Johnson Redbook. The Fed's Beige Book is also scheduled for release and given the divergence between market expectations and Fed guidance, the central bank's report on economic conditions in the Fed districts could take on increased importance.

While sterling traded higher against the U.S. dollar and euro today, it ended the North American trading session well off its highs. Consumer prices rose 0.4% in the month of March and 0.5% year over year. Both of these readings as well as the core CPI report was stronger than expected, and likely to move higher in the coming month if oil prices stay above $40 a barrel. Following 2 days of gains, today's reports extended the rally in sterling. However the details show some affects of an early Easter and with Brexit risks looming, sterling failed to hold onto its gains. Denmark also voted against the Association Agreement (a trade pact) between the European Union and U.K. Even though the vote is nonbinding and the EU could undermine Denmark's decision, it is a sign of the growing resentment towards the European Union that the Brits could end up sharing. No major U.K. economic reports are scheduled for release tomorrow but the Bank of England meets on Thursday.

After rising to a fresh 6 month high, the euro gave up its earlier gains to end the day lower against the U.S. dollar. Even with today's pullback the currency pair continues to hold above 1.13 and remains comfortably within its narrow trading band. Eurozone industrial production numbers are scheduled for release tomorrow and while the recent drop in German IP points to a softer number we believe the impact on euro should be limited. The U.S. dollar and Fed policy are the main focus and as long as stocks hold steady, EUR/USD will still be aiming for 1.15.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.