Last night, we learned that China's manufacturing sector grew at its slowest pace in 3 years. The PMI index dropped to 49.4 from 49.7 with non-manufacturing PMI also slipping to 53.5 from 54.4. What is interesting about these numbers is that they conflict with the private Caixin report, which actually showed an improvement in manufacturing activity. Yet the fact that China did not show stronger numbers suggests that there could be even more significant underlying weakness. This is bad news for Australia but an easing bias for the RBA is not a done deal.

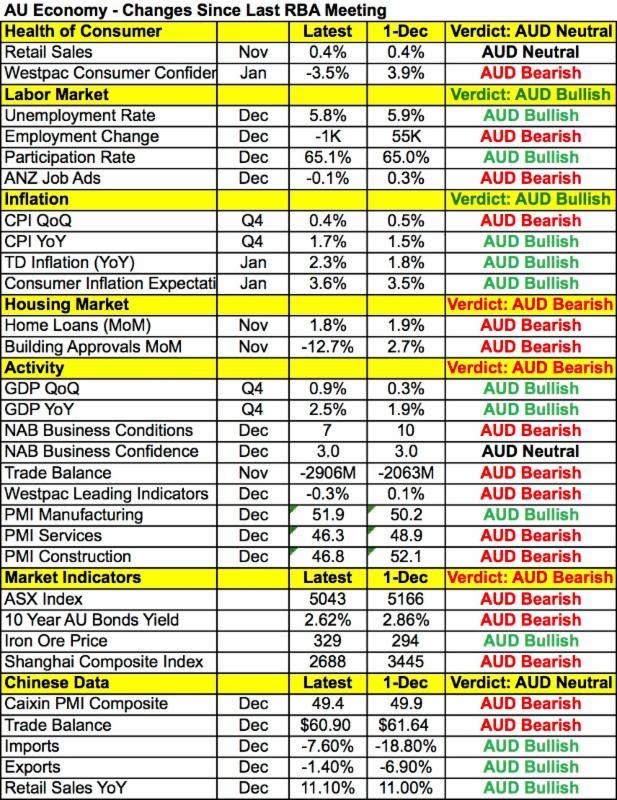

A lot has changed in the past 2 months, giving the Reserve Bank of Australia much to think about this evening. While no changes in interest rates are expected, investors will be looking to see if they signal plans to ease monetary policy in the coming months. From the perspective of Chinese growth, financial market volatility and the decline in global inflation, the RBA should be considering another rate cut. Taking a look at the table below, consumer confidence, job ads, housing market activity, trade, business conditions, service and construction activity all deteriorated since the last central bank meeting in December. However steady retail sales growth, stronger manufacturing activity, a drop in the unemployment rate, rise in the participation rate and relatively healthy job growth in October and November along with higher annualized CPI and inflation expectations provide reasons for the RBA to be optimistic. While oil prices are lower, gold and iron ore prices are higher now than in December, which means the prices of commodities that are for important for Australia increased.

Back in December, the RBA described the post boom economy as "quite respectable" and that looking ahead, "the outlook appears to be for a continuation of moderate growth. While there's a lot more to be concerned about in 2016, the RBA also has reasons to hold off adjusting their monetary policy stance. This lack of clarity means that the best way to trade the RBA rate decision is to wait because if they shift to a dovish bias, the move lower in AUD/USD could be significant.

Meanwhile many investors were confused about why the 6% drop in oil prices today failed to send the Canadian dollar sharply lower. Instead, USD/CAD closed firmly below 1.40. Apparently there was heavy selling by leveraged funds which may continue. However when USD/CAD diverges this much from oil on a day where the U.S. - Canadian 2 year yield spread moved in favor of USD/CAD gains, we can't help but view this as an attractive buying opportunity. The biggest risks for the Canadian dollar this week are the regularly scheduled weekly oil inventory data and Friday's employment report.

Sterling was the day's best performing currency. Stronger than expected manufacturing activity and an uptick in mortgage approvals set the tone for trading. However GBP/USD didn't gain traction until the North American session. The Bank of England meets this week and while we are still waiting for a few pieces of data to be released we looked at how the U.K. economy performed over the past month and there has actually been material improvements since the January meeting. Most importantly, price pressures increased, consumer confidence improved and the unemployment rate ticked lower. Between today's better than expected PMI manufacturing report and overstretched positioning (CFTC report short sterling positions at their highest level since 2013), today's move in GBP/USD is a classic short squeeze.

Euro also traded higher against the greenback despite dovish comments from ECB President Draghi. Nothing new was said but equally negative comments from ECB member Nowotny and Coeure confirm that the central bank is serious about easing. Nowotny said China is a particular concern and Coeure said the central bank may reconsider policy stance in March as they stand ready and able to play its part in recovery. As such we continue to view the euro as a sell on rallies.

Finally, with a Global Dairy auction and fourth quarter employment numbers scheduled for release tomorrow, the New Zealand dollar will also be in play. If dairy prices fall for the third auction in a row, it would reinforce the Reserve Bank's concerns about the economy and revive the decline in the currency. However if prices recover then part of these worries will fade and the recent rebound in NZD/USD will be justified.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.