Selecting the best currencies to trade this week boils down to market expectations. If a positive or negative report has been priced in or if the data won't change the market's expectations for policy moves the currency's reaction will be nominal. This is true of most this week's PMI reports and some labor market releases. More specifically while the U.S. non-farm payrolls report takes on special meaning this week, the German and Canadian reports should have only a limited impact on EUR and CAD. The market is convinced that the ECB will ease and a stronger employment report won't change their views. At the same time, the Bank of Canada meets before the Canadian employment report and their outlook for the economy should have a greater impact on the currency. We believe U.K. PMIs will be strong but policymakers have mostly ignored positive economic reports. Both the RBA and the BoC are expected to leave monetary policy unchanged and unless one of them suggests that they are willing to cut rates, the impact on AUD and CAD should be short-lived. So that leaves us with the ECB, NFP and Yellen's testimonies. Most investors agree that the ECB will ease, payrolls will be strong and Yellen will suggest that tightening is around the corner but few have a good grasp of how far the ECB or Fed will go and how strong payrolls will be. This room for surprise means that there can still be a big reaction to this month's main events.

Everyone is watching euro this week and we believe that it will test and break 1.05. While investors have completely discounted easing by the ECB, there's a great deal of uncertainty surrounding what actions the central bank will take. They could lower the deposit rate, extend the soft end date of the program beyond September 2016, expand the types of assets purchased, introduce a two-tiered deposit rate system and/or front load their purchases. Given the recent weakness in the Eurozone economy, low inflation and the risk of a deeper downturn, Mario Draghi could be more aggressive than most investors anticipate. EUR/USD could easily extend its losses if the market ends up underestimating the central bank.

The Dollar Index rose to its strongest level in 8 months and what is interesting about the move is that this milestone was reached with losses versus the British pound, Swiss Franc, Australian, New Zealand and Canadian dollars. Data from the U.S. was weaker than anticipated with the Chicago PMI index dropping to 48.7 from 56.2 and pending home sales rising only 0.2% compared to the market's 1% forecast. Yet the resilience of the dollar indicates that investors are convinced this week's jobs report will be strong enough for the Fed to raise rates and Janet Yellen who speaks numerous times this week will confirm that tightening remains likely. Since NFPs are not due until the end of the week, our focus will be on Fed speak. Aside from Yellen, 9 other FOMC members are scheduled to make comments and we will be looking for consistency in their views. Ultimately we believe that the dollar will trade higher this week unless Yellen backtracks on her comments and suggests that the central bank may pass on raising rates this year.

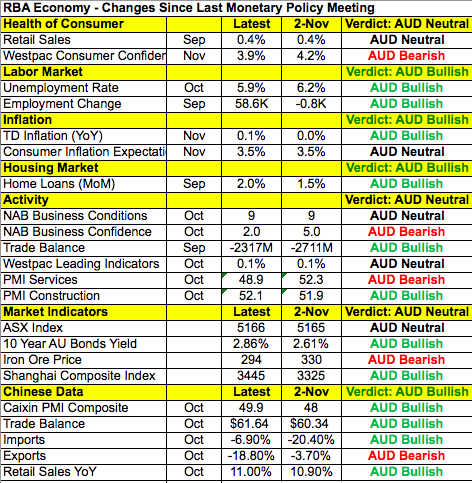

Tonight the main focus will be on the Australian dollar, which traded higher against all of the major currencies ahead of this evening's monetary policy announcement. No changes to interest rates are expected from the RBA but Governor Glenn Stevens' relaxed outlook for the economy indicates that they are in no rush to lower rates again. His optimism about the domestic recovery could make its way into the monetary policy statement or his speech this week. As shown in the table below there has been slightly more improvement in Australia and China's economy since the last RBA meeting. Tonight's Chinese PMI numbers are also expected to show a controlled slowdown in China's economy. The big news today was the IMF's official inclusion of the Chinese Yuan in their SDR basket. The Yuan will be allocated a 10.92% weighting which is slightly less than forecast. What is interesting about the new weightings is that the biggest change is for the euro, which now accounts for 30.9% of the basket instead of 37.4%. While EUR/USD did not have much of a reaction to the news, it is certainly not positive for the currency.

For the first time in 7 months, GBP/USD traded below 1.50 but the sell-off was short-lived with the currency pair bouncing strongly to end the day well above this key level. Whether sterling manages to hold this rate largely depends on what happens in the next 24 hours. We are looking for manufacturing activity to improve but if BoE Governor Carney or other U.K. policy makers express concerns about the U.K. recovery, the data wont matter. Carney is less dovish than his peers but low inflation is a serious and persistent problem.

Both the Canadian and New Zealand dollars traded higher today on the back of stronger data. Canada's current account deficit narrowed in the third quarter while New Zealand business activity ticked sharply upwards. The New Zealand dollar was actually the day's best performing currency. End of year flows and the prospect of ECB easing drove investors into the highest yielding major currency.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.