Thanks to Janet Yellen the U.S. dollar moved higher against all of the major currencies today. Both the head of the Federal Reserve and 2015 Fed voter Dudley said interest rates could increase in December if data supports the move. While the last qualifying statement indicates that strong labor market numbers are a necessary prerequisite to a rate hike, Yellen's comment that the "FOMC thought it could be appropriate to move in December" is a sign that U.S. policymakers are eager for lift off to begin. Yellen expressed confidence in the economy, talked about how labor slack diminished significantly even though job gains slowed and pointed to rising wages as a sign of strength in the labor market. The latest ISM non-manufacturing report reinforced the bright prospects for the U.S. economy. Service sector activity was expected to slow but instead expanded at its second strongest pace in 10 years. More importantly, the employment component of the index rose to its second highest level since August 2005. The last time we saw a number this strong was in July 2015, the month that non-farm payrolls rose 223k. ADP declined slightly from 190K to 182K but the strength of ISM, low level of jobless claims and the optimism of the Fed make us confident that non-farm payrolls will rise by at least 200K. However the dollar is rising not only because the Fed could raise interest rates next month but also because relatively speaking, the U.S. is currently the strongest major economy. We expect the dollar to remain firm going into and out of Friday non-farm payrolls report.

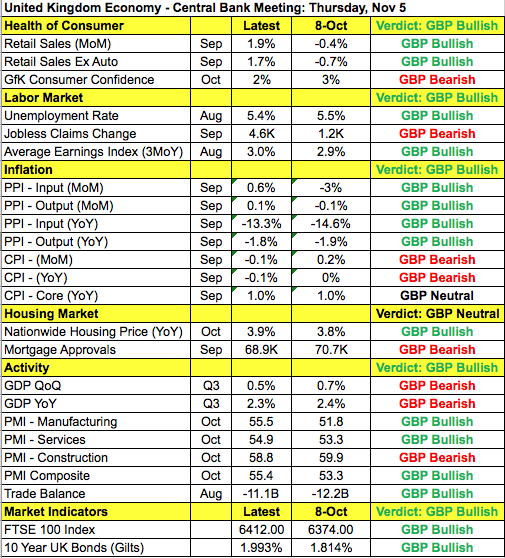

With a Bank of England meeting and Quarterly Inflation Report scheduled for release, GBP will be in play over the next 24 hours. While U.S. dollar strength drove GBP/USD lower today, we expect further gains for sterling on the back of the BoE. As shown in the table below, there has been significantly more improvement that deterioration in the U.K. economy since the last monetary policy meeting. Retail sales rose strongly in September, the unemployment rate declined, wages increased and service along with manufacturing activity accelerated. Although consumer prices eased, which is a big problem for the central bank, the uptick in PPI and the rise in market indicators should keep the central bank optimistic. The BoE is not looking to raise interest rates at this time but the improvement in the economy could lead to upgraded economic forecasts and/or encourage one additional MPC member to join Ian McCafferty in voting for an immediate rate rise.

EUR/USD and NZD/USD were the two worst performers today. Softer Eurozone and stronger U.S. data drove EUR/USD to a 2-month low. Service sector activity for the region was revised lower causing a similar downward revision to the composite index. While France saw stronger activity Germany continued to falter. Eurozone producer prices fell less than expected but on annualized basis PPI printed at -3.1% vs. -2.6% in August. As U.S. data gets stronger, Eurozone data is getting weaker and this dynamic has and will continue to weigh on EUR/USD. Our initial target for the currency pair is 1.08 and we are not far from that price level. While we are looking for EUR/USD to remain weak, we don't anticipate much in the way of further losses before the ECB meeting. Instead, we believe that the currency pair will find support next week once NFPs are behind us.

NZD/USD on the other hand is feeling the strain of last night's disappointing labor data and yesterday's drop in dairy prices. Today's decline took the currency pair to the 100-day SMA. If NZD/USD extends its losses it would be the first time since May that the pair closed below the moving average. This is significant because it opens the door to a stronger decline in the pair including a possible move down to 63 cents. All of the recent NZ economic reports reinforce the RBNZ's dovish bias and confirms that the door remains open for another rate cut by the central bank.

Despite better than expected economic data, the Canadian dollar traded lower against the greenback. USD/CAD resumed its rise as oil prices resumed its slide. The "reason" for today's drop in oil is a stronger dollar. While the trade deficit narrowed, imports fell for the first time in 5 months as exports increased. The decline in imports signals the weakness of internal demand and raises our overall concern about Canadian economic activity. The IVEY PMI report is scheduled for release tomorrow and we are looking for a slowdown in manufacturing activity.

The Australian dollar also traded lower today. Economic data was mixed with service sector activity slowing, retail sales growth meeting expectations and the trade deficit narrowing more than anticipated. Initially investors interpreted these reports to be positive for AUD but by the end of the North American trading session, AUD/USD also fell victim to USD strength. While today's Australian economic reports were not terrible, we don't believe that they are extremely encouraging as well. Yet AUD is looking better than other currencies such as EUR, NZD, JPY and CAD.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.