Forex News and Events

Back to fundamentals

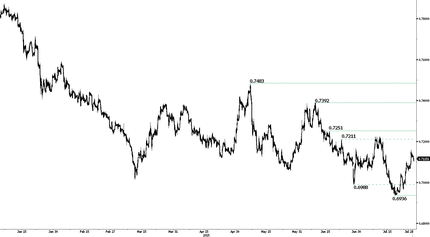

According to data released today, the UK economy expanded by 0.7% q/q in line with market expectations. Following a soft patch of 0.4% in 1Q the growth is now trending closer to 2015 expectations. The service sector was the bright spot expanding 0.7 q/q. While construction growth was flat, production has supported by output increase in the oil and gas industry. The strong GDP read complements the acceleration in the labor markets and points to further expansion in 3Q. Recent Bank of England meeting minutes acknowledged the solid outlook but the actual prints will provide some relief to hawkish members. This solid read should increase the likelihood that BoE members Weale and McCafferty vote for policy tightening at the August meeting. As the monetary policy divergence theme strengthen, GBP should become one of the primary beneficiaries as expectations for a February 2016 rate hike increase. Currently the BoE seems not really concerned by the GBP strength which should allow GBP to trade higher against EUR and USD. GBPUSD spiked to 1.5589 on the GDP release. GBPUSD should be supported by 1.5483 uptrend channel with a target of range top at 1.5732.

IMF advises ECB to expand its QE:

“The International Monetary Fund issued yesterday its annual report on the Eurozone’s economy. The tone of this report is somewhat alerting as the institution warns about contagion fears, high unemployment and lack of growth in the Eurozone. Also, it is stated that all the necessary tools must be used and ready to deploy to save banks. Hence, the European banking system should continue to have access to liquidity and sovereign debt markets must be maintained in order. Furthermore, it fosters the ECB to expand its quantitative easing (QE) program beyond September 2016. In addition, the IMF is pushing the ECB to use the exact same tools used by the United States since 2008 with the results we are now seeing. In other words, the ECB has to face against lack of growth with monetary tools that have proven to be inefficient to create growth and to avoid deflation. This does not the IMF to forecast a Eurozone GDP Growth of 1.5% this year and 1.7% next year. We remain even more sceptical about those forecasts as unemployment in the Eurozone is still high, averaging around 11% and near 25% in Greece and Spain and we anticipate QE will not have the desired effects. EURUSD price action is mainly driven by the US this week against a backdrop of FOMC meeting and Q2 GDP. However, we think that European Business confidence as well as start of negotiations for the third Greek Bailout and its uncertainties will provide downside pressure to the pair which is likely to challenge again the 1.1000 level.” Yann Quelenn - Market Analyst

Free Trading ideas & Signals

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.