Good morning from Hamburg and welcome to our latest Daily FX Report of this week. Wall Street ended flat on Thursday as investors digested ho-hum corporate earnings and new data showed that the economy grew more quickly in the second quarter. Procter & Gamble, Facebook and Whole Foods Market all fell after quarterly reports that left investors wanting more. U.S. economic growth accelerated in the June quarter as solid consumer spending offset a drag from weak business spending on equipment, suggesting steady momentum that could bring the Federal Reserve closer to hiking interest rates this year. With a mixed bag of corporate earnings over halfway through second-quarter reporting season and a sharp focus on when the Federal Reserve will begin raising interest rates from near zero, investors on Thursday saw few reasons to pay more for shares.

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

The dollar rose to a one-week high against a basket of currencies on Thursday as news of faster U.S. economic growth in the second quarter supported expectations that the U.S. Federal Reserve will raise interest rates as early as September. The dollar index was up 0.5 percent at 97.496 after touching 97.773, its highest in a week. The USD rose to a seven-week peak of 124.58 yen before retreating to 124.12 yen, up 0.2 percent on the day. The euro shed 0.5 percent to $1.0925 after hitting an one-week low at $1.0894. The euro faced further selling pressure on a Financial Times report that said the International Monetary Fund could not officially join bailout talks with Greece until the debt-burdened nation agrees to comprehensive reforms. While recent economic data has raised the chances of a U.S. rate increase, some analysts caution that Greece's unresolved debt woes and turmoil in China's financial markets may worsen, forcing the Fed to postpone a rate hike in September.

The dollar's renewed strength put pressure on commodities prices and currencies closely linked to them. As a result the Canadian dollar was down 0.5 percent at $1.3005, and Australian dollar dipped 0.1 percent at $0.7291. The New Zealand dollar fell 0.9 percent to $0.6601 The strong U.S. dollar also pushed the price of crude oil, a major Canadian export, lower, which put further pressure on the CAD. The Canadian dollar finished at C$1.3010 to the USD, or 76.86 U.S. cents, weaker than the Bank of Canada's official close of C$1.2944, or 77.26 U.S. cents, on Wednesday.

Daily Technical Analysis

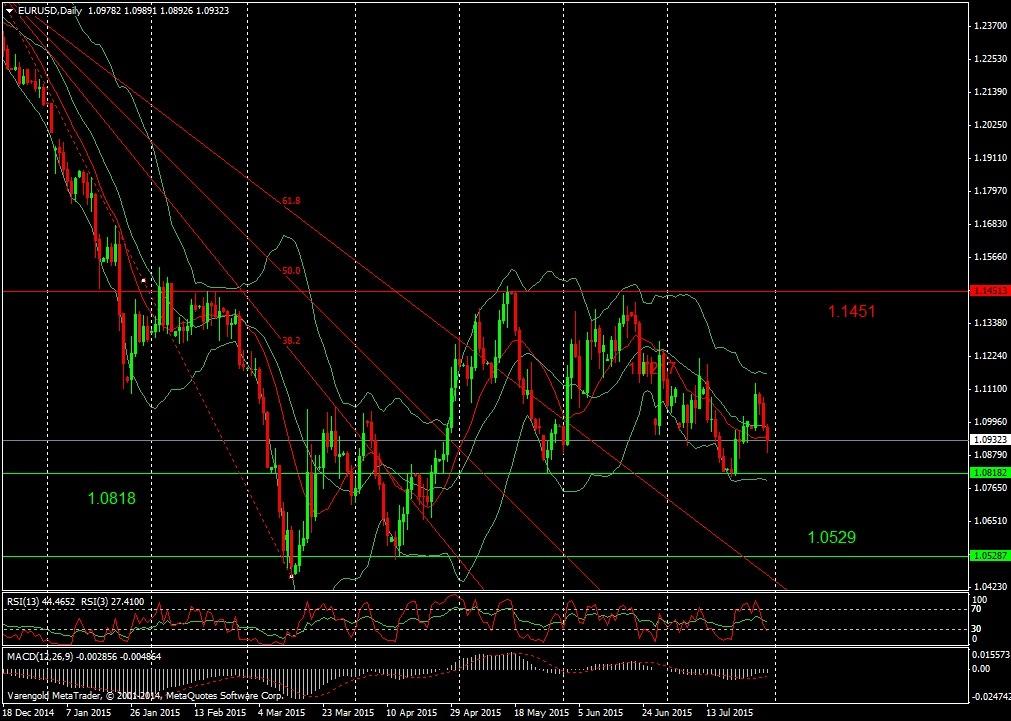

EUR/USD (Daily)

A quick glimpse on the chart reveals that investors are unsure these days regarding the future direction of this currency pair. For months this currency pair is already traded in a very narrow sideward channel leaving no room for any significant course corrections. According to the indicators and regarding the fundamentals there are no major signs for a significant movement at the moment. The trend remains stable between $1.08 and $1.11.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.