EUR/USD Current Price: 1.1148

View Live Chart for the EUR/USD

Majors remained static for most of the first half of the day, as investors waited for the US employment data. The January Nonfarm Payroll report rocked the market, as the US economy added just 151K new jobs in the month, although the unemployment rate fell to 4.9%, the lowest in 8 years. Wages came out as a big surprise, rising well above expected, up 0.5% monthly basis, while compared to a year before, it remained at 2.5%. The initial market reaction was a rally against the greenback, with the EUR/USD pair running up to 1.1245 that was quickly faded. The dollar began grinding higher after the dust began to settle, as higher wages are good to boost inflation.

The EUR/USD pair is short term bearish according to the 1 hour chart, heading towards the 1.1120 immediate support as the technical indicators accelerated their declines below their mid-lines and the price is being contained by its 20 SMA. In the 4 hours chart, the technical indicators are finally correcting overbought readings, while the 20 SMA maintains a strong bullish slope around 1.1060, providing support in the case of further declines.

Support levels: 1.1120 1.1060 1.1025

Resistance levels: 1.1160 1.1200 1.1240

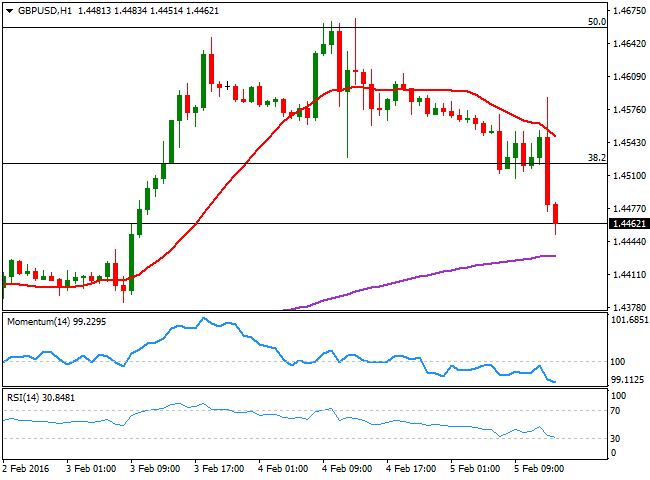

GBP/USD Current price: 1.4462

View Live Chart for the GBP/USD

The Pound is today the weakest across the board, falling down to 1.4451 against the greenback after the US NFP release. The GBP/USD began its decline after a poll from You Gov showed an increase in the ones favoring a Brexit, up to 45% of the voters. The pair has bounced some from the level, but maintains a short term bearish tone, as in the 1 hour chart, the price is below a bearish 20 SMA, while technical indicators head south within bearish territory. In the 4 hours chart, the price has broken below its 20 SMA and 200 EMA, while the technical indicators head south, with the RSI already entering bearish territory, increasing chances of a downward continuation.

Support levels: 1.4430 1.4380 1.4350

Resistance levels: 1.4510 1.4550 1.4590

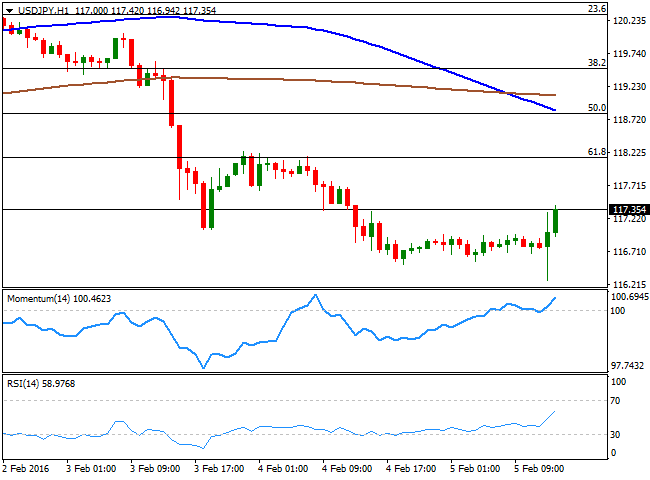

USD/JPY Current price: 117.38

View Live Chart for the USD/JPY

Limited correction, sell on spikes. The USD/JPY pair gains some ground after the release of a mixed US employment report, showing a strong rise in wages during January, and the lowest unemployment rate in eight years. Nevertheless, and with the market dollar-negative, the rally seems quite shy, and mostly a correction. Technically, the 1 hour chart shows that the technical indicators are bouncing higher within positive territory, while the 100 SMA extends further its decline and crosses below the 200 SMA above the current level. In the 4 hours chart, the technical indicators are posting tepid recoveries from oversold territory, but lack upward strength, while the price is also far below its moving averages, supporting the ongoing advance is barely corrective. Further rises are likely to be seen as selling opportunities, up to the 118.10 region.

Support levels: 117.00 116.60 116.20

Resistance levels: 117.70 118.10 118.50

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.