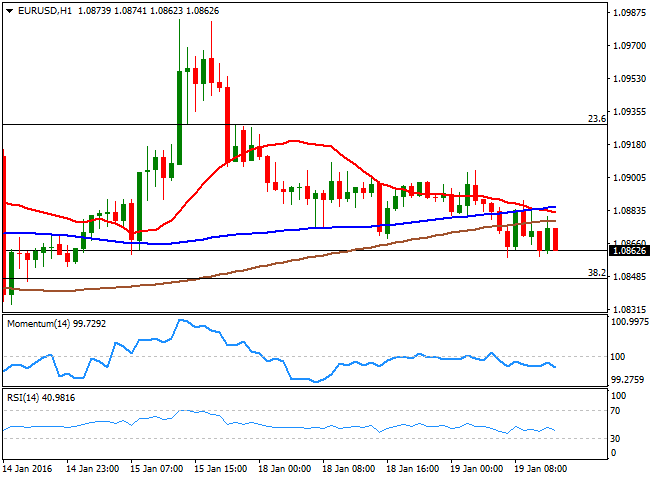

EUR/USD Current Price: 1.0863

View Live Chart for the EUR/USD

Markets are extremely active this Tuesday, but the common currency is unable to react, not to news neither to sentiment, trading within a tight range against the greenback ahead of the US opening. The EUR/USD pair has spiked up to 1.0904 earlier in the day, but the pair remains above 1.0845, the immediate support as per being the 38.2% retracement of the December bullish run. The data released this morning showed that the EU inflation matched expectations, flat in December compared to the previous month, and up by 0.2% in the same month, but compared to a year before. The German ZEW survey surprised with some improvement in local sentiment, although when it comes to the region, it was a big miss, printing 22.7 against the 27.9 expected and the 33.9 previous.

With only the TIC flows for November ahead in the US, the short term technical picture for the pair is bearish, given that in the 1 hour chart, the price is extending below its moving averages, with the 20 SMA crossing below the 100 and 200 ones, above the current price, while the technical indicators head lower below their mid-lines. In the 4 hours chart, the Momentum indicator has crossed its mid-line towards the downside, while the price is right below its moving average, all together in a tight range and lacking directional strength. Should the price extend below 1.0845, the pair will likely test the 1.0800 level, where buying interest has been defending the downside.

Support levels: 1.0845 1.0800 1.0760

Resistance levels: 1.0925 1.0965 1.1000

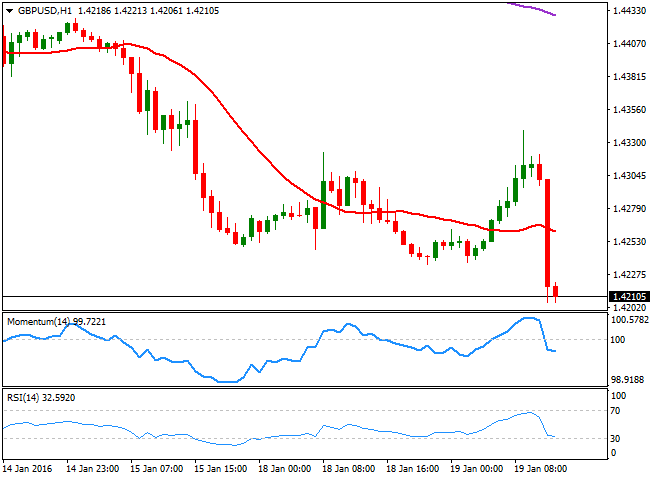

GBP/USD Current price: 1.4209

View Live Chart for the GBP/USD

The reasons beyond the latest Pound´s decline has become even more clear this Tuesday, as the currency plummeted to fresh multi-year lows against its American rival, following a dovish statement coming from BOE's head, Mark Carney. The leader of the Central Bank stated that is no time to raise rates, triggering a 100 pip decline in less than an hour. He also said that domestic demand is solid, but that consumption remains resilient. Earlier in the day, news showed that the UK CPI rose by 0.2% in the year to December 2015, compared with a 0.1% rise in the year to November 2015, while house prices increased by 7.7% in the year to November 2015, up from 7.0% in the year to October 2015, although the PPI came out negative, and worse than-expected.

The GBP/USD pair trades at levels last seen in March 2009, and is poised to extend its decline, pressuring the lows and with the 1 hour indicators heading lower within bearish territory. In the same chart, the price is back below a now bearish 20 SMA, now around 1.4260. In the 4 hours chart, the pair was rejected once again by a strongly bearish 20 SMA, now around 1.4300, while the technical indicators turned sharply lower after correcting oversold readings, and in line with further declines, supporting a break below the 1.4200 figure for the upcoming hours.

Support levels: 1.4185 1.4140 1.4100

Resistance levels: 1.4260 1.4290 1.4320

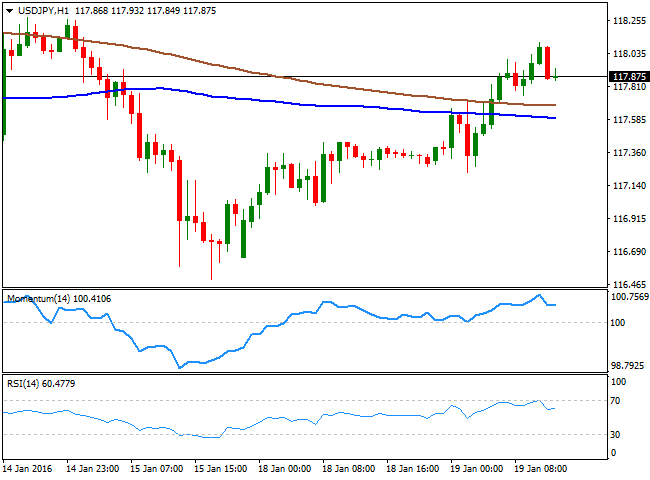

USD/JPY Current price: 117.86

View Live Chart for the USD/JPY

Short term bullish towards 119.00. Despite poor Chinese data released at the beginning of the day, investors have been dropping the safe haven yen, and the USD/JPY pair has been tracking stocks in its way higher, now retreating from its daily high of 118.10. Technically, the 1 hour chart shows that the price is above the 100 and 200 SMAs that anyway maintain a negative tone, while the indicators have retreated from overbought levels, and then turned horizontal within positive territory, not yet confirming additional declines. In the 4 hours chart, the price stalled short from a strongly bearish 100 SMA around 118.60, while the technical indicators are losing their bullish slope above their mid-lines. The pair will likely follow Wall Street during the upcoming US session, and advance to fresh daily highs, but the background is still dominated by bears, with a break below 117.40 now required to see the pair resuming its slide.

Support levels: 117.40 116.90 116.50

Resistance levels: 118.10 118.60 119.00

AUD/USD Current price: 0.6930

View Live Chart for the AUD/USD

Improved market's sentiment has helped the Aussie advance up to 0.6956 against the greenback, a fresh weekly high for the pair, and in spite poor Chinese data. The day started with a hurdle of negative data coming from the second world's largest economy, showing that industrial production growth slowed to 5.9% y/y from 6.2%, fixed investment to 8.3% y/y from 10.2%, GDP to 6.8% y/y from 6.9%, and retail sales slowed to 10.7% from 11% in real terms, ending the 2015 with the weak tone that prevailed all through the second half of the year. Short term, the 1 hour chart maintains a bullish tone, given that the technical indicators head higher near overbought territory after a limited downward correction, as the price advances well above a bullish 20 SMA. In the 4 hours chart, the price is above its 20 SMA and the Momentum indicator heads higher above the 100 level, although the RSI turned lower around its mid-line, limiting chances of further advances at the time being.

Support levels: 0.6906 0.6860 0.6825

Resistance levels: 0.6960 0.7000 0.7040

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.