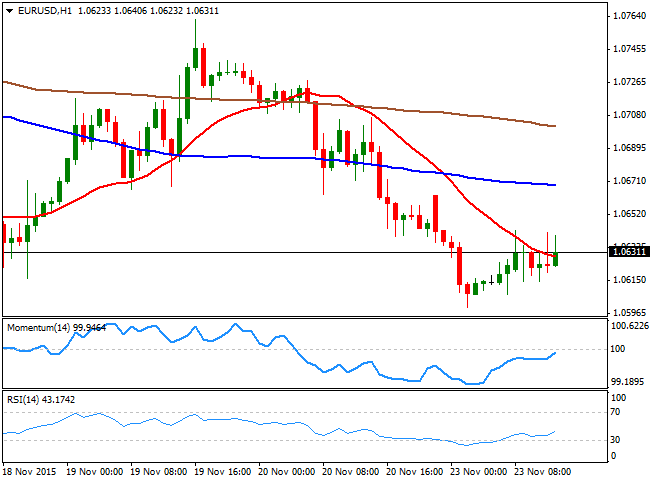

EUR/USD Current price: 1.0631

View Live Chart for the EUR/USD

The dollar trades generally higher this Monday, despite an intraday decline against commodity currencies on the back of a sudden advance in oil prices. The EUR however, is unable to benefit from short term dollar declines, with the EUR/USD pair trading near a fresh 7-month low of 1.0599 posted at the beginning of the week. The macroeconomic figures released in Europe beat expectations, signaling some continued growth in the EU particularly in the services sector. Nevertheless, the pair met selling interest on advances towards 1.0650, the immediate resistance, and the 1 hour hart shows that the price is unable to settle above a bearish 20 SMA, whilst the technical indicators have bounced from oversold territory and continue advancing, but below their mid-lines. In the 4 hours chart, however, the bearish tone is clearer with the Momentum indicator heading sharply lower below its 100 level and the RSI indicator steady around 39.Support levels: 1.0590 1.0550 1.0510

Resistance levels: 1.0650 1.0690 1.0730

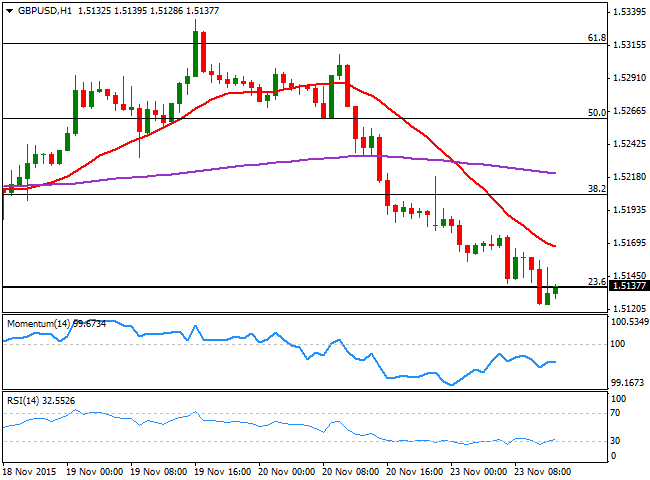

GBP/USD Current price: 1.5138

View Live Chart for the GPB/USD

The GBP/USD pair fell down to 1.5124 on the back of dollar's demand, but has managed to bounce some, following a sharp recovery in oil prices, due to some comments coming from Saudi Arabia's producers, which are willing to do whatever it takes to stabilize the oil market. The GBP/USD 1 hour chart shows that the technical indicators are correcting from oversold territory, but remain deep in the red whilst the 20 SMA heads sharply lower above the current level, maintaining the risk towards the downside. In the 4 hours chart, a bearish tone prevails, as the price has fallen further below its 200 EMA, whilst the technical indicators lack directional strength near oversold levels.

Support levels: 1.5120 1.5085 1.5050

Resistance levels: 1.5160 1.5190 1.5220

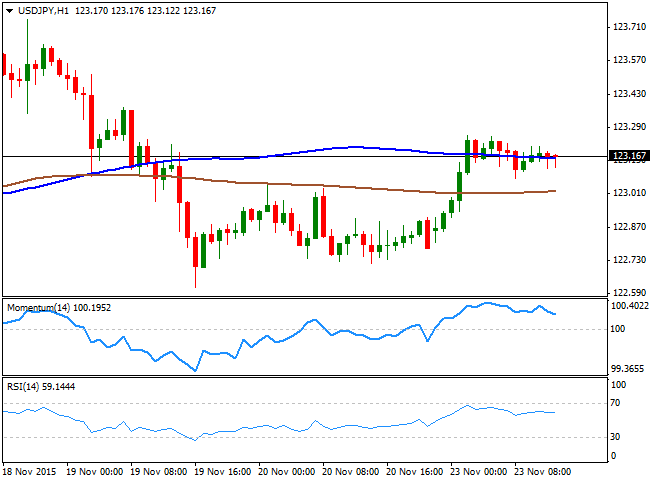

USD/JPY Current price: 123.16

View Live Chart for the USD/JPY

The USD/JPY pair regained the 123.00 during the Asian session, and despite Japan banks were closed on holidays, limiting volatility at the beginning of the day. The pair however, has lost its upward strength and is currently consolidating around its 100 SMA in the 1 hour chart, where the technical indicators have turned slightly lower, but are still well above their mid-lines, far from suggesting a downward move. In the 4 hours chart, the Momentum indicator is aiming higher around its 100 level, whilst the RSI stands horizontal around 53, all of which limits chances of a bearish movement during the American session, although lacks enough strength to confirm an upward continuation.

Support levels: 123.05 122.60 122.20

Resistance levels: 123.40 123.75 124.10

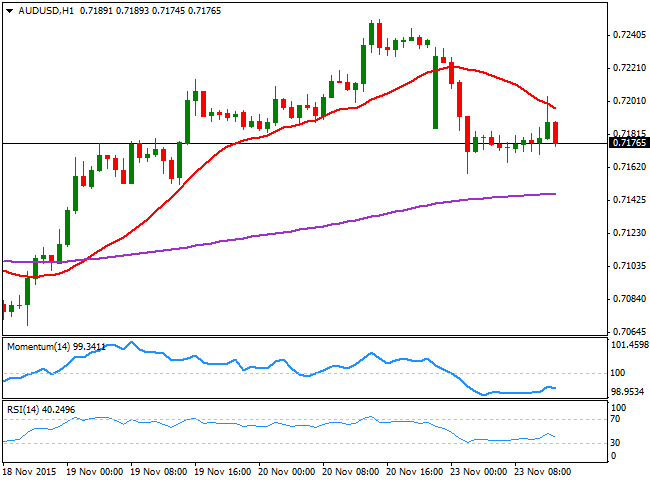

AUD/USD Current price: 0.7176

View Live Chart for the AUD/USD

The Aussie was among the most affected by oil prices' decline during the Asian session, falling down to 0.7158 against the greenback. The AUD/USD pair bounced back towards the 0.7200 level on Saudi's authorities comments, yet selling interest surged around the 0.7200 level. Short term, the 1 hour chart shows that the price remains below a bearish 20 SMA, whilst the technical indicators have resumed their declines below their mid-lines, pointing for additional declines, particularly on a break below 0.7150, a strong static support. In the 4 hours chart, the technical indicators have erased all of their overbought readings and are about to cross their midlines towards the downside, whilst the price is hovering around a mild bullish 20 SMA, in line with the shorter term view.

Support levels: 0.7150 0.7110 0.7070

Resistance levels: 0.7200 0.7240 0.7285

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.