EUR/USD Current price: 1.1037

View Live Chart for the EUR/USD

Adding to yesterday ECB's announcement, the People Bank of China cut its benchmark lending rate and reserve requirements for banks during the European morning, in another attempt to boost local growth. Stocks markets are loving the easing announcements, with European indexes rallying to fresh 2-months highs and US indexes pointing to open with strong gains. Early data in the EU showed that growth in the region was quite strong at the beginning of the last quarter, as Services and Manufacturing PMIs in the region, beat expectations, with only the German manufacturing sector missing. The EUR remains subdued, breaking lower against the greenback and trading around the 1.1030 level ahead of the US opening.

The 1 hour chart shows that the price has briefly advanced above a bearish 20 SMA before resuming its slide, whilst the technical indicators turned sharply lower after correcting the extreme oversold readings reached after the ECB. In the 4 hours chart, the technical indicators have extended their declines to fresh lows in extreme oversold levels, pointing for a continued decline towards the key 1.1000 level, as long as 1.1080 now attracts selling interest. Further declines below 1.1000 should fuel the bearish momentum in the pair, and see it extending down to 1.0960 before the end of the day

Support levels: 1.1000 1.0960 1.0920

Resistance levels: 1.1080 1.1120 1.1160

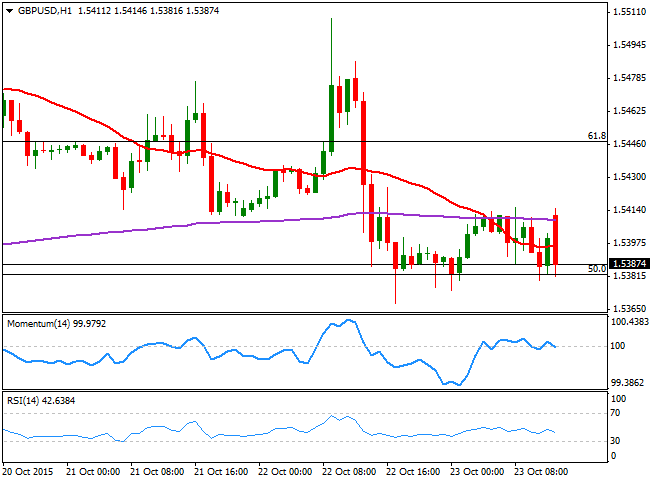

GBP/USD Current price: 1.5387

View Live Chart for the GPB/USD

The GBP/USD pair trades in a tight range this Friday, with no macroeconomic data in the UK to affect the Pound. The pair attempted to recover earlier in the day, but selling interest around 1.5415, the former weekly low, capped the upside, suggesting the pair may now extend its decline. Technically, the 1 hour chart shows that the price is now below its 20 SMA, whilst the technical indicators present tepid bearish slopes below their mid-lines, not yet confirming a downward continuation. In the 4 hours chart, the 20 SMA heads strongly lower above the current level, whilst the technical indicators present limited bearish potential below their mid-lines. Should the price accelerate below yesterday's low, the decline can extend down to the 1.5320 price zone, the 38.2% retracement of its latest daily decline.

Support levels: 1.5365 1.5320 1.5280

Resistance levels: 1.5415 1.5450 1.5495

USD/JPY Current price: 120.88

View Live Chart for the USD/JPY

Heading towards 121.35. The USD/JPY pair trades near its daily high set at 120.98, having bounced sharply from a low set at 120.22 early Europe. The pair is being supported by stocks, skyrocketing in Europe and the US as the PBoC decided to cut its benchmark lending rate. The surprise decision, following yesterday ECB's promise of more easing coming in December, is supporting a rally in the USD/JPY towards the top its latest range at 121.35. The technical picture is bullish in the short term, given that the 100 SMA continues advancing above the 200 SMA, both below the current level, whilst the technical indicators recovered their bullish tone after erasing the extreme overbought readings reached last Thursday. In the 4 hours chart, the technical indicators have corrected their extreme overbought readings, and resumed their advances. supporting the shorter term view. Given that the level has contained advances since late August, stops above it should be large, and if triggered, should see the upward momentum accelerating, up to 121.80/122.00 during the upcoming hours.

Support levels: 120.35 120.00 119.70

Resistance levels: 120.90 121.35 121.80

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.