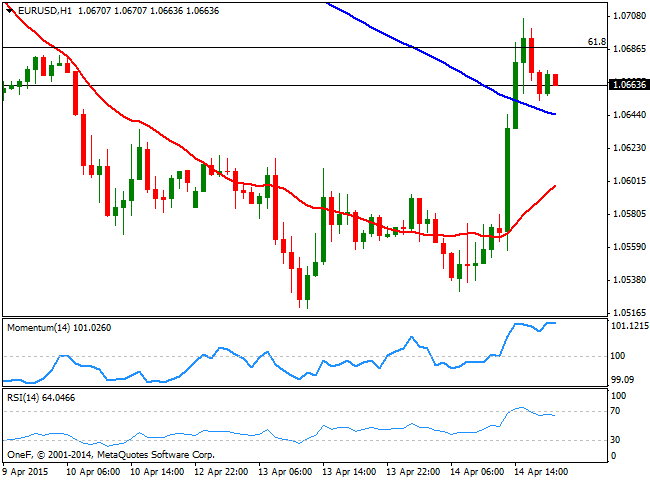

EUR/USD Current price: 1.0663

View Live Chart for the EUR/USD

The dollar ended the day lower across the board, weighed by weaker-than-expected US Retail Sales, that grew 0.9% in March, against expectations of 1.1% rise, while core readings for January and February were revised lower. The US data continues to disappoint, which puts the expected return of the country to its 2% inflation target, further away. The dollar fell further after the IMF warned that global growth remains moderate and downgraded its forecast for US growth. The EUR/USD pair surged up to 1.0706, albeit renewed worries over Greece kept the common currency subdue. Earlier in the day, some IMF officials voiced doubts about the viability of Greece's membership of the euro zone, as negotiations with the troubled country are "not working," increasing the risk of a default by the end of April. Next Wednesday, the ECB will have its monthly economic meeting, and although is expected to be a non-event, market can be extremely cautious ahead of it.

In the meantime, the 1 hour chart shows that the technical indicators are easing from overbought levels, albeit the price recovered above its 100 SMA, currently around 1.0645. In the same chart, the 20 SMA presents a strong bullish slope around 1.0600, limiting chances of a stronger slide. In the 4 hours chart, is clear that the pair was unable to establish above the 61.8% retracement of its latest bullish run, whilst the technical indicators turned lower above their mid-lines. At this point, the pair needs to resume its slide below the 1.0600 figure to retake the bearish bias, whilst steady gains above 1.0720 should favor additional intraday advances for this Wednesday.

Support levels: 1.0645 1.0600 1.0550

Resistance levels: 1.0685 1.0720 1.0755

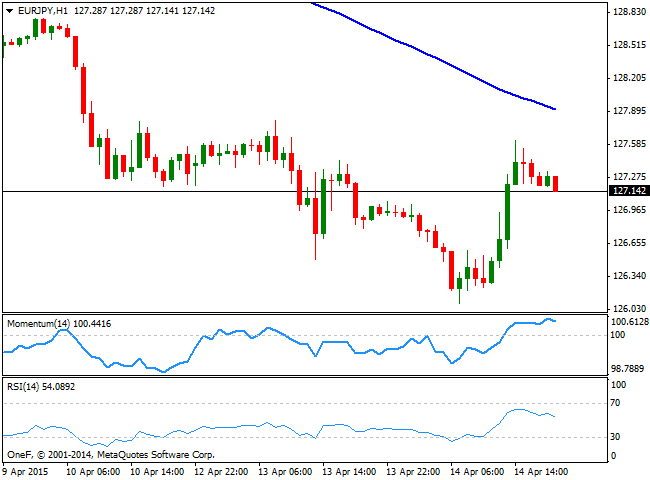

EUR/JPY Current price: 127.13

View Live Chart for the EUR/JPY

The Japanese yen maintain its strength during the past Asian session, driving the EUR/JPY down to 126.08 before the dollar's slump favored a recovery up to 127.62. Technically, the short term picture shows that the price stalled well below a bearish 100 SMA, currently around 127.90, whilst the technical indicators are losing their upward potential above their mid-lines, limiting chances of a stronger recovery. In the 4 hours chart the technical indicators have corrected oversold readings, but stalled right below their mid-lines, and are now turning lower, supporting the shorter term view. Only some follow through beyond the 128.10 will see the pair extending its advance intraday, approaching then the 129.00 region.

Support levels: 126.90 126.50 126.10

Resistance levels: 127.65 128.10 128.70

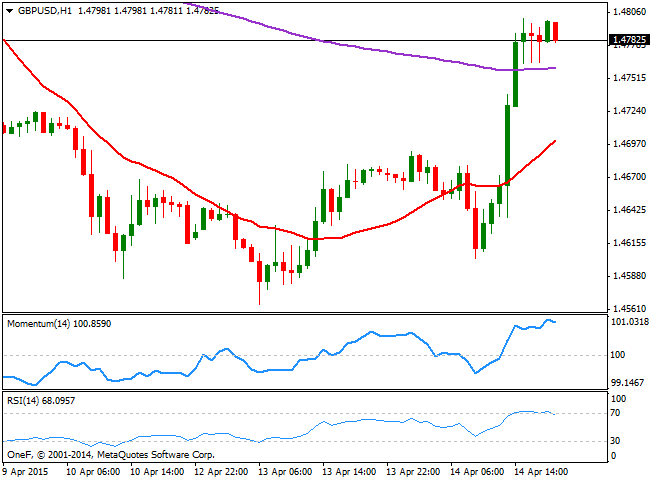

GBP/USD Current price: 1.4781

View Live Chart for the GBP/USD

The British Pound posted a strong come back on broad dollar weakness, advancing up to 1.4801 against its American rival. The GBP/USD posted a daily low of 1.4602 early in the European session, from where it slowly recovered following the release of the UK inflation for March that remain steady at a record low of 0.0%. Housing prices rose by 7.2% yearly basis, less than expected, whilst the output price index for goods produced by local manufacturers fell 1.7% in the year to March 2015. Technically, the short term picture favors the upside, as the pair consolidates near its daily high, whilst the price stands well above a bullish 20 SMA, currently around 1.4700, while the technical indicators are giving signs of exhaustion in overbought territory, but are far from signaling a probable short term retracement. In the 4 hours chart the technical indicators have lost the upward potential but remain well above their mid-lines, whilst the 20 SMA remains flat in the 1.4650 region.

Support levels: 1.4760 1.4725 1.4680

Resistance levels: 1.4805 1.4840 1.4875

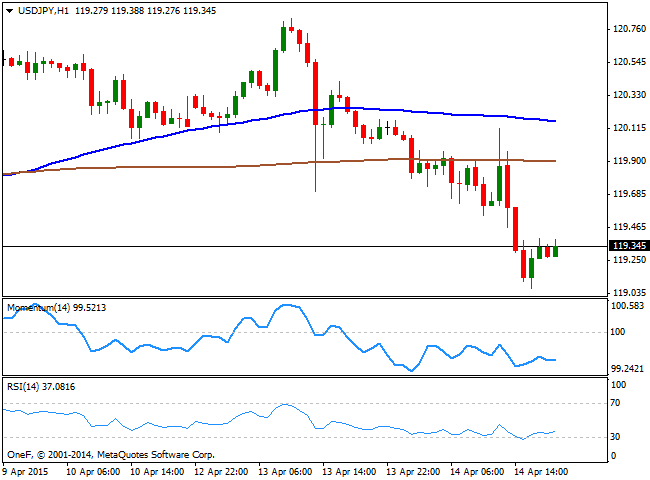

USD/JPY Current price: 119.34

View Live Chart for the USD/JPY

The Japanese strengthened against its American rival, with the USD/JPY falling down to 119.06 before posting a shallow bounce. The fall was triggered by weak data coming from the US alongside with IMF's downgrade of the country's outlook. Abe's advisor Hamada hit again the wires, trying to explain his yesterday's comments, and stating that 120.00 for the pair is an acceptable level, and that he referred to purchasing power parity, not spot price. But his words could not reverse the pair's bearish momentum. Technically, the downside is favored according to the 1 hour chart, as the price extended further below its moving averages, with the 200 SMA capping the upside around 119.90. In the same chart, the technical indicators stand well below their mid-lines, albeit directionless. In the 4 hours chart the price is also below its moving averages, whilst the technical indicators are losing their bearish potential near oversold readings, supporting the shorter term view.

Support levels: 118.90 118.50 118.15

Resistance levels: 119.45 119.90 120.20

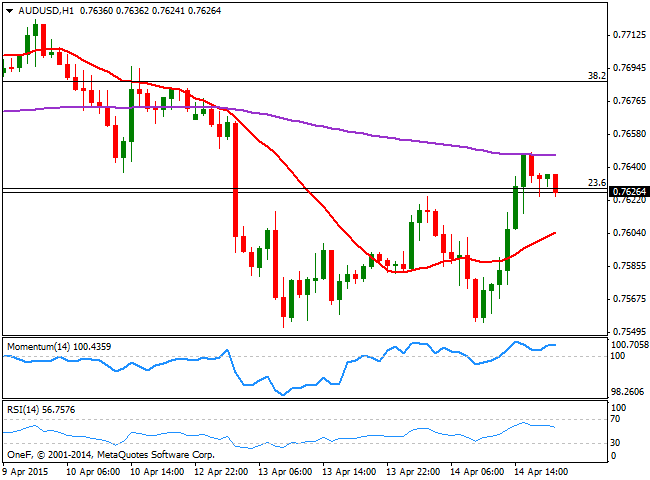

AUD/USD Current price: 0.7626

View Live Chart for the AUD/USD

The AUD/USD pair approached its weekly low of 0.7579 earlier in the European session, dragged lower by falling gold prices, albeit finally surged as the greenback got sold off. The pair is now retracing from a daily high set at 0.7648, maintaining a mild short term positive tone according to the 1 hour chart, where the technical indicators hover in positive territory, and the 20 SMA heads higher well below the current price, around the 0.7600 figure. In the 4 hours chart however, the price was unable to extend above a bearish 20 SMA, while the technical indicators are retracing from their mid-lines. The price is now struggling around the 23.6% retracement of its latest bearish run, which means that additional declines below the 0.7600 figure should put the pair back in the bearish track. The immediate resistance stands at 0.7660, with a recovery above it exposing the pair to a retest of the 0.7740 region, 50% retracement of the same rally.

Support levels: 0.7590 0.7550 0.7520

Resistance levels: 0.7660 0.7700 0.7740

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.