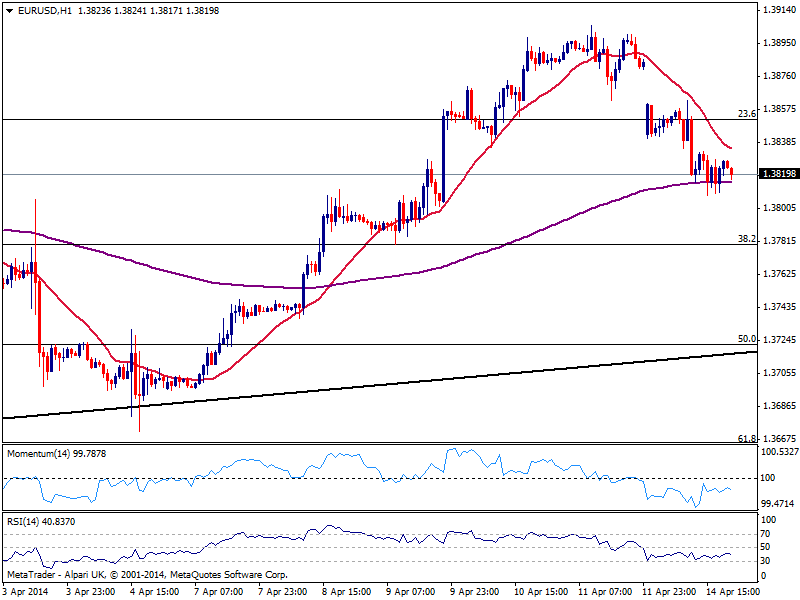

EUR/USD Current price: 1.3819

View Live Chart for the EUR/USD

EUR suffered this Monday trading near its daily low of 1.3807 ahead of Asian opening against the greenback. The pair has even left the weekly opening gap unfilled after the constant bombard of ECB officers all though the day supporting some QE. It’s yet to be seen if words will be backed by actions and how much more are investors willing to bend blindly on next month action. As for the short term, the EUR/USD presents a slightly bearish tone according to the hourly chart as indicators head lower in negative territory and 20 SMA continues to contain the upside. In the 4 hours chart the pair presents a limited bearish tone, as indicators aim now higher barely below their midlines: current bearish tone may face strong buying interest in the 1.3750/80 area, with bears taking control only with a break below 1.3720 support.

Support levels: 1.3810 1.3780 1.3750

Resistance levels: 1.3850 1.3890 1.3920

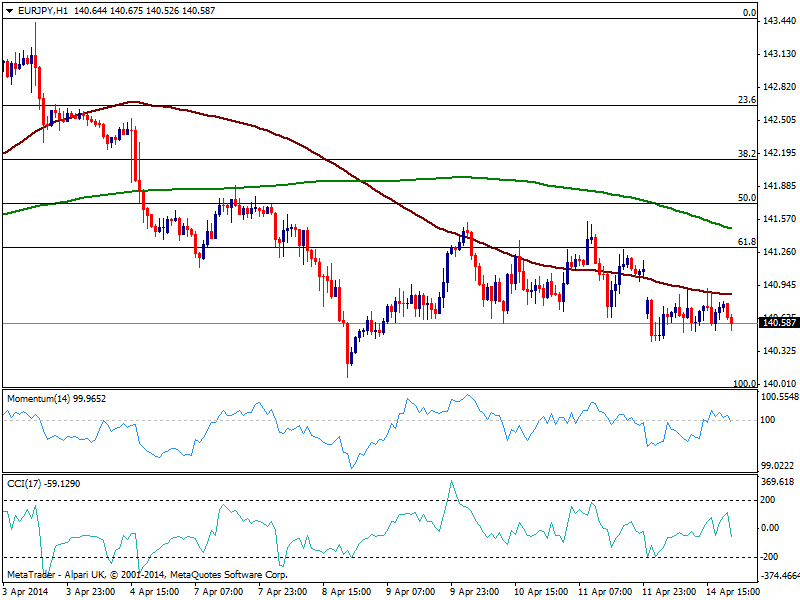

EUR/JPY Current price: 140.58

View Live Chart for the EUR/JPY

The EUR/JPY remained subdue on EUR weakness, with the pair trading in a tight range since early Asian opening. The hourly chart shows price remained limited below a bearish 100 SMA, while indicators are now turning south around their midlines. In the 4 hours chart indicators present a neutral stance, albeit the downside remains exposed with the daily chart showing current candle developing fully below its 100 DMA, now offering dynamic resistance around 141.00: as long as below the level, bulls had little chance today.

Support levels: 140.40 139.90 139.35

Resistance levels: 141.10 141.50 142.00

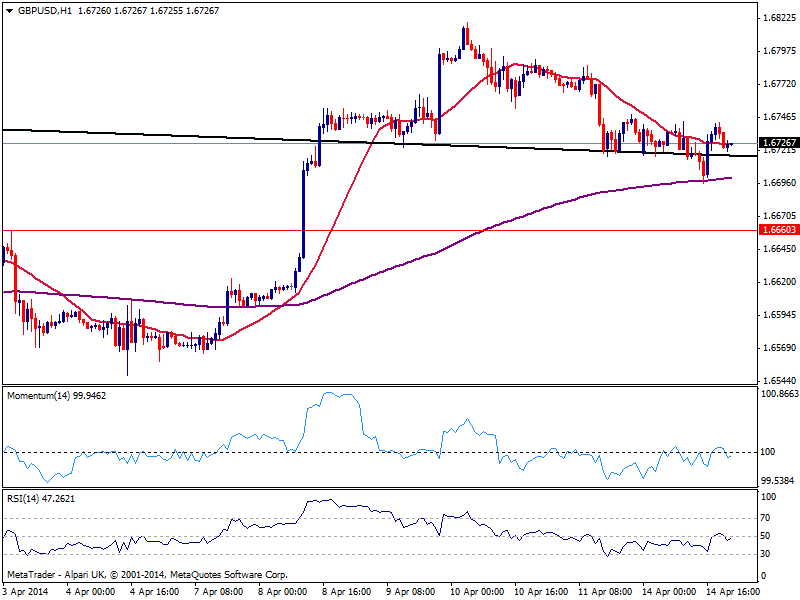

GBP/USD Current price: 1.6726

View Live Chart for the GBP/USD

The GBP/USD remained confined to a tight range for most of the day, finally unchanged right above 1.6720. A short term dip below 1.6700 triggered a quick bounce reflecting not enough selling interest at the time being. In the short term, the hourly chart shows price hovering back and forth around a flat 20 SMA while indicators stand in neutral territory; in the 4 hours chart indicators head higher near their midlines, erasing early bearish tone, reinforcing the short term view. Nevertheless, steady gains above 1.6750 are required to confirm further advances, while downside corrective movements can extend down to 1.6660 without really affecting the dominant bullish trend.

Support levels: 1.6695 1.6660 1.6625

Resistance levels: 1.6750 1.6785 1.6820

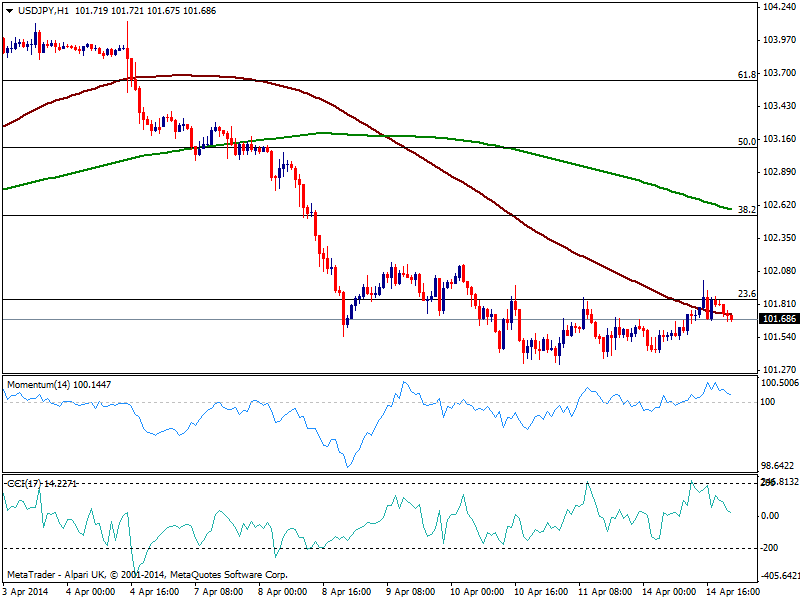

USD/JPY Current price: 101.68

View Live Chart for the USD/JPY

The USD/JPY erased its intraday gains triggered by positive US data, with the pair unable to advance beyond the 102.00 level. the hourly chart shows price now below its 100 SMA that maintains a strong bearish slope, while indicators aim lower in positive territory, showing neither much bearish strength. In the 4 hours chart indicators hold in neutral territory, yet as long as below the mentioned 102.00 mark, the downside remains favored towards a test of 101.20 price zone.

Support levels: 101.55 101.20 100.70

Resistance levels: 102.00 102.35 102.60

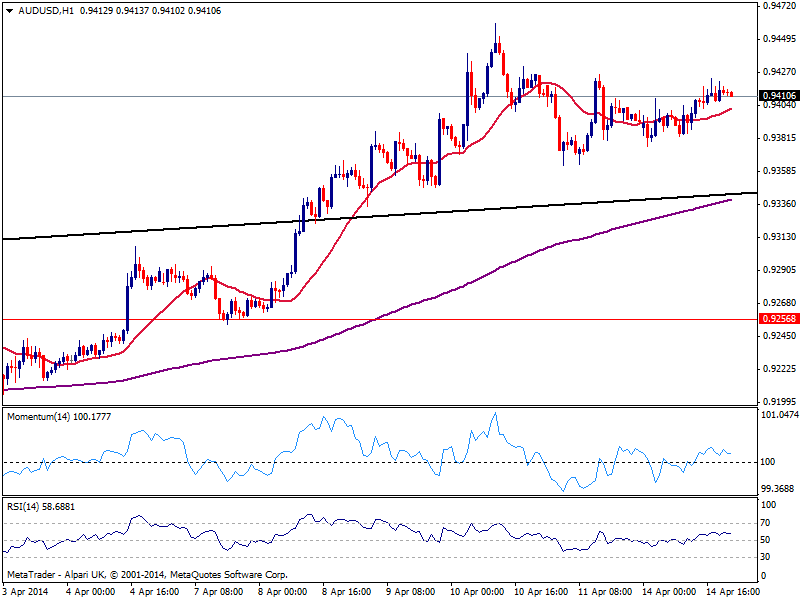

AUD/USD Current price: 0.9410

View Live Chart for the AUD/USD

With no changes in current US session, the AUD/USD holds to its shy intraday gains and consolidates above the 0.9410 price zone. Short term technical readings suggest the upside remains favored, while the 4 hours chart shows a quite neutral stance amid recent lack of momentum. Chinese data in today’s calendar will likely affect the pair, with dips down to 0.9360 area probably seen as buying opportunities.

Support levels: 0.9360 0.9320 0.9290

Resistance levels: 0.9445 0.9485 0.9530

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.