US equities turned positive on Wednesday after strong quarterly earnings by Morgan Stanley, Bank of America, and Procter & Gamble. The two banks published better-than-expected results, which were helped by the rising loan growth and investment banking revenues. P&G, on the other hand, reported strong revenues, helped by rising demand and prices. The company expects most of its costs will remain elevated in the first half of the year. The earnings season will continue later today, with the key companies to watch being Union Pacific, Fifth Third, Northern Trust, and Netflix.

The US dollar index retreated in the overnight session after the slight decline of bond yields. After soaring to a two-year high, the 10-year bond yield declined to 1.84% while the 30-year dropped to about 2.17%. The index declined even after relatively strong US housing starts and building permits data. The housing department said that housing starts rose from 1.678 million in November to 1.70 million. In the same period, the number of building permits increased from 1.71 million to 1.87 million. These numbers mean that the important housing sector is doing well.

The economic calendar will have some key events later today. Earlier on, the Australian Bureau of Statistics (ABS) reported strong jobs numbers. The country’s unemployment rate declined from 4.6% in November to 4.5% in December. Later today, Eurostat will publish the latest consumer inflation data. Economists expect the data to show that the headline CPI rose to 5.0% in December. These numbers will not have a major impact on the euro because, in most months, they are in line with the first estimate.

Elsewhere, the Turkish central bank will deliver its interest rate decision later today. Analysts expect that the bank will leave its main interest rate unchanged at 14.0%. The decision comes a day after the country received a $5 billion loan from the United Arab Emirates. Other key numbers to watch will be the American initial jobless claims and the Philadelphia Fed manufacturing index.

EUR/USD

The EURUSD pair crawled back during the American and Asian sessions. The pair is trading at 1.1335, which is slightly above the ascending trendline shown in yellow. It has also moved slightly below the important resistance at 1.1362. The pair is slightly below the 25-day moving average. It has also formed a small bearish flag pattern. Therefore, there is a possibility that it will have a bearish breakout later today.

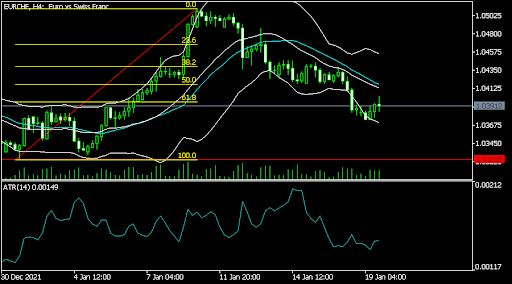

EUR/CHF

The EURCHF pair moved sideways in the overnight session. It is trading at 1.0395, which is a few points above yesterday’s low of 1.0373. On the four-hour chart, the pair has moved to the 61.8% Fibonacci retracement level. It is also between the lower and middle lines of the Bollinger Bands while the Average True Range (ATR) has been falling. Therefore, the pair will likely have a bearish breakout also.

XBR/USD

The XBRUSD pair continued its bullish trend ahead of the upcoming EIA inventories numbers. The pair is trading at 87.95, which is the highest it has been in seven years. It has moved above the 25-day and 50-day moving averages. Most importantly, it has risen above the key resistance level at 85.90, which was the highest level in October. Therefore, the pair will likely keep rising as investors eye 90.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

USD/JPY holds near 155.50 after Tokyo CPI inflation eases more than expected

USD/JPY is trading tightly just below the 156.00 handle, hugging multi-year highs as the Yen continues to deflate. The pair is trading into 30-plus year highs, and bullish momentum is targeting all-time record bids beyond 160.00, a price level the pair hasn’t reached since 1990.

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

FBI cautions against non-KYC Bitcoin and crypto money transmitting services as SEC goes after MetaMask

US FBI has issued a caution to Bitcoiners and cryptocurrency market enthusiasts, coming on the same day as when the US Securities and Exchange Commission is on the receiving end of a lawsuit, with a new player adding to the list of parties calling for the regulator to restrain its hand.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.