Cable slips below 1.28 on weak retail sales, traders hedge against the French election risks

Cable slipped below 1.2800, as the UK’s retail sales excluding auto fuel contracted by 1.5% on month to March. The FTSE’s intraday positive trend on cheaper pound. The FTSE 100 traded past 7130p after the release.

From a technical perspective, the GBPUSD is considered in a positive trend above 1.2600 (major 38.2% retracement on March – April rise). Intermediate support is eyed at 1.2765 (pivot) and 1.2717 (minor 23.6% retrace & 100-hour moving average). Put options are waiting at 1.2800 at today’s expiry, while call options trail above the 1.2850, if exercised, could give a positive spin to the pound against the US dollar for a weekly close above the 50-week moving average (1.2860).

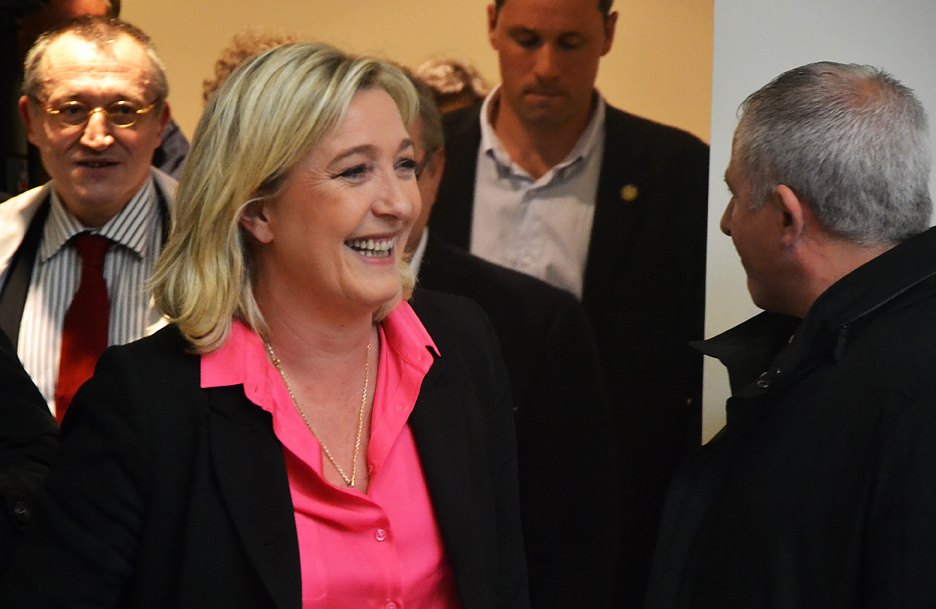

Paris attack, a ‘benediction’ for Le Pen’s populist campaign?

Thursday’s terrorist attack in Paris could butter Marine Le Pen’s bread just before the first round of the French presidential election due on Sunday, April 23rd.

According to the latest polls aggregated by Bloomberg, the independent candidate Emmanuel Macron has taken the lead with 23% chances of winning the first round, followed by Front-National’s Marine Le Pen (22%), the Republican François Fillon (20%) and the Socialist Jean-Luc Mélenchon (19%).

Could Thursday’s attack reshuffle the odds into Sunday’s decision?

The euro advanced versus the majority of its G10 peers, except the sterling, since Monday.

The EURUSD reversed gains yesterday, after trading at 1.0772 (major 61.8% retracement on March – April decline) and could further decline on speculations that the latest incident could help the anti-EU, anti-euro candidate Le Pen to receive more support on Sunday’s vote.

A final between Le Pen versus François Fillon or Emmanuel Macron is expected to be positive for the euro, given that she is given circa 60% chances of losing the second and the final round of the election. If however she paves her way to the Elysée Palace, the euro is widely expected to depreciate toward the parity or below against the US dollar.

From an intraday perspective, the Eurozone manufacturing and services PMI printed a stronger-than-expected preliminary performance in April. The ECB’s seasonally adjusted current account surged to 37.9 billion euros in February. The last month’s figure was revised up to €26.1 billion from €24.1 billion. The solid data escorted the EURUSD higher to 1.0738, yet traders sold off the pair as fast as they bought it.

In addition, the inflows to the Swiss franc and the yen hint at a rising anxiety. Downside risks prevail as traders could further trim their positions into France’s election week-end.

The EURJPY rebounded after hitting the 200-day moving average (117.90) on Thursday, as the EURCHF remained offered above its 100-day moving average (1.0705).

Still, the major move is not on the spot markets because of the risk of a relief rally on Monday, yet on the alternative markets. The need to hedge the downside risks on the euro without capping the upside potential, has mostly pushed investors toward the currency options through the week. The EURJPY and the EURCHF (25d) one-week risk reversals tanked to their lowest levels since June 2016.

VStoxx are pushed higher as well, as European stock traders hedge against the risk of price volatility into and following the first round.

Quick glance to Asia

Nikkei (+1.03%) and Topix (+1.07%) closed the week on a positive session, as the USDJPY advanced to 109.42 on broad based USD demand and the Bank of Japan (BoJ) Governor Kuroda’s warning that the policies unwinding the free-trade could bring the BoJ to continue its easy monetary policy until the 2% inflation target is hit.

The BoJ is expected to maintain the status quo at next week’s monetary policy meeting.

Light call expiries could reinforce the USDJPY’s recovery before the weekly closing bell. Yet, the downbeat EURJPY should cap the upside potential. Barriers are eyed at 110.00.

Chinese steelmakers were mixed on news that the US could limit steel imports from China, in line with Trump’s campaign promises.

Hang Seng (-0.13%) and Shanghai’s Composite (-0.27%) failed to build on earlier gains and turned negative in the afternoon session.

News on the US’ upcoming ‘major tax reforms’ revived Fed hike expectations

The US dollar and the US yields firmed after the US Treasury Secretary Mnuchin said that the ‘major tax reform’ will be revealed ‘very soon’. According to the latest news, US President Donald Trump is preparing to propose $200 billion infrastructure development plan that would leverage the private financing. This is less than $500 billion that he has hinted following his election last year, yet sufficient to keep the Federal Reserve (Fed) alert on the monetary policy side. Mnuchin also said he hopes that the tax reform will not ‘take till the end of the year’, adding that he is confident that the US’ debt ceiling would be raised accordingly to prevent a renewed risk of government shutdown.

The expectations of a June Fed rate hike rose to 56.7% from 43% earlier this week.

The Dow Jones rebounded by 174.22 points in New York yesterday. The Dow is called 20 points firmer at $20’598 at Friday’s open.

Gold swing between improved US yields and French election risks

Gold tested the bottom of the $1278 - $1295 range. In one hand, buyers dither on entering fresh long positions due to the current improvement in the US yields. On the other hand, the French political risks prevent many from walking away from the safe-haven gold, given that the recovery in yields remains only marginal.

Higher US yields could trigger a negative breakout and encourage a deeper downside correction to $1272 (minor 23.6% retracement on mid-March to mid-April rise). The key support to the weekly positive trend stands at a distant $1257 (major 38.2% retrace). On the opposite direction, tenser pre-election atmosphere in France and surprise geopolitical developments could trigger a positive breakout and push the price of an ounce to $1300 and above. The key mid-term resistance is eyed at $1315 (76.4% retracement on July to December 2016 decline).

Author

Ipek Ozkardeskaya

Swissquote Bank Ltd

Ipek Ozkardeskaya began her financial career in 2010 in the structured products desk of the Swiss Banque Cantonale Vaudoise. She worked in HSBC Private Bank in Geneva in relation to high and ultra-high-net-worth clients.