Bitcoin price falls below key support as sentiment wanes

The NZDUSD price rose on Friday even after New Zealand extended lockdown measures as the number of Covid cases rose. The country prolonged the lockdown until the end of August as the country recorded 70 new cases. The new cases mean that residents will need to stay inside household bubbles and can only leave home for essential reasons. As a result, the country’s strong recovery will likely see some weakness considering that many businesses have been forced to close. This month, the Reserve Bank of New Zealand (RBNZ) left interest rates unchanged and postponed its schedule to hike interest rates.

The EURUSD was in a tight range today as traders waited for a speech by Jerome Powell at the virtual Jackson Hole summit. This speech will be watched closely since the Federal Reserve will not hold a meeting this month. Also, some FOMC members have welcomed any moves to taper asset purchases. For example in a statement on Thursday, Fed’s Esther George said that the bank should start tapering soon. Meanwhile, data from Germany showed that import prices rose by 15%, the highest level in 40 years. Without energy, import prices rose by 9% in July, helped by metals, plastic, and wood products. Therefore, there are concerns that businesses will need to push some of these costs to consumers.

Global stocks rose slightly as investors waited for the speech by Powell and US personal consumption expenditure (PCE) data. In Europe, the DAX index rose by 0.10% while the FTSE 100 rose by 0.15%. The biggest news today is China planning to block IPO of data-heavy technology companies in the US. The report was first reported by the Wall Street Journal (WSJ), which quoted people familiar with the matter. This means that many of the biggest tech companies in the country like Bytedance will likely be barred from going public in the US. In another development, the country’s highest court took aim at companies that overworked employees. It aimed at the 996 rule, in which employees are supposed to work from 9am to 9pm six days a week.

EUR/USD

The EURUSD pair was little changed today. It is trading at 1.1760, which is slightly above this week’s low of 1.1680. On the daily chart, the pair has formed an M-pattern and is currently hovering near its lower part. It has also moved below the 25-day and 15-day moving averages and is slightly above the 38.2% Fibonacci retracement level. Therefore, a bearish breakout will be confirmed if the price moves below the support at 1.1760.

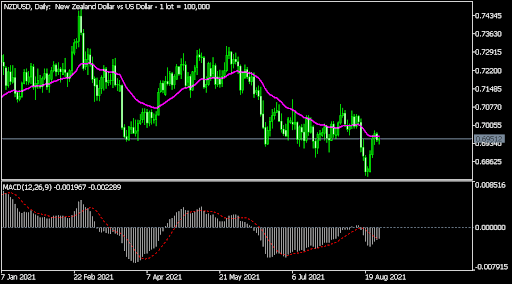

NZD/USD

The NZDUSD pair is trading at 0.6950. On the daily chart, this price is slightly below the key support at 0.6988. The current level is along the lowest level on March 26. The pair has also moved below the short and longer-term moving averages. The signal and histogram of the MACD have also moved below the neutral level. Therefore, the pair will likely end the week at the current level. A more bearish breakout will be confirmed if the price moves below 0.6988.

BTC/USD

The BTCUSD pair declined to a low of 46,259, which was the lowest level since last week. On the four-hour chart, the pair moved below the lower side of the rising wedge pattern. It also below the 25-day and 15-day moving averages while the MACD has moved below the neutral level. Therefore, the pair may keep falling as bears target the key support at 45,000.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.