AUD/USD Weekly Forecast: Fundamentals point the aussie lower

- COVID risk aversion resurfaces with rising cases and lockdowns in Europe.

- US statistics indicate stronger fourth quarter economic growth.

- RBA discounts the possibility of a rate hike in 2022.

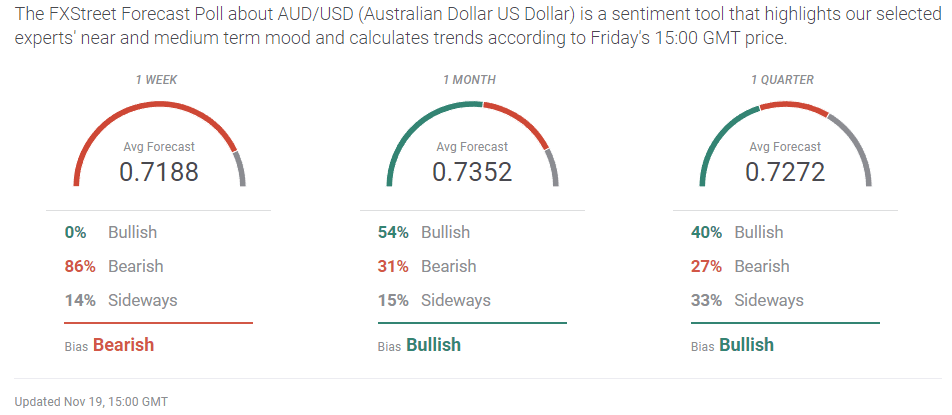

- FXStreet Forecast Poll expects the AUD/USD to rebound from the September low at 0.7174.

The AUD/USD lost ground for the third week in a row, pummeled by broad US dollar strength and a return of the COVID risk aversion trade. Austria instituted a partial lockdown and Germany contemplated a return to restrictions amid rising case counts that defy high vaccination rates in both countries.

A potential rate divergence surfaced with the US Federal Reserve moving towards rate hikes in 2022 and the Reserve Bank of Australia (RBA) expecting none. On Tuesday, RBA Governor Philip Lowe noted that "the economy and inflation would have to turn out very differently from our central scenario for the Board to consider an increase in interest rates next year."

Chinese property market woes continued with negative implications for the mainland and Australia’s resource based economy. The US rating agencies Moody’s and S&P expressed concern about the status of China Evergrande Group, with the latter considering a default “highly likely” at some point.

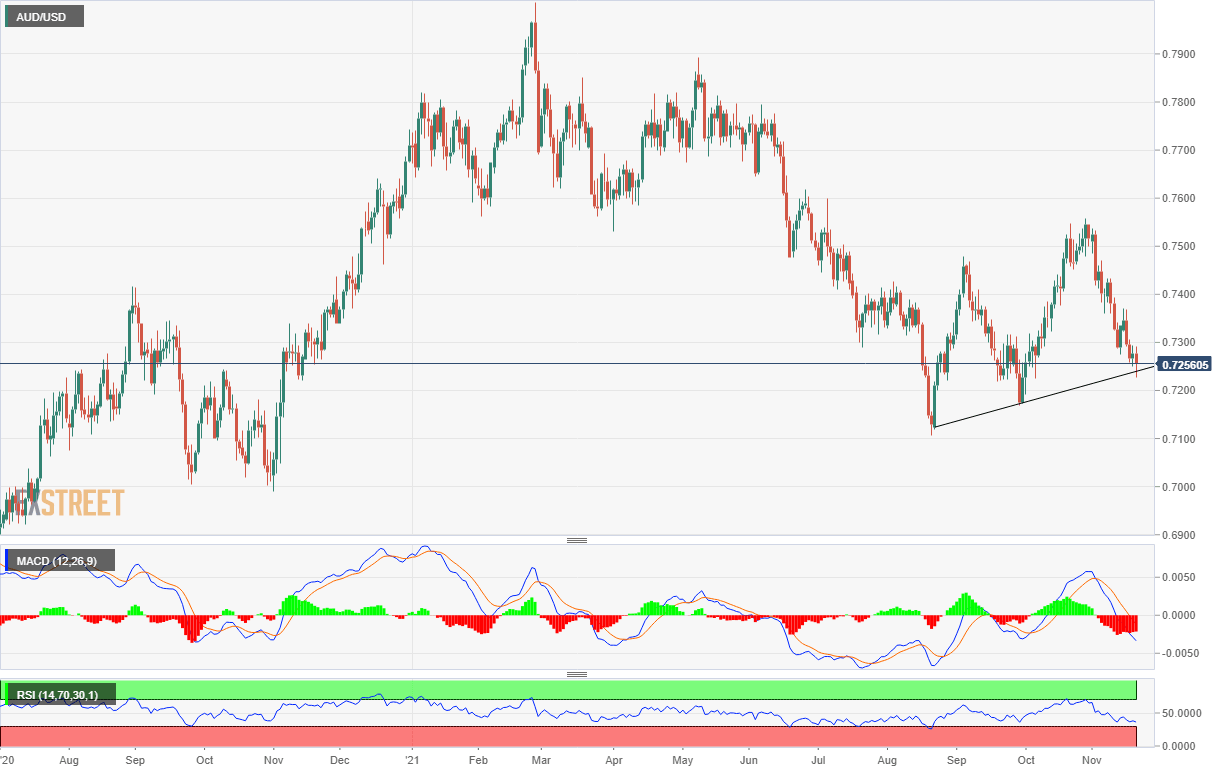

The AUD/USD fall was contained on Friday by the upward support line at 0.7240 that extends back to late August but the pair has lost 3.4% this month and 1.2% this week.

Australian economic information provided little this week to counter the strong results from the US.

The excellent US Retail Sales report combined with a Consumer Price Index (CPI) at its highest level since 1990, should keep the Fed on track to end its $120 billion bond buying program on schedule by June 2022. Evidence of a strengthening recovery may be sufficient for the Federal Open Market Committee (FOMC) to advance its taper timetable at the December 15 meeting.

AUD/USD outlook

Fundamental and technical factors do not favor the aussie. While higher US interest rates are mostly speculative, the Fed is officially behind ending its emergency interventions and has projected at least one fed funds hike. Meanwhile, Governor Lowe’s prediction weighs on the aussie.

The US economy appears to be accelerating in the fourth quarter after a weak 2% performance in the third. The Atlanta Fed GDPNow estimate for the final three months is currently running at 8.2%.

The US 10-year Treasury yield lost 4 basis points on Friday, largely on media notice that President Biden will announce the new Fed Chair this weekend. Current Chief Jerome Powell is considered the favorite but Governor Lael Brainard has been mentioned in the media as a long-shot. She is generally thought to be a bit more dovish hence the drop in Treasury rates.

With the AUD/USD resting on weak support, the 2021 low at 0.7130 from August should be in play with September’s bottom at 0.7174 an interim stop.

Australian Retail Sales for October due on Friday will not change the economic scenario.

American information is heavily loaded on Wednesday before the Thanksgiving holiday on Thursday. Durable Goods Orders for October should confirm the excellent Retail Sales release. The first revision to third quarter GDP may offer a slight improvement. Better results will support the dollar.

The bias in the AUD/USD is lower with scant support ahead of the year’s low.

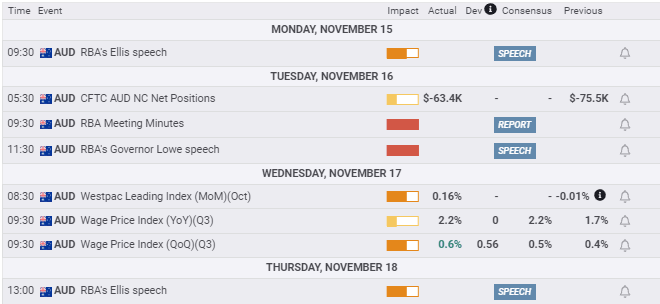

Australia statistics November 15–November 19

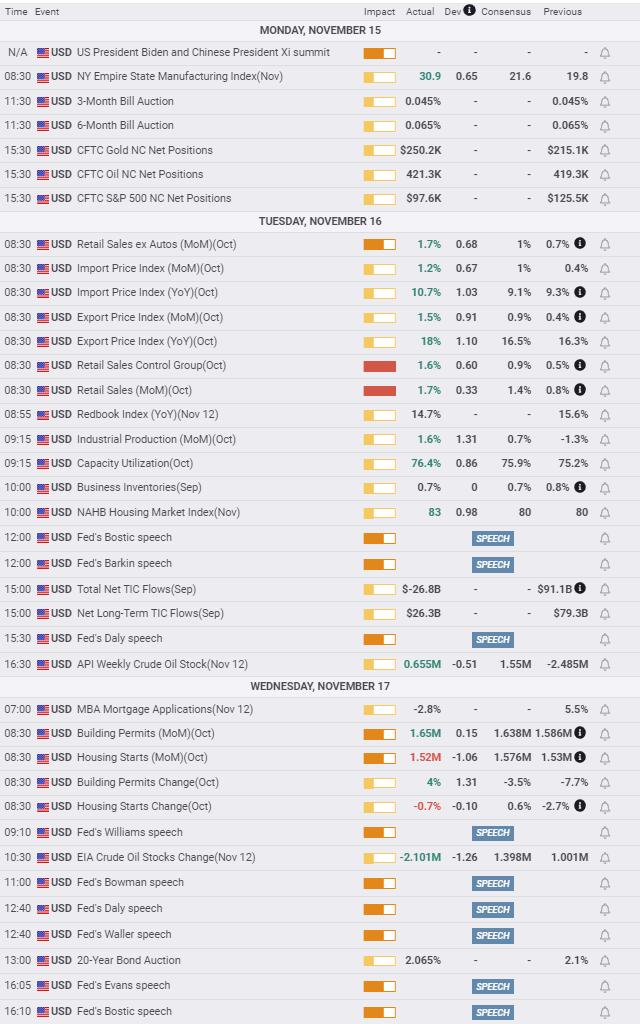

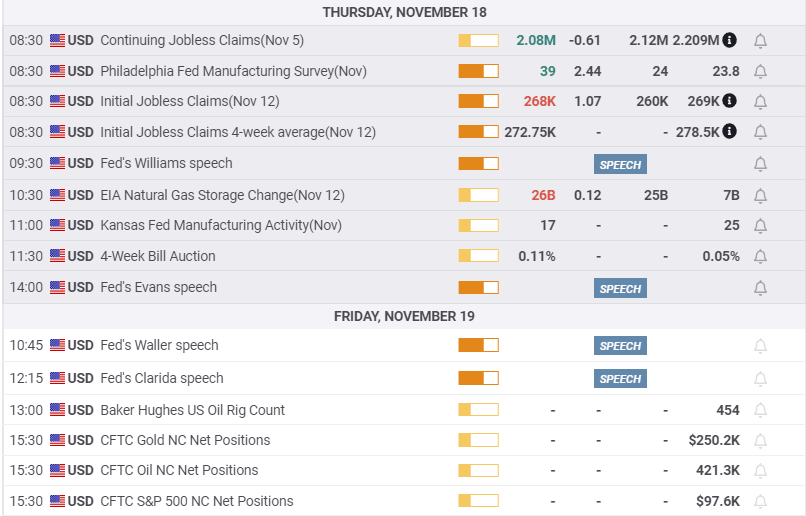

US statistics November 15–November 19

FXStreet

Australia statistics November 22–November 26

FXStreet

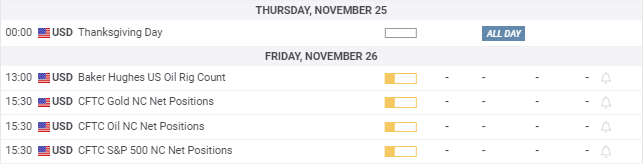

US statistics November 22–November 26

AUD/USD technical outlook

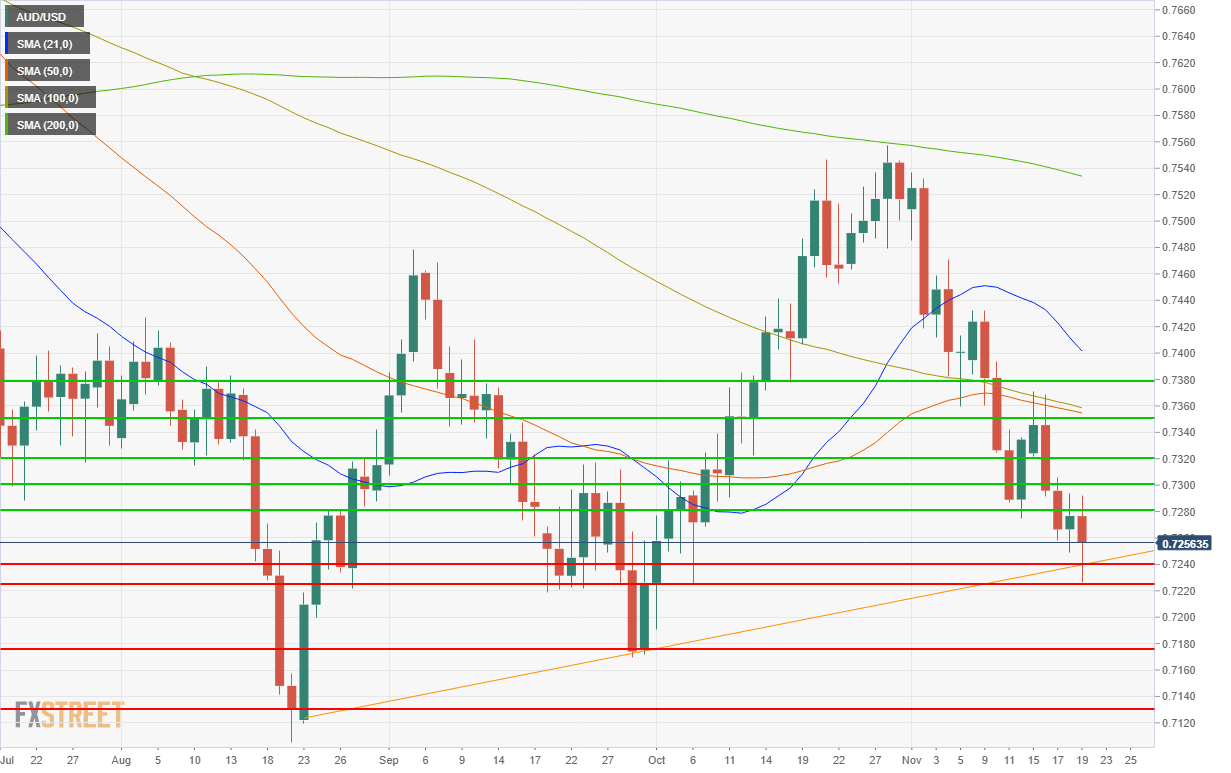

The MACD (Moving Average Convergence Divergence) cross of the signal line on November 2 remains the dominant technical condition. The steady differential between the two lines indicates a negative tendency. The Relative Strength Index (RSI) has moved lower since November 12 but has not entered oversold status suggesting there are more losses ahead.

The nearly conjoined 50-day moving average (MA) at 0.7354 and the 100-day MA at 0.7358 bracketed by resistance lines at 0.7350 and 0.7380 make a formidable 30 point band. The prevalence of resistance over support and the greater spacing beneath the Friday close indicate weakness to the September low at 0.7174 and the August and 2021 bottom at 0.7130.

Resistance: 0.7280, 0.7300, 0.7350 (0.7354 50-day MA, 0.7358 100-day MA), 0.7380

Support: 0.7240, 0.7225, 0.7175, 0.7130

FXStreet ForecastPoll

The FXStreet Forecast Poll is bearish but expects the September low at 0.7174 to hold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.