AUD/USD Outlook: Bearish break seems imminent, US Retail Sales awaited

- AUD/USD seesawed between tepid gains/minor losses on Thursday and ended on a flat note.

- A turnaround in the risk sentiment undermined the safe-haven USD and benefitted the aussie.

- Investors now look forward to the monthly US Retail Sales data for a fresh directional impetus.

The AUD/USD pair had some good two-way price moves on Thursday and was influenced by a combination of diverging forces. The US dollar built on the previous day's hotter-than-expected US CPI-inspired gains and climbed to one-week tops. This, in turn, was seen as a key factor that exerted some downward pressure and dragged the pair below the 0.7700 mark, or over one-week lows. However, a combination of factors kept a lid on any meaningful upside for the greenback and assisted the pair to attract some buying at lower levels.

A sharp pullback in the US Treasury bond yields held the USD bulls from placing aggressive bets. This, along with a positive turnaround in the equity markets, further acted as a headwind for the safe-haven buck. The pair recovered nearly 60 pips from sub-0.7700 levels, though lacked any strong follow-through. Upbeat US economic data helped limit the intraday USD slide and capped gains for the major. In fact, the number of Americans filing for unemployment insurance fell to a 14-month low of 473K during the week ending May 8.

Separately, the Producer Price Index rose 0.6% in April and 6.2% YoY, surpassing consensus estimates. Against the backdrop of a red-hot US CPI report this week, this pointed to a buildup of inflationary pressure in the US amid improving prospects for growth, plans for infrastructure spending and pandemic-related stimulus measures. That said, the data failed to shift the Fed's view that any spike in inflation will be temporary. The pair finally settled nearly unchanged for the day and remained confined in a range through the Asian session on Friday.

The market attention now shifts to the US monthly Retail Sales figures, due later during the early North American session. The report will be closely scrutinized for guidance on whether the upward pressure on prices will persist. This will play a key role in driving the Fed rate expectations and influence the near-term USD price dynamics. Apart from this, the broader market risk sentiment will contribute to producing some meaningful trading opportunities on the last day of the week.

Short-term technical outlook

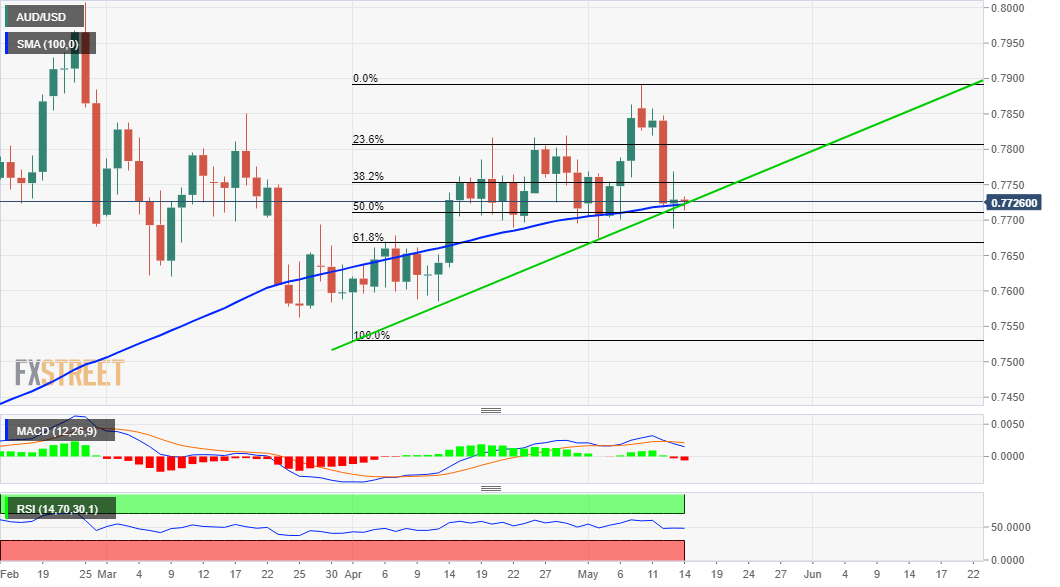

From a technical perspective, the overnight resilience below the 0.7700 mark and the subsequent rebound warrants some caution for bearish traders. This makes it prudent to wait for acceptance below the mentioned handle before positioning for an extension of this week's retracement slide from the 0.7890 area, or two-and-half-month tops.

Sustained breakthrough will also mark a bearish breakdown through confluence support – comprising of 100-day SMA, 50% Fibonacci level of the 0.7531-0.7890 positive move and an upward sloping trend-line. The latter, along with another ascending trend-line, constituted the formation of a bearish rising wedge pattern on the daily chart.

The pair might then weaken further below the 61.8% Fibo. level, around the 0.7670 region and accelerate the downfall towards testing the 0.7600 mark. Some follow-through selling below the 0.7575-70 region would expose YTD lows, around the 0.7530 region before the pair eventually drops to the key 0.7500 psychological mark.

On the flip side, the overnight swing highs, around the 0.7745 region, nearing the 38.2% Fibo. level now seems to act as an immediate strong hurdle. A sustained move beyond should allow bulls to aim back to reclaim the 0.7800 mark. The mentioned handle coincides with the 23.6% Fibo. level, which if cleared should pave the way for additional gains.

The next relevant target to the upside is pegged near the 0.7855 region, above which the pair seems all set to climb back to the 0.7900 mark. The momentum could further get extended towards the 0.7965-70 intermediate resistance before the pair eventually darts to conquer the key 0.8000 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.