AUD/USD Forecast: Next on the upside comes 0.6640

- AUD/USD extended its optimism beyond 0.6500.

- The selling pressure in the Dollar helped the pair.

- Further gains look likely above the 200-day SMA.

Thursday saw renewed selling interest in the US Dollar (USD), motivating AUD/USD to keep its weekly uptrend well in place and briefly surpassing the critical 200-day SMA around 0.6530.

Regarding the Greenback, sellers appeared back in the market after US Q1 GDP figures came in short of expectations and quarterly inflation prints ticked higher, reigniting speculation that the Federal Reserve (Fed) might keep its restrictive stance for longer.

Meanwhile, the daily advance in the Australian dollar was accompanied by further improvement in the risk complex as well as by the positive performance of copper and iron ore prices.

Regarding monetary policy, investors kept projecting a rate cut by the Reserve Bank of Australia (RBA) at some point in the latter part of the year, particularly after inflation figures published earlier in the week surprised to the upside. On this, market sentiment now implies a 90% likelihood of a 25 bps rate cut in 2024, compared to the approximately 50 bps of easing earlier this month.

Meanwhile, both the RBA and the Fed are expected to start their easing cycles later than the majority of their G10 peers.

With the Fed's resolute stance on tightening monetary policies and the potential for the RBA to commence an easing cycle later this year, the likelihood of sustained gains in AUD/USD is seen as limited for the time being.

Additionally, recent Chinese economic data hasn't strongly signalled a lasting recovery, which is necessary to underpin a significant rebound in the Australian dollar.

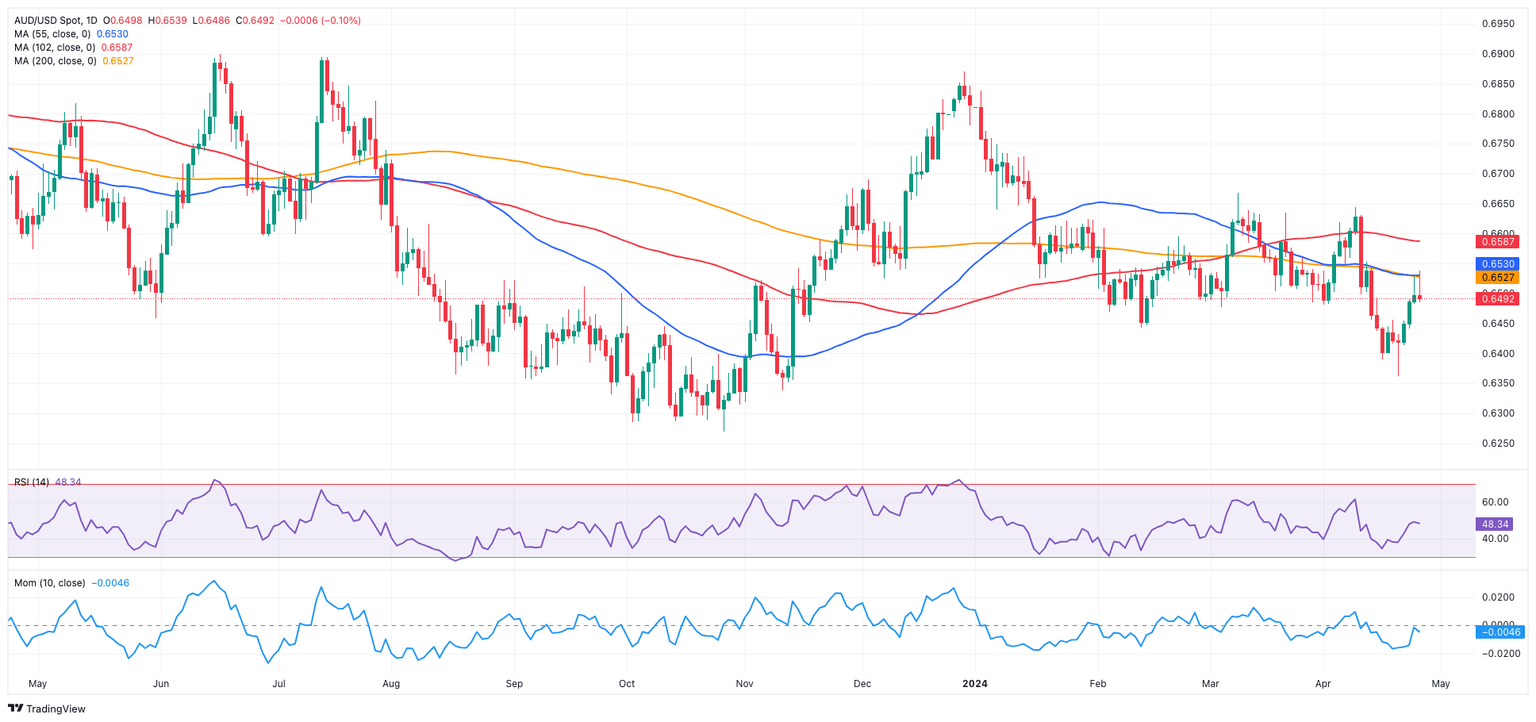

AUD/USD daily chart

AUD/USD short-term technical outlook

A further advance may see AUD/USD revisit the weekly top of 0.6538 (April 25), which appears bolstered by the key 200-day SMA of 0.6526. The trespass of this zone could open the door to a test of the April peak of 0.6644, followed by the March high of 0.6667 (March 8) and the December 2023 top of 0.6871. Further north, the July 2023 peak of 0.6894 (July 14) emerges ahead of the June 2023 peak of 0.6899 (June 16) and the critical 0.7000 level.

Meanwhile, if sellers seize control and the AUD/USD falls below its 2024 low of 0.6362 (April 19), spot might revert to its 2023 bottom of 0.6270 (October 26) before reaching the round milestone of 0.6200.

Looking at the larger picture, a sustained break above the crucial 200-day SMA would likely result in more gains.

On the 4-hour chart, the pair seems to have met some resistance around 0.6540-0.6530 band. However, the initial support level is the 55-SMA at 0.6451 prior to 0.6362, and 0.6338. On the upside, immediate barrier lines up at 0.6538 before 0.6552. In addition, the RSI rebounded past 60.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.