AUD/USD Forecast: Australian employment figures are already old news

AUD/USD Current Price: 0.6997

- Australia expected to have recovered 112.5K job positions in June, unemployment seen at 7.4%.

- Major pairs continue to move on sentiment instead than on data.

- AUD/USD bullish around 0.7000, needs to conquer the 0.7060 price zone.

Risk-appetite sent the AUD/USD pair to 0.7037, yet as it happens lately, the pair was unable to sustain gains above the 0.7000 threshold. The pair rallied despite July Westpac Consumer Confidence came in at -6.1%, falling from the previous 6.3%. Now trading just around the mentioned level, investors are waiting for June Australian employment data.

Expectations indicate that the country could have added 112.5K new jobs, after losing roughly 830K jobs in the previous two months, as a result of the ongoing pandemic. The unemployment rate is seen rising to 7.4% after jumping to 7.1% in the previous month and almost two-decade high. However, good news could be offset by the latest Melbourne lockdown, which means employment numbers will likely fall again in the upcoming months. Also, China will publish its Q2 GDP, foreseen at 9.6% from -9.8% in Q1. This last will also unveil June Retail Sales and Industrial Production, both seen recovering from negative levels.

AUD/USD short-term technical outlook

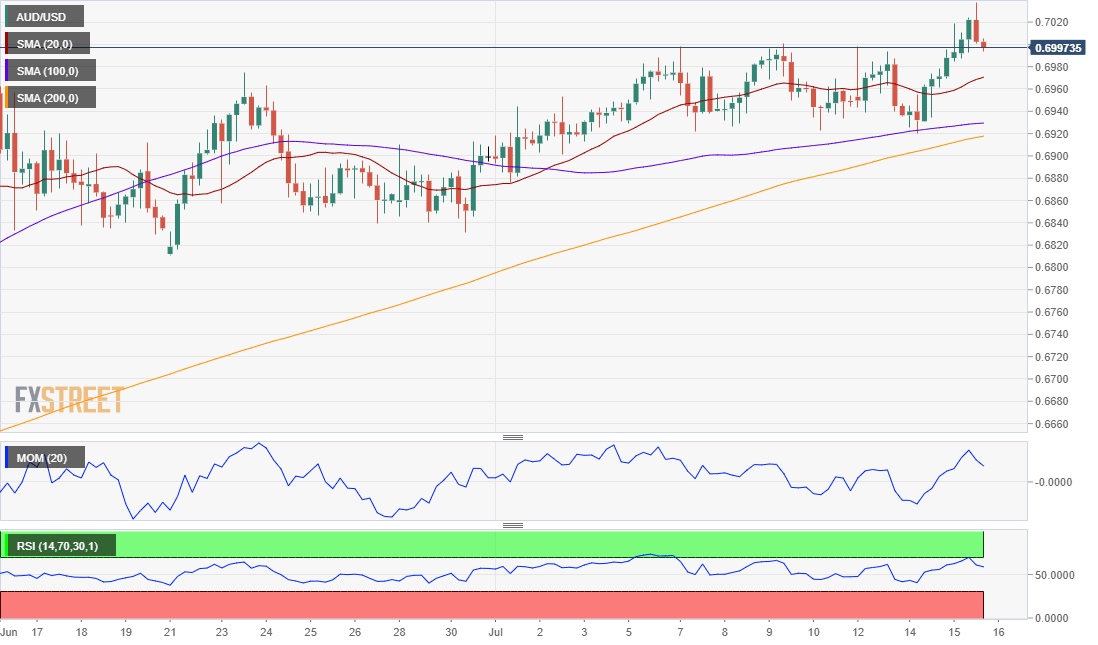

The AUD/USD pair is at the upper end of its latest range, but still far below the high set this year at 0.7063. The technical picture favors a bullish extension that could be triggered by data, although the pair needs to conquer the mentioned area to be able to extend its gains in the following sessions. The 4-hour chart shows that the price is comfortable well above all of its moving averages, with the 20 SMA heading modestly higher above the larger ones, as technical indicators consolidate above their midlines, reflecting absent selling interest.

Support levels: 0.6980 0.6940 0.6895

Resistance levels: 0.7025 0.7060 0.7100

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.