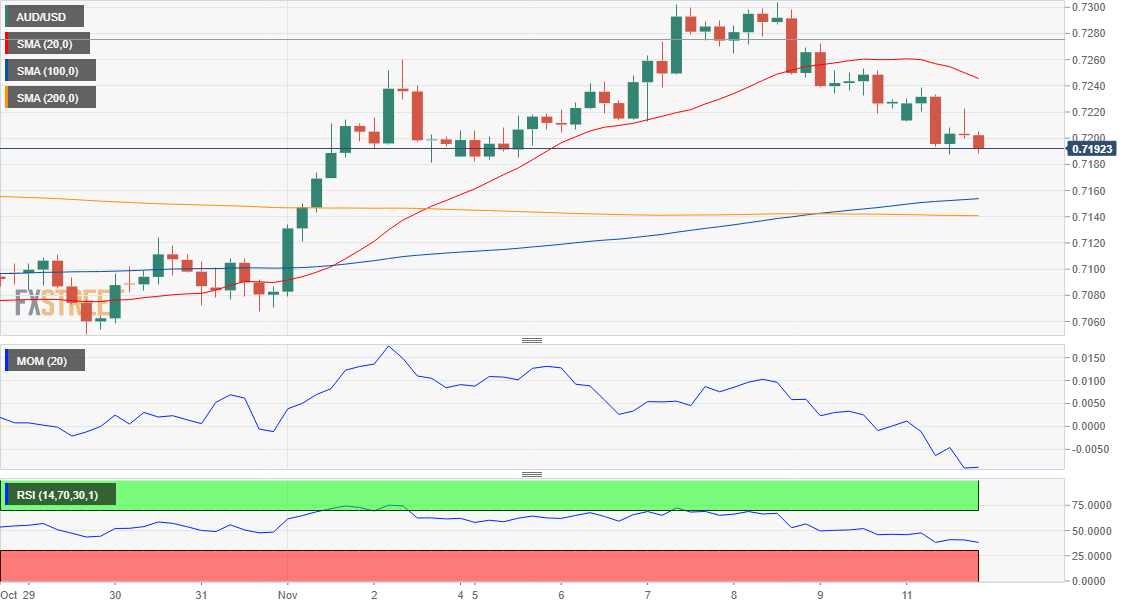

AUD/USD Current price: 0.7192

- Australian October NAB´s Business indexes to be out during the next Asian session.

- Aussie weighed by equities rout at the end of the end.

The AUD/USD pair settled a couple of pips above a 1-week low of 0.7187, a level achieved at the beginning of the day. The greenback opened the week strengthening against all its major rivals as European equities were in sell-off mode following weekend headlines, spurring concerns about a no-deal Brexit and the EU imposing sanctions to Italy over the 2019 budget. Despite a positive tone in Asian equities, the Aussie was unable to attract buyers. A modest intraday bounce came by the hand of headlines bringing some temporal Brexit hopes, but the pair resumed its decline as US equities collapsed. There were no news affecting the Australian currency at the beginning of the week, with the October NAB's Business Conditions and Business Confidence indexes scheduled for today, and some minor Chinese figures that won't affect the AUD.

The pair is currently trading near its daily low and below the 38.2% retracement of its October/November rally at 0.7195. The intraday attempt to recover ground met sellers around 0.7220, making of this last a relevant resistance for the upcoming hours. In the 4 hours chart, the 20 SMA gains downward strength well above the current level, while technical indicators maintain their strong bearish slopes, the Momentum at daily lows and the RSI at around 37, all of which leans the risk toward the downside. A strong static support comes at 0.7170, with a break below the level exposing the 0.7100 level. Above the mentioned 0.7220 level, on the other hand, the pair could retest the 0.7250 static resistance level, albeit there are no technical signs to support such recovery at the moment.

Support levels: 0.7170 0.7130 0.7100

Resistance levels: 0.7220 0.7250 0.7290

View Live Chart for the AUD/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.