It was all about USD/JPY on Friday as an overly long market started to book profits ahead of the traditional August holiday period. Copper prices fell heavily after inventory data out of China but this had little impact on currency markets. Equity and debt markets were very steady.

Japanese retail sales data is the only release of note on the economic calendar and this normally has little influence on the Yen. We can expect a fairly quiet session today ahead of some big risk events in Europe and the US later in the week.

USD/JPY fell below 98.00 earlier this morning in thin interbank trade as the market went chasing stops. This pair has fallen quite sharply from 100.25 and we should expect support levels to be very firm below 97.50 through 97.00. Volatility is likely to stay high and this pair looks like the perfect vehicle for day traders.

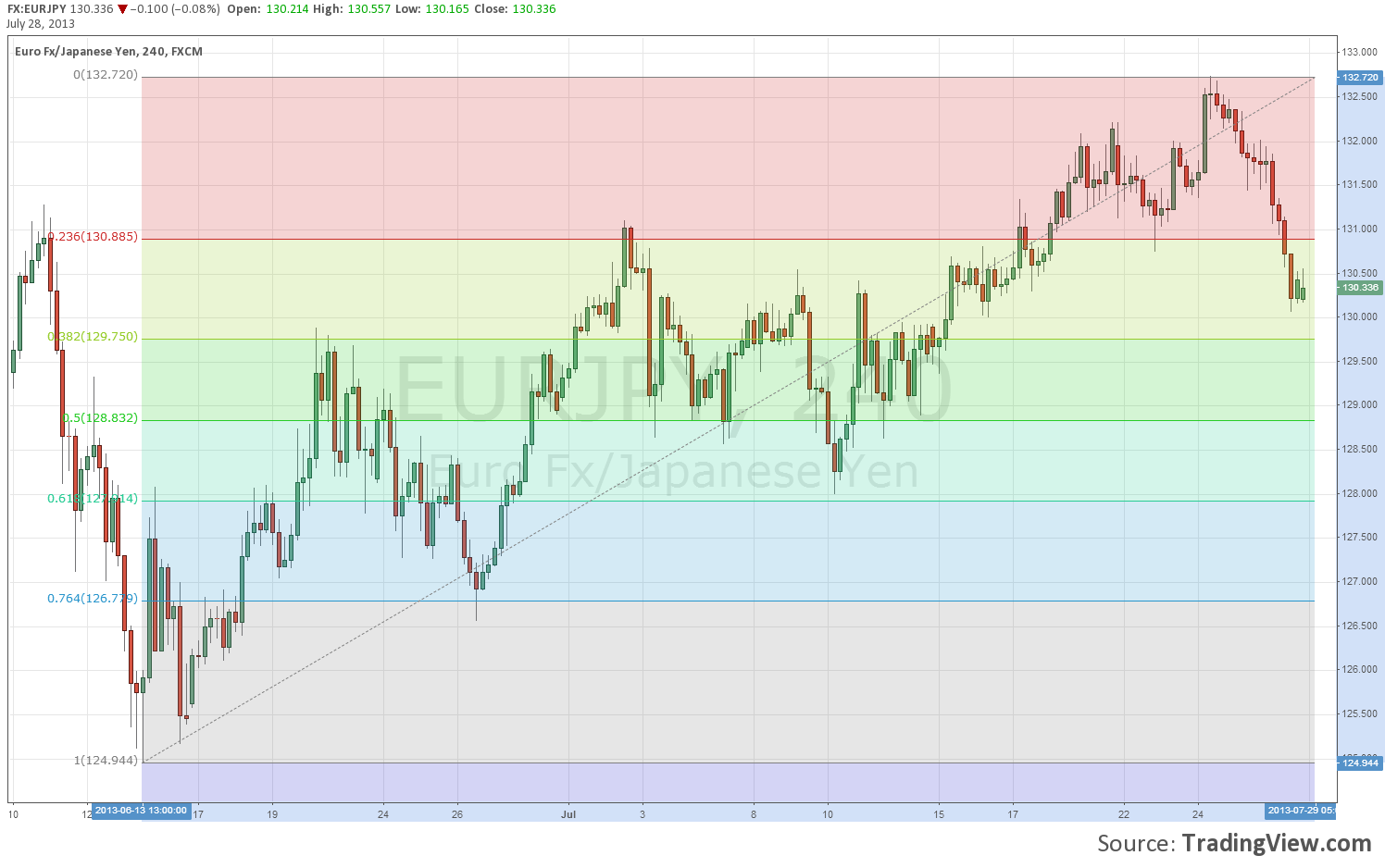

EUR/JPY will find technical support near 129.75 with resistance levels now starting at 130.75.

AUD/JPY still looks to be in sideways consolidation between 90.00/93.50 so play the edges of this range.

AUD/USD is trying to form short-term support now near .9230 and the bulls will try to build a base for an attack on important medium-term resistance levels .9330/50. Stops are reportedly quite large above .9350 and the fact that the AUD didn’t react to the lower copper prices does suggest that the bears are getting tired.

EUR/USD is chopping sideways between 1.3250/1.3300, with short-term USD buying being balanced by EUR selling on the crosses. The medium term target here is 1.3400/20 and only a clean break above there will alter the range-trading mode.

EUR/GBP looks mildly bullish whilst above .8550 but EUR/CHF is grinding lower again and frustrating the many CHF bears.

Good luck today.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.