The AUD has been on the sidelines over the last few days with the market’s focus elsewhere. AUD/USD has traded in pretty tight 50 pip ranges but that might change today when we get the jobs data. There is very large selling interest near 1.0600 and stops immediately above 1.0605, so these levels are certain to keep dealers nervous.

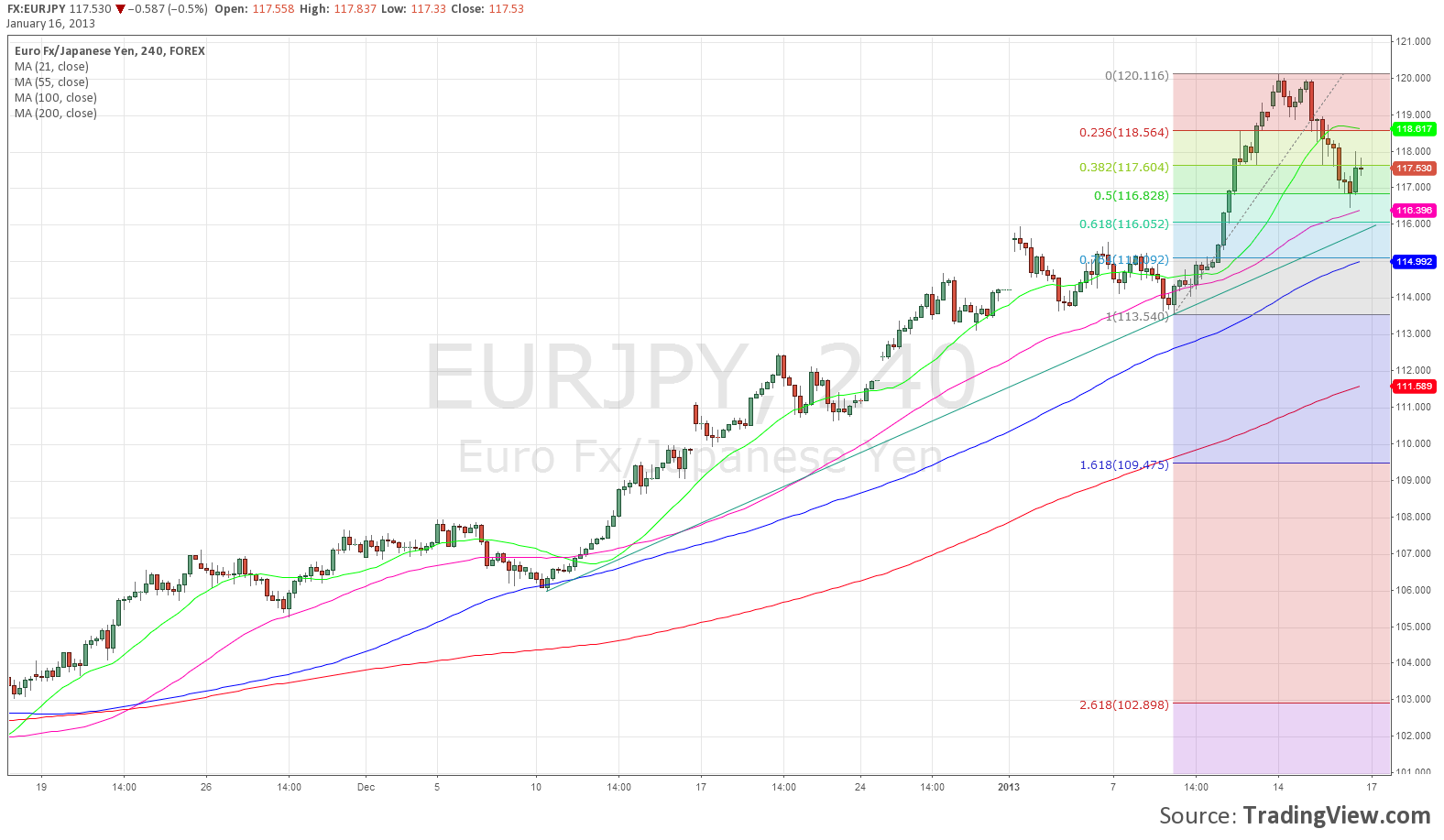

EUR/JPY looks like it wants to test a 61.8% retracement level at 116.05 (see chart) and that is the bears most immediate target. With an interim top in place at 120.00, any rallies towards that level will attract plenty of profit takers. I’d play as close to the edges of this range as possible, with a bullish bias in line with the recent dominant trend.

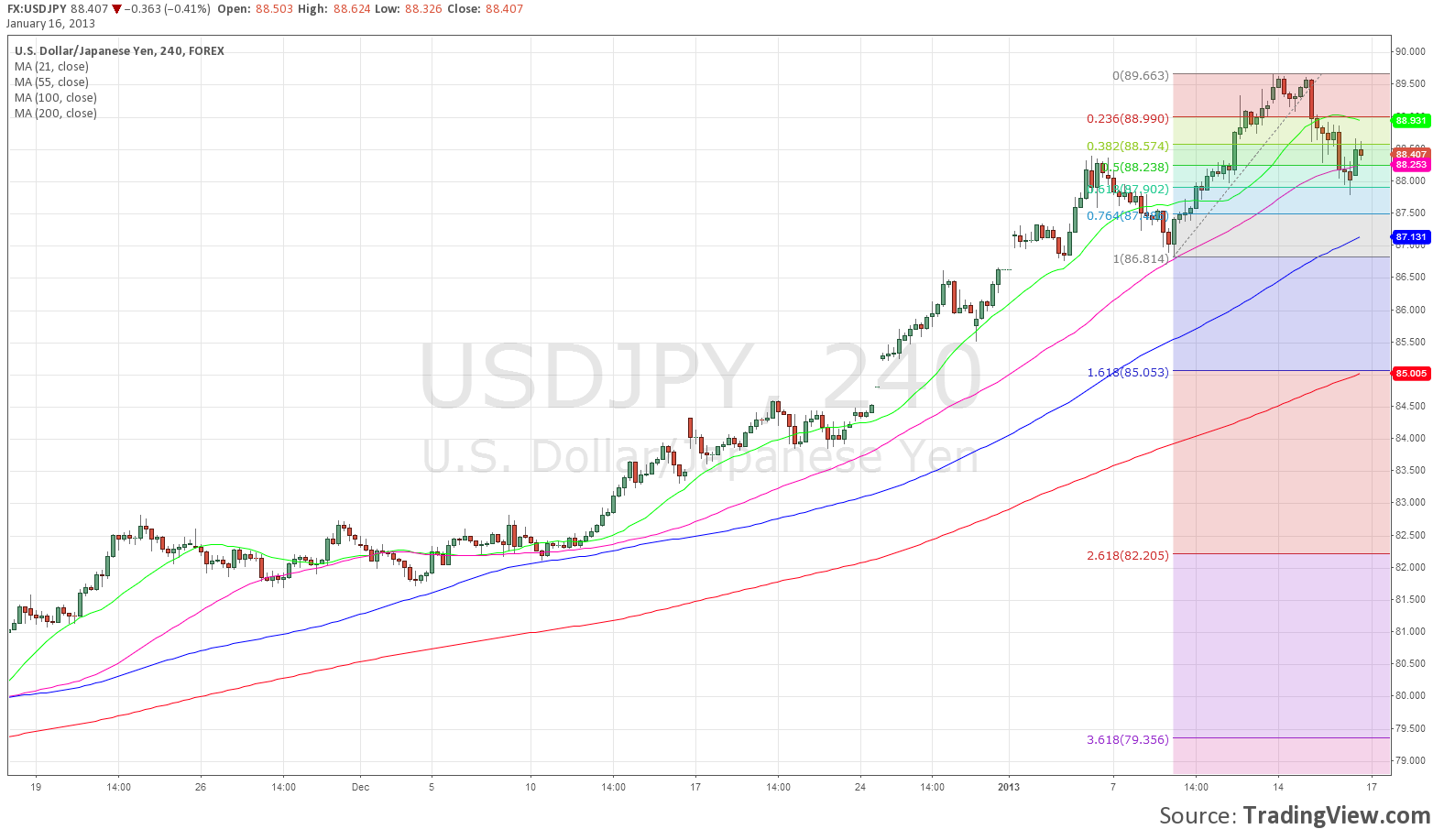

USD/JPY is also in consolidation mode and it may well be that we fit into an extended 85/90 range just as the Japanese officials are calling for. The 4-hour chart is still overbought (see chart) but starting to ease and I prefer a period of range trading here, possibly 88.00/89.50 in the short-term.

EUR/USD is being totally dominated by flows in the crosses, falling yesterday when EUR/JPY profit-taking emerged but then bouncing when EUR/GBP and EUR/CHF dip-buyers emerged. I very much expect this trend to continue for the next few sessions. Sovereign and real-money buyers are reported at 1.3250/60 with plenty of trailing stops now below 1.3240.

Cable fell in early European trade on heavy GBP/CHF flows and there is talk of large orders on the 1.59 handle, with buyers at 1.5930/45 and stops below 1.5900.

EUR/CHF is still being magnetically drawn towards massive optionality at 1.2500 in my opinion.

Good luck today.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.