Gold Price Forecast: XAU/USD buyers not ready to give up yet

- Gold price bounces early Friday after correcting from five-week highs of $2,726 on Thursday.

- Hot US PPI data boost hawkish December Fed rate cut bets, propping up the US Dollar, Treasury bond yields.

- Gold price looks to regain $2,700 and beyond as the daily RSI stays bullish and the 50-day SMA holds.

Gold's price looks to resume this week’s recovery to monthly highs of $2,726 early Friday, following Wednesday’s brief aberration. The US Dollar (USD) consolidates recent gains alongside the US Treasury bond yields amid a relatively light economic calendar heading into the weekend.

Gold price gears up for pre-Fed repositioning

Expectations of a hawkish US Federal Reserve (Fed) interest rate next week fuelled a fresh leg higher in the US Dollar and the US Treasury bond yields on Wednesday, unfolding a corrective decline in Gold price from multi-month highs.

Markets now believe that the Fed could send a hawkish message by signalling a pause in January following the expected 25 basis points (bps) rate cut at its December 17-18 policy meeting, especially after the US Producer Price Index (PPI) data came in hotter-than-expected.

The annual PPI rose 3.0% in November, above the market expectation of a 2.6% growth. Meanwhile, the annual core PPI rose 3.4% in the same period, surpassing the estimate of 3.2%. The monthly PPI and the core PPI rose 0.4% and 0.2%, respectively. Markets are fully pricing in a 25 bps rate cut by the Fed next week, the CME Group’s FedWatch Tool shows.

Meanwhile, the USD also drew support from a EUR/USD sell-off in the face of a dovish rate cut delivered by the European Central Bank (ECB). Additionally, rallying US Treasury bond yields on solid bond auctions this week underpinned the sentiment around the Greenback while capping the Gold price uptrend.

In Friday’s trading so far, Gold price is finding fresh demand as China’s stimulus optimism fades on increasing worries over the US-Sino trade war. In a gated story, the Wall Street Journal (WSJ) reported that China has already begun retaliating to the upcoming US President-elect Donald Trump’s tariffs by deploying non-tariff measures. “China launched a regulatory probe into Nvidia, threatened to blacklist an American apparel maker, blocked the export of critical minerals to the US and squeezed the supply chain for drones,” the WSJ said.

Markets will continue to take cues from broader market sentiment without any top-tier US economic data releases later in the day. The end-of-the-week flows and repositioning ahead of next week’s Fed policy decision will also play their part in driving Gold price.

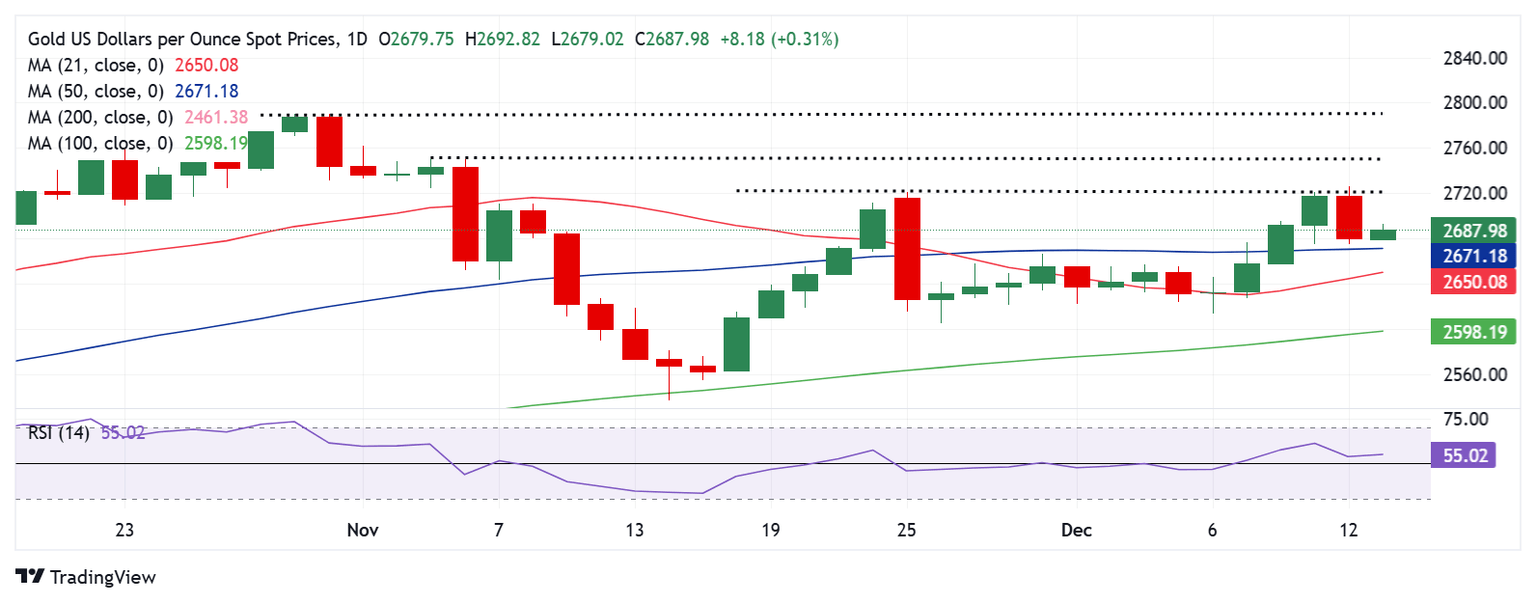

Gold price technical analysis: Daily chart

Gold price faced rejection at higher levels on Thursday and turned south before finding support at the 50-day Simple Moving Average (SMA) at $2,671 early Friday.

The 14-day Relative Strength Index (RSI) has also witnessed a renewed upside while holding well above the 50 level.

If Gold price resumes the recovery momentum, it could retest the multi-week high of $2,726, above which 2,750, the confluence of the psychological barrier and the November 5 high, will act as a tough nut to crack.

A failure to defend the 50-day SMA support at $2,671 on a daily candlestick closing basis will prompt sellers to target the 21-day SMA at $2,650 once again.

The last line of defence for Gold buyers is seen at the previous week’s low of $2,613.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.