When are the UK CPIs and how could they affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for October month is due early on Wednesday at 07:00 GMT. The key inflation data will join the current Brexit drama and the coronavirus (COVID-19) headlines to entertain the GBP/USD traders. The price economics gain more importance ahead of BOE Governor Andrew Bailey’s speech, scheduled for release at 16:30 GMT.

The headline CPI inflation is expected to recover from 0.5% prior to 0.6% on an annual basis. The Core CPI that excludes volatile food and energy items is likely to remain unchanged at 1.3% YoY. Talking about the monthly figures, the CPI bears the pessimistic consensus of -0.1% versus +0.4% prior.

In this regard, analysts at TD Securities said,

We look for core CPI to slip to 1.1% y/y in October (marker forecasts 1.3%), as general economic weakness weighs on inflationary pressures. Plus, with the growth in the share of online shopping this year, Amazon Prime Day shifting from July to October may have had an outsized effect. We look for headline CPI to come in at 0.4% y/y (expectations 0.5%), with some downward pressure from the OFGEM price review and reduction in electricity prices.

Deviation impact on GBP/USD

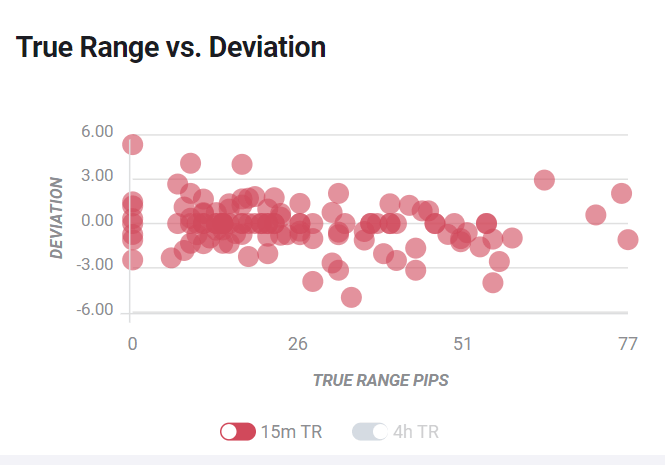

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed, the initial market reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3. The same suggests the importance of the key inflation data for GBP/USD pair traders.

How could it affect GBP/USD?

By the press time of pre-London open on Wednesday, GBP/USD cheers the broad US dollar weakness, coupled with the hopes of a UK-EU trade deal by early next week, to mark 0.07% intraday gains while picking up the bids near 1.3260.

Although recent updates suggesting France’s easing stand on the fisheries demand remove one more hurdle for a Brexit deal, there are many other points where the ex-neighbors, namely the European Union (EU) and the UK, don’t agree. Hence, the Brexit optimism may fade and can join the latest covid-19 resurgence-led woes to weigh on the quote. Downbeat inflation numbers, if matched forecast, may exert additional pressure on the GBP/USD pair.

Technically, a joint of 10-day SMA and an ascending trend line from November 02, currently around 1.3195, becomes the key for GBP/USD traders to watch.

Key notes

GBP/USD Forecast: Brexit hopes underpin the pound

GBP/USD Price Analysis: Buyers stay hopeful above 1.3195 support confluence

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.