GBP/USD Forecast: Brexit hopes underpin the pound

GBP/USD Current price: 1.3258

- Market rumors suggest that a trade deal could be announced in the next few days.

- The United Kingdom will publish its October inflation data this Wednesday.

- GBP/USD could extend its advance beyond 1.3315 but depends on Brexit progress.

The GBP/USD pair got boosted by market talks hinting a trade deal between the UK and the EU might be around the corner. The pair hit a daily high of 1.3272, now trading in the 1.3250 price zone, further underpinned by the broad dollar’s weakness. Trade talks have resumed in Brussels, and the encouraging headlines over a breakthrough were partially overshadowed by the potential failure of negotiations, as the two sides are still away on key points. Ireland Prime Minister Micheal Martin said that the UK economy is not prepared for a no-deal Brexit.

This Wednesday, the UK is set to publish October inflation figures. The annual CPI is foreseen at 0.6% in October, after printing 0.5% in September. The monthly inflation, however, is expected to have fallen by 0.1%. Additionally, BOE’s Governor Andrew Bailey is scheduled to speak in a public event.

GBP/USD short-term technical outlook

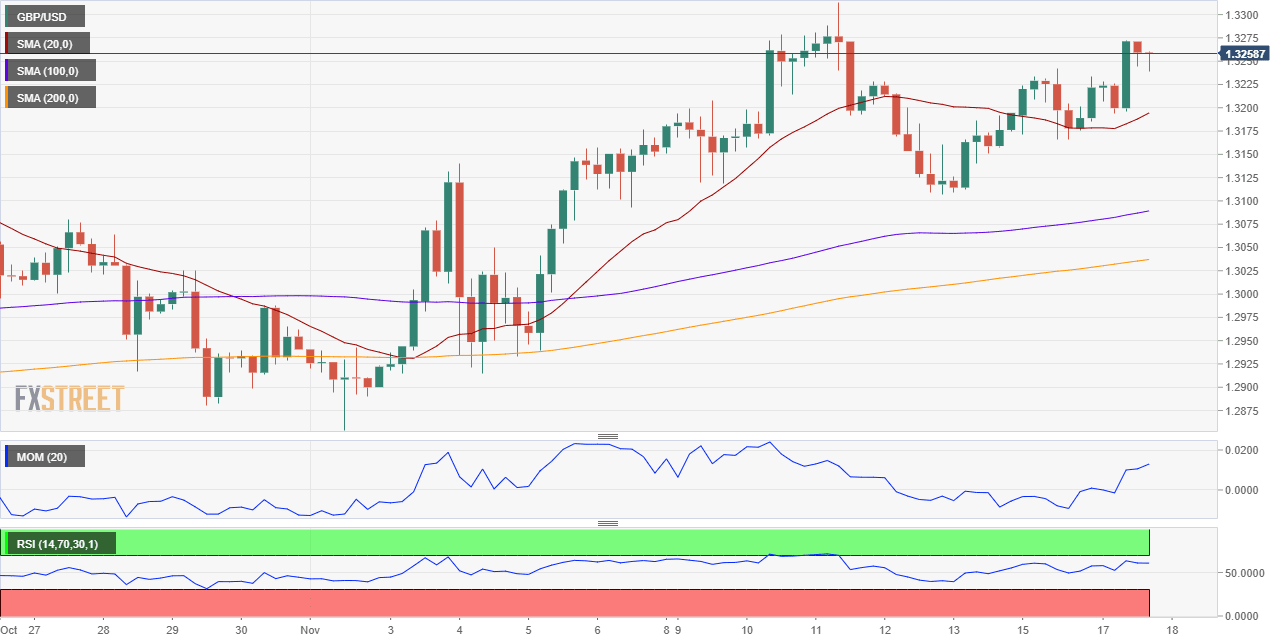

The GBP/USD pair has room to extend its advance, according to intraday technical readings. The 4-hour chart shows that technical indicators retreated from near overbought levels, but they remain well above their midlines, without clear directional strength. The 20 SMA aims modestly higher around 1.3190, while the larger ones maintain their bullish slopes below it. A substantial advance will be more likely on a break above 1.3313 this month´s high.

Support levels: 1.3210 1.3165 1.3120

Resistance levels: 1.3275 1.3320 1.3360

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.