Wake Up Wall Street (SPY) (QQQ): Is this rally running out of fuel?

Here is what you need to know on Thursday, August 11:

Equities

Looks like the rally may be finally running out of steam as gains are harder to come by this morning. No surprise as the Nasdaq is up over 20% from its low. People are streaming but not dating if the latest results from Disney (DIS) and Bumble (BMBL) are to be believed. SPY rallied above the key $415 resistance area, and now things get harder with more volume up here. Futures are up slightly across the board with the Nasdaq Composite and S&P 500 up half a percentage point. The Fed might get more concerned the more this equity rate continues and sent a few hawkish missives out on Wednesday. Thus far they have been ignored as the holiday lull sees lower volumes helping support risk.

Oil

The whipsaw from the CPI print continues, but overall probably bullish. Gasoline demand appears to have rebounded last week during the driving season, helping the short-term rally. The IEA is also out saying that 2023 oil demand will rise by 2.1 million barrels per day to surpass 2019 levels. This goes against some bearish bets on a global slowdown in oil demand.

Fixed Income

Yields remain subdued and at prior levels, which should help support recent equity bullishness. The US yields are all lower this morning in Europe with the 2-year at 3.15% and the 10-year now down to 2.73%. MOVE volatility also falls as investors exit for the holiday season, and Fed funds futures prices 50/50 on a 75 or 50 bps rate hike in September.

FX

The dollar remains under pressure as the continued positioning correction from early summer is continued. The CPI print is naturally not dollar supportive, and the dollar index is down to 104.80 now. The USD/JPY is down six handles in the last two weeks!

Bitcoin and Gold

Bitcoin continues to benefit from risk and trades up to $24,700, while Gold is steady at $1,797.

European markets are mixed: Eurostoxx +0.2%, FTSE -0.6% and Dax +0.2%.

US futures are higher: S&P +0.6%, Nasdaq same and Dow +0.5%

Wall Street top news (QQQ) (SPY)

IEA says oil demand to surpass pre-covid levels in 2023.

Sonos (SONO) is down on weak earnings.

Six Flags (SIX) misses earnings, stock falls sharply.

Canada Goose (GOOS) revenue ahead of forecasts, EPS in line.

Utz Brands (UTZ) up 7% on strong earnings.

Disney (DIS) soars on strong earnings from streaming, price increases and advertising model.

Bumble (BMBL) misses on earnings.

Dutch Bros (BROS) opens 600th store.

Dillards (DDS) up on strong earnings.

Hannesbrands (HBI) down on earnings miss.

Coinbase (COIN) up as Goldman raises price target.

AMC Chief Accounting Officer sells some stock.

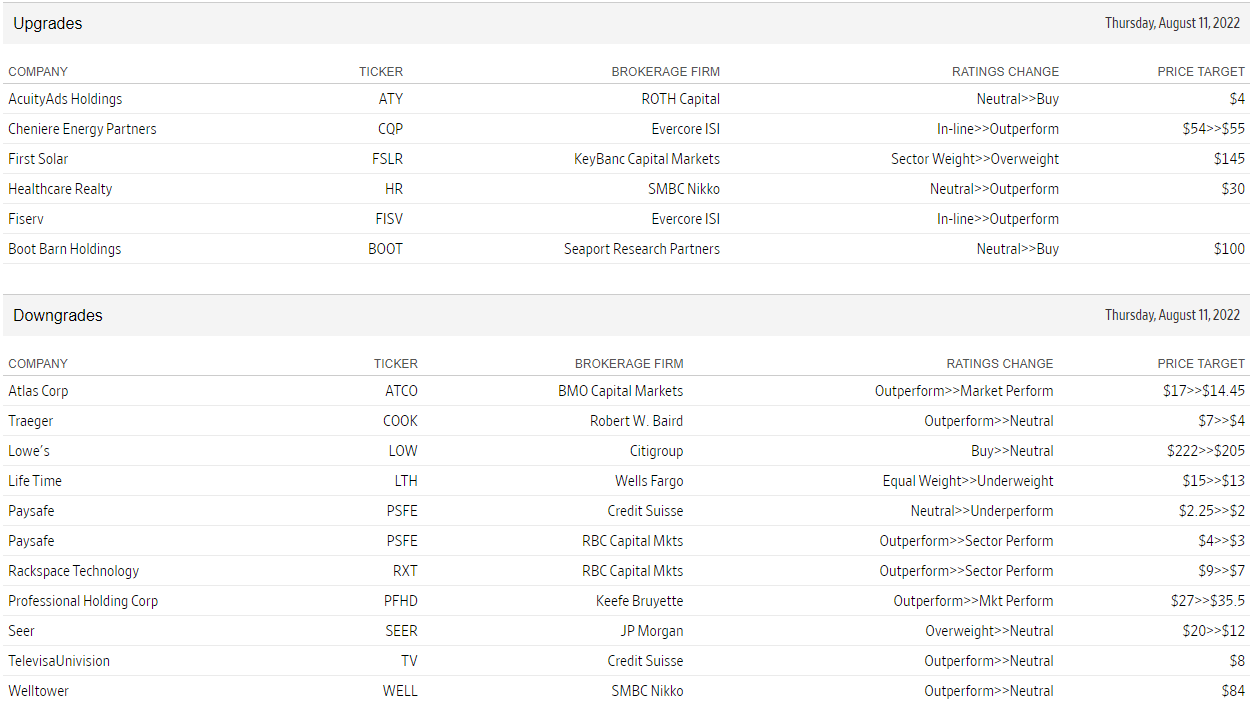

Upgrades and downgrades

Source: WSJ.com

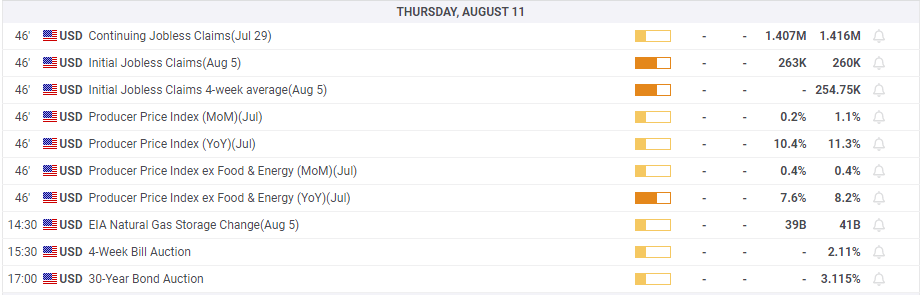

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.