US Dollar dips to fresh weekly loss ahead of US election results

- The US Dollar price action is easing as the US heads to the voting booths on Tuesday.

- Traders brace for volatility as it could take days or weeks to know who will be the next US president in case of a very tight result.

- The US Dollar index trades just below 104.00 and hangs onto important technical support.

The US Dollar (USD) turns a touch softer on Tuesday after the US opening bell, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trading further below 104.00 as markets brace for the US presidential election. Chances that markets will know if either Vice President Kamala Harris or former US President Donald Trump will claim victory by Wednesday look rather slim. No less than 165 lawsuits have already been filed on election fraud and recount requests even before the voting has started.

This could mean that this 60th presidential election could surpass the 46 days of legal uncertainty last seen when George W. Bush won in 2000. Only a landslide victory by several points could avoid a legal battle that would plunge markets into uncertainty going into year-end.

The US economic calendar includes the final readings of the S&P Global and the Institute for Supply Management (ISM) Services Purchase Managers Index (PMI) for October. No real changes are expected from preliminary readings.

Daily digest market movers: Forget about it

- Look out for headlines risk on Tuesday and Wednesday in case no clear winner is declared in the 60th US presidential election.

- At 13:45 GMT, S&P Global has released the final reading for October’s PMI. Services PMI came in a touch softer at 55 against the 55.3 in the initial reading.

- Around 15:00 GMT, the ISM has published its final reading for October’s services sector. The ISM Services PMI jumped to 56, coming from 54.9.

- Ahead of the first possible headlines on the US presidential election, the US Treasury is auctioning a 10-year note around 18:00 GMT.

- US equities are in a good mood and are heading higher with the Nasdaq up near 1% on the day while the US casts its votes.

- The CME FedWatch Tool is backing a 25 basis point (bps) interest-rate cut by the Federal Reserve (Fed) on Thursday’s meeting with a 98.0% probability. More interesting is the December 18 meeting, where a 50 bps interest-rate cut from the current level is expected by an 81.7% chance, suggesting that markets anticipate a rate cut this week and in December.

- The US 10-year benchmark rate trades at 4.36%, making its way back up to the 4.38% last seen at the close last Friday.

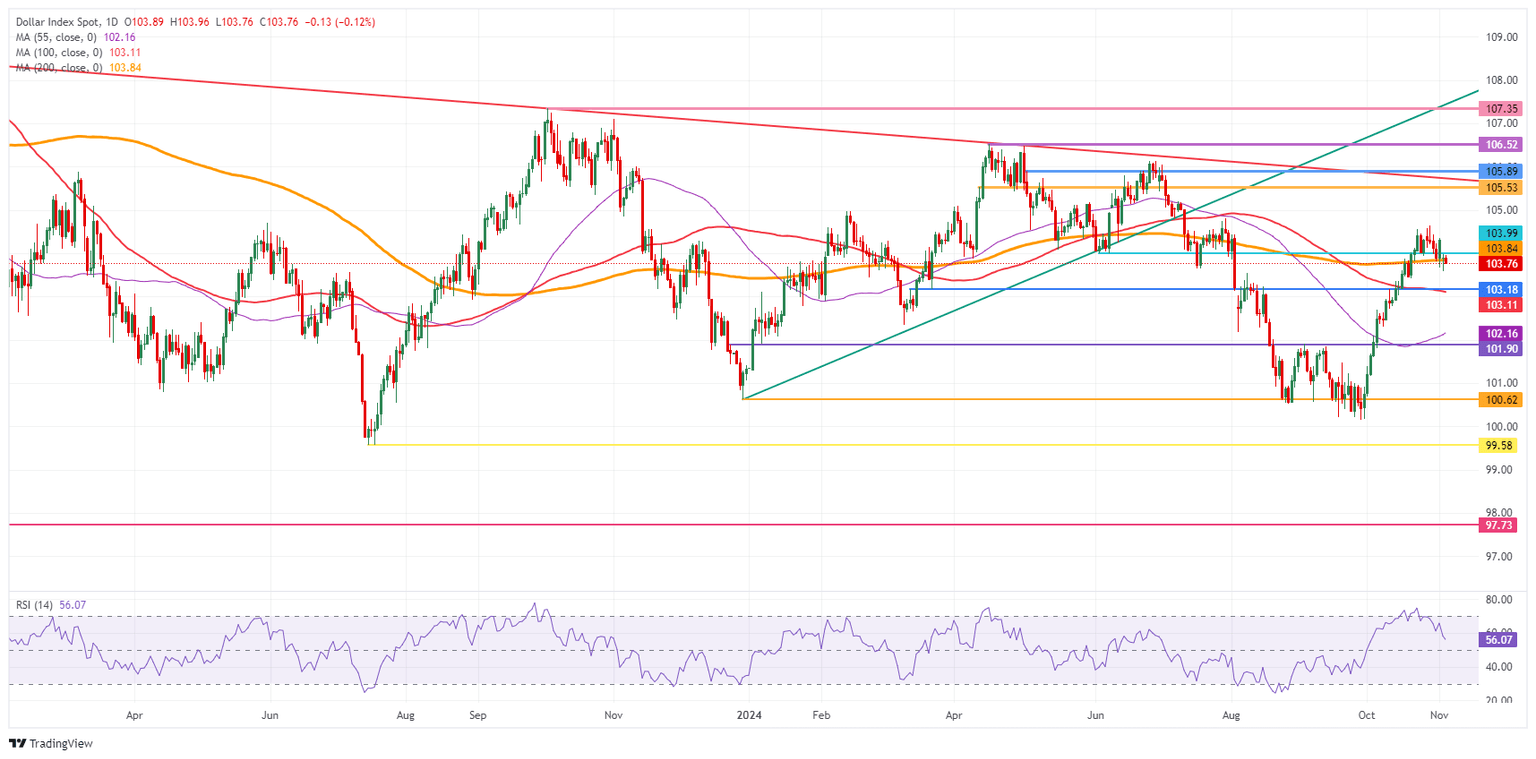

US Dollar Index Technical Analysis: Landslide is the key

The US Dollar Index (DXY) is having its calm moment before the storm. It looks to be very unpredictable what the US presidential election outcome will be on Wednesday when the world will wake up. The DXY is clinging onto the 200-day Simple Moving Average (SMA) at 103.84, and it is expected to whipsaw through it in the next 24 hours once results come in.

The DXY has given up two key levels and needs to regain control of them before considering recovering toward 105.00 and higher. First up is the 200-day SMA at 103.84, together with the 104.00 big figure. The second element is the October 29 high at 104.63.

On the downside, the 100-day SMA at 103.12 and the pivotal level of 103.18 ( March 12 high) are the first line of defence. In case of rapid and volatile moves this week, look for 101.90 and the 55-day SMA at 102.16 to consider as substantial support. If that level snaps, an excursion below 101.00 could be possible.

US Dollar Index: Daily Chart

Banking crisis FAQs

The Banking Crisis of March 2023 occurred when three US-based banks with heavy exposure to the tech-sector and crypto suffered a spike in withdrawals that revealed severe weaknesses in their balance sheets, resulting in their insolvency. The most high profile of the banks was California-based Silicon Valley Bank (SVB) which experienced a surge in withdrawal requests due to a combination of customers fearing fallout from the FTX debacle, and substantially higher returns being offered elsewhere.

In order to fulfill the redemptions, Silicon Valley Bank had to sell its holdings of predominantly US Treasury bonds. Due to the rise in interest rates caused by the Federal Reserve’s rapid tightening measures, however, Treasury bonds had substantially fallen in value. The news that SVB had taken a $1.8B loss from the sale of its bonds triggered a panic and precipitated a full scale run on the bank that ended with the Federal Deposit Insurance Corporation (FDIC) having to take it over.The crisis spread to San-Francisco-based First Republic which ended up being rescued by a coordinated effort from a group of large US banks. On March 19, Credit Suisse in Switzerland fell foul after several years of poor performance and had to be taken over by UBS.

The Banking Crisis was negative for the US Dollar (USD) because it changed expectations about the future course of interest rates. Prior to the crisis investors had expected the Federal Reserve (Fed) to continue raising interest rates to combat persistently high inflation, however, once it became clear how much stress this was placing on the banking sector by devaluing bank holdings of US Treasury bonds, the expectation was the Fed would pause or even reverse its policy trajectory. Since higher interest rates are positive for the US Dollar, it fell as it discounted the possibility of a policy pivot.

The Banking Crisis was a bullish event for Gold. Firstly it benefited from demand due to its status as a safe-haven asset. Secondly, it led to investors expecting the Federal Reserve (Fed) to pause its aggressive rate-hiking policy, out of fear of the impact on the financial stability of the banking system – lower interest rate expectations reduced the opportunity cost of holding Gold. Thirdly, Gold, which is priced in US Dollars (XAU/USD), rose in value because the US Dollar weakened.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.