US Dollar gears up for French elections risk over the weekend

- The US Dollar has Trump and Suzuki to thank for its early recovery on Friday.

- PCE fully falls in line of expectations.

- The US Dollar index hovers around 106.00, back to Wednesday’s levels.

The US Dollar (USD) is having difficulties in pricing in all events and elements that are moving in the markets. Traders are still digesting the Trump-Biden debate where nearly everyone saw former US President Donald Trump as the victor.While intervention risk from the Japanese government hangs over the US Dollar, French voters will go to the polls on Sunday. Recent results show the Far Right leading by 36.2%, followed by the Far Left with 28.3% and President Emmanual Macron's party lagging by 20.4%.

On the US economic calendar front, Personal Consumption Expenditures (PCE) came in fully in line of expecations. The disinflationary trajectory is in tact and is not facing any hiccups for now. Traders will now be on the lookout for the University of Michigan, ahead of the first round in the French elections over the weekend.

Daily digest market movers: France heading to first round of elections

- One Sunday night markets will know who will be heading to the second and final round of the French political elections on the week therefter. For now the Far Right movement is in the lead, followed by the Far Left and the party from current rulling President Emmanuel Macron.

- At 12:30 GMT, The Personal Consumption Expenditures for May was released:

- Core Monthly PCE went from 0.2% to 0.1%.

- Headline Monthly PCE headed from 0.3% to 0.0%.

- Yearly Headline PCE faded a touch from 2.7% to 2.6%.

- Yearly Core PCE eased from 2.8% to 2.6%.

- The Chicago Purchase Managers Index (PMI) was an upbeat surprise, though remains in contraction from 35.4 to 47.4.

- At 14:00 GMT, the University of Michigan will release its final reading for June:

- Consumer Sentiment jumped to 68.2, coming from 65.6.

- Inflation expectations eased a touch to 3%, from 2.1%.

- Equities are trying to close this week off on a high note, with already several green closures in Asia, while European and US equities are in the green.

- The CME Fedwatch Tool is broadly backing a rate cut in September despite recent comments from Federal Reserve (Fed) officials. The odds now stand at 57.9% for a 25-basis-point cut. A rate pause stands at a 35.9% chance, while a 50-basis-point rate cut has a slim 6.2% possibility.

- The US 10-year benchmark rate trades near the weekly high at 4.28%.

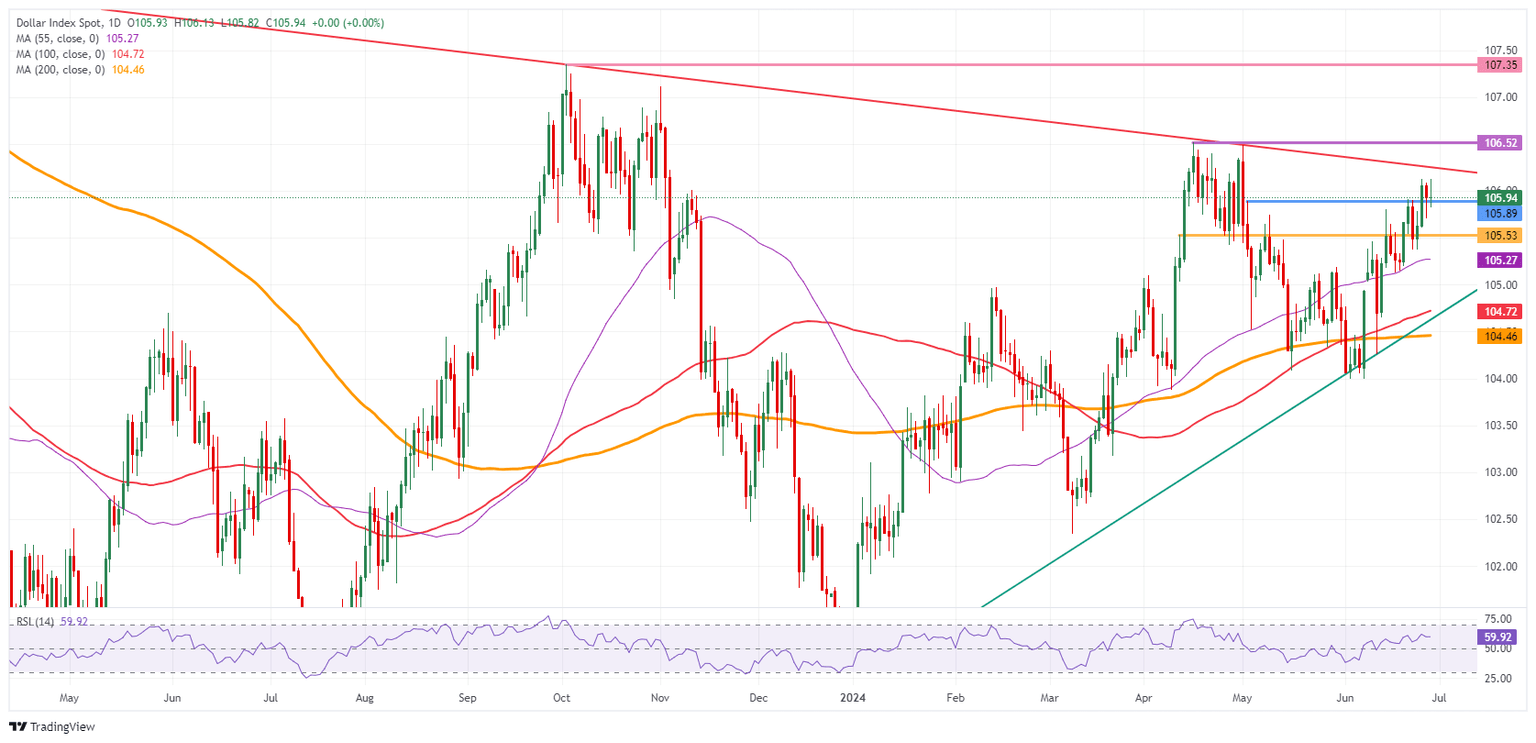

US Dollar Index Technical Analysis: Several risks ahead

The US Dollar Index (DXY) may go where it wants to go in the coming days, though a sword of Damocles is hanging above its performance. The Japanese Ministry of Finance has repeated its state of emergency on the exchange rate and might intervene at any given moment as of now. That means a substantial move could unfold, which would knock out the Greenback for a moment.

On the upside, the biggest challenge remains 106.52, the year-to-date high from April 16. A rally to 107.35, a level not seen since October 2023, would need to be driven by a surprise uptick in US inflation or a further hawkish shift from the Fed.

On the downside, 105.53 is the first support ahead of a trifecta of Simple Moving Averages (SMA). First is the 55-day SMA at 105.27, safeguarding the 105.00 round figure. A touch lower, near 104.72 and 104.46, both the 100-day and the 200-day SMA form a double layer of protection to support any declines. Should this area be broken, look for 104.00 to salvage the situation.

US Dollar Index: Daily Chart

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.